- AQH Weekly Deep Dive

- Posts

- Rewind Edition: Top Quant Research & Training Materials

Rewind Edition: Top Quant Research & Training Materials

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

This Week, in this rewind edition highlights the year’s most valued quant research, spanning derivatives pricing, market microstructure, and live algorithmic trading. From risk-neutral pricing and no-arbitrage to bond repos, Monte Carlo methods, Python trading with Interactive Brokers, and FX arbitrage, these articles map how quantitative finance works in practice—from theory to execution.

Bonus Content, here we curate the year’s highest-rated quant training videos and software, covering live algorithmic trading with Python and the IB API, American Option Trading and Monte Carlo simulation for Exotic Options Trading, and hands-on calibration of USD SOFR yield curves and credit curves for credit derivative pricing.

Table of Contents

Feature Article: Top Quant Research Articles

This year, readers consistently rated the following articles as standout deep dives into core quantitative finance topics. They span foundational theory such as risk-neutral pricing and no-arbitrage, the market plumbing of bond repos and securities financing, and practical implementation through Monte Carlo methods for exotic options and live Python-based algorithmic trading with Interactive Brokers. We also explored FX arbitrage and cross-currency basis, where elegant theory meets real-world funding frictions. Together, these pieces reflect how quantitative finance works in practice—from models to markets to execution.

Risk-Neutral Pricing Explained

This article examines the full risk-neutral pricing framework from the ground up by linking replication, self-financing portfolios, no-arbitrage conditions, martingales and the role of convexity adjustments. We explain these concepts for traders and quants in clear, everyday language.

Article Link:

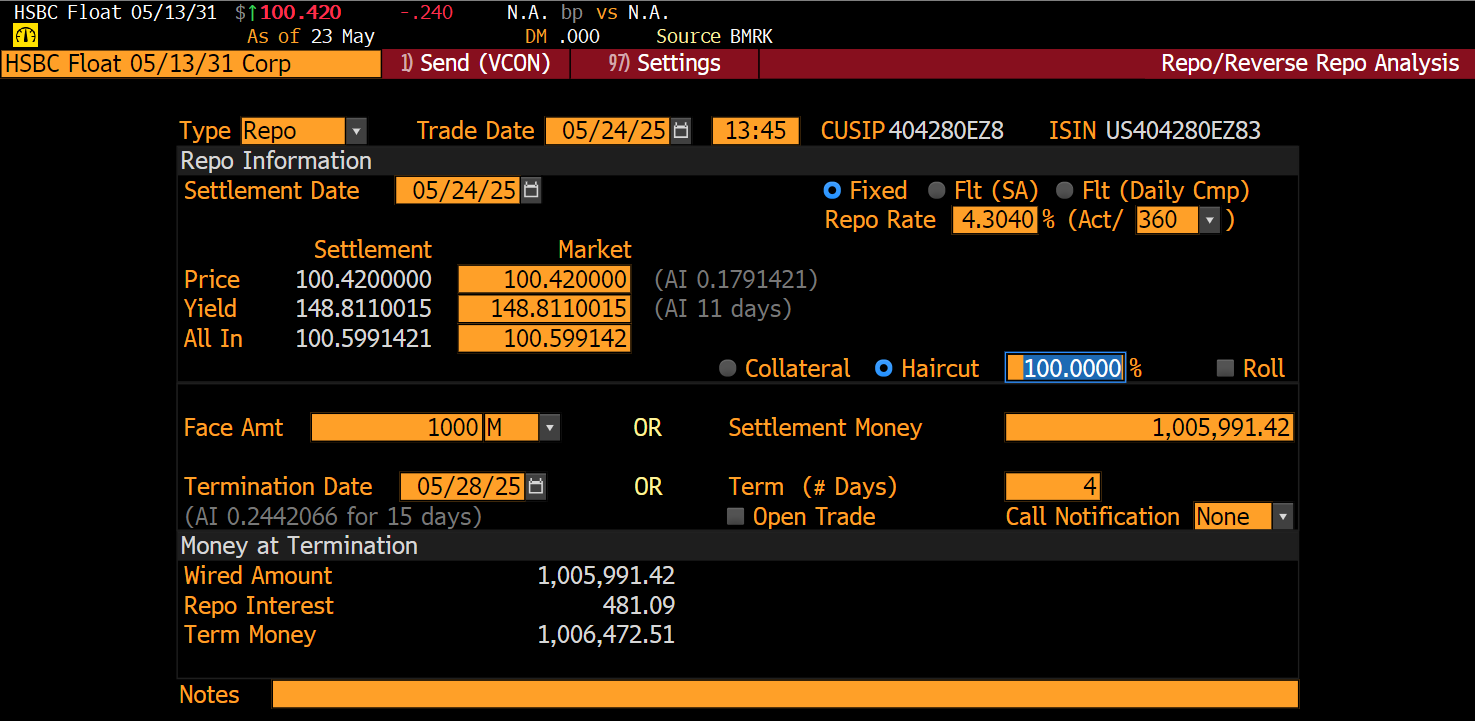

Bond Repos & Securities Financing

Here we dive into bond repurchase agreements (Repos) and securities financing.

Article Link:

https://algoquanthub.beehiiv.com/p/bond-repurchase-agreements-repos-and-securities-financing

American Option Trading

We review the world of American options, putting pricing theory to the test against live markets and option chain quotes on Interactive Brokers (IBKR).

Article Link:

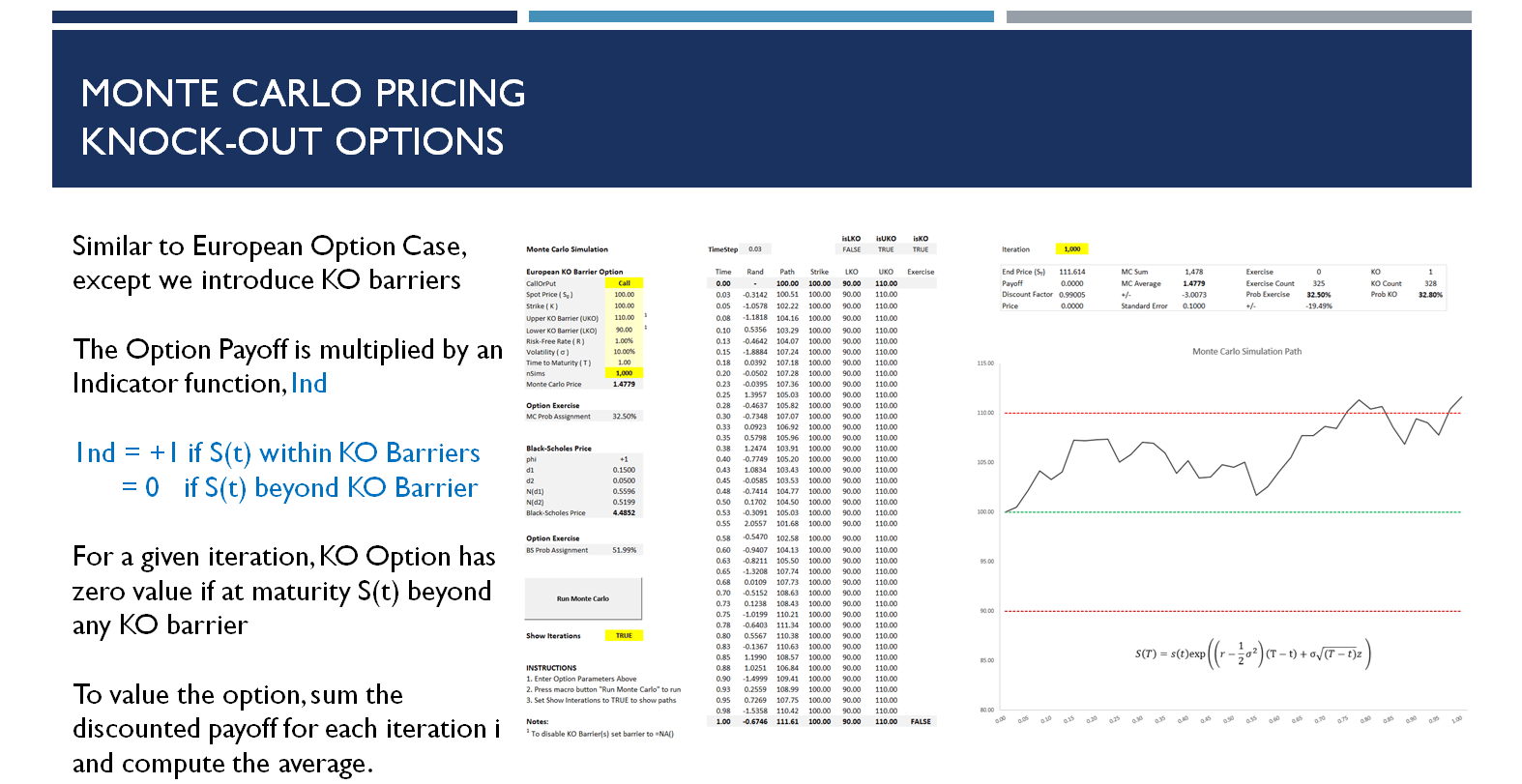

Monte Carlo for Exotic Option Trading

An outline how to use Monte Carlo Simulation to price vanilla and exotic options.

Article Link:

https://algoquanthub.beehiiv.com/p/monte-carlo-for-exotic-option-pricing

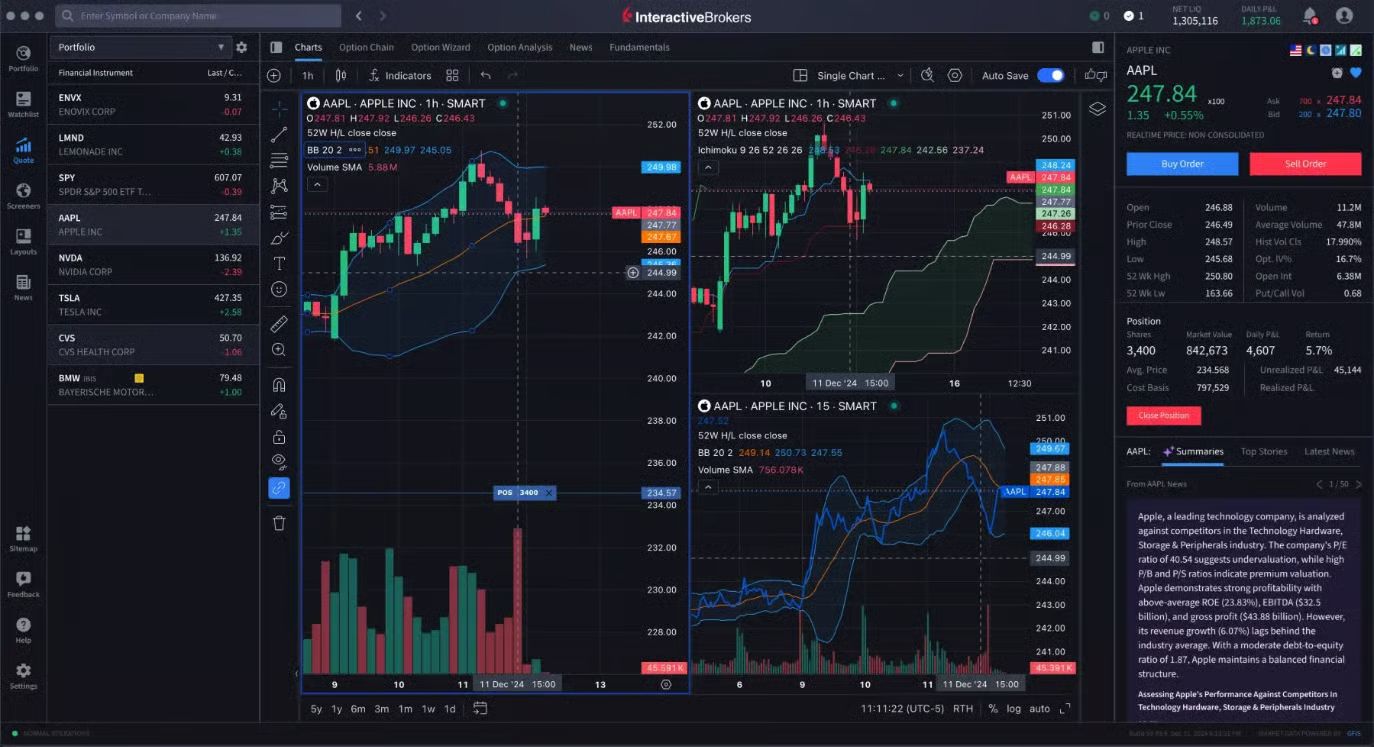

Live Algo Trading using Python and the IB Broker API

Here we discuss how to automate and seamlessly connect trading algorithms directly to financial markets for both simulated and live trading using the Interactive Brokers Python API (IBAPI).

Article Link:

https://algoquanthub.beehiiv.com/p/algoquanthub-weekly-deep-dive-8d59

FX Arbitrage & Cross Currency Basis

This article looks at FX arbitrage and the persistent cross-currency basis. We look why covered interest rate parity (CIP) breaks down and the trading opportunities this presents.

Article Link:

https://algoquanthub.beehiiv.com/p/algoquanthub-weekly-deep-dive-131e85d741dbfbc3

How to become a Quant?

Here we’ll learn how to land a Quant job. We take you through the details of what is a Quant, what they do, how to become a Quant, CVs, the interview process and why become a Quant.

Article Link:

https://algoquanthub.beehiiv.com/p/algoquanthub-weekly-deep-dive-b74d

Keywords:

Risk Neutral Pricing, Arbitrage, Replication Portfolios, Convexity Adjustments, Bond Repos, Securities Financing, American Options Trading, Monte Carlo Simulation, Exotic Options, Algo Trading, Python, IB Broker, Python API, FX Arbitrage, Interest Rate Parity, Cross Currency Basis

Bonus Article: Top Quant Training Videos & Software

Here we curate the year’s highest-rated quant training videos and software, covering live algorithmic trading with Python and the IB API, American and exotic option pricing via Monte Carlo simulation, and hands-on curve calibration for USD SOFR and credit markets.

Live Algo Trading using IB Brokers Python API

A complete guide on how to use the IB Broker API connect your Python code to the IB Broker trading platform to place orders, manage orders, source market data, view trading positions, cash balances and more.

YouTube Playlist:

https://www.youtube.com/watch?v=xNXM1EZD-u0&list=PL3Lm138CRBL6fuc53ek6pWnUWHYdKcFVz

Python Training:

https://payhip.com/b/DW9phAmerican Option Trading

Discover the ultimate toolkit for options traders and quants with a sharp focus on American Options pricing and powerful Monte Carlo simulation tools. This bundle delivers fast, market-accurate pricing and cutting-edge analysis, designed to train and elevate your trading and modelling skills to a professional level.

YouTube Playlist:

https://www.youtube.com/watch?v=Qi0II24p_So&list=PL3Lm138CRBL48DAh2rGUgMJ5085vEyi1F

Premium Training Bundle:

Monte Carlo Simulation for Exotic Options Trading

The training materials presented here take you step‑by‑step through stochastic calculus, risk‑neutral pricing, and martingales, while giving you hands‑on tools to simulate and price options. With PowerPoint slides, an interactive Excel workbook, and fully functional C++ and Python source code, you’ll learn not only the math behind Monte Carlo but also how to implement it, test convergence, and tackle exotic barrier options with confidence.

YouTube Playlist

https://www.youtube.com/watch?v=xdBHMLZa2rw&list=PL3Lm138CRBL7ToKe9jhuxXRujR5u8DZj0

Premium Training with Excel Workbook

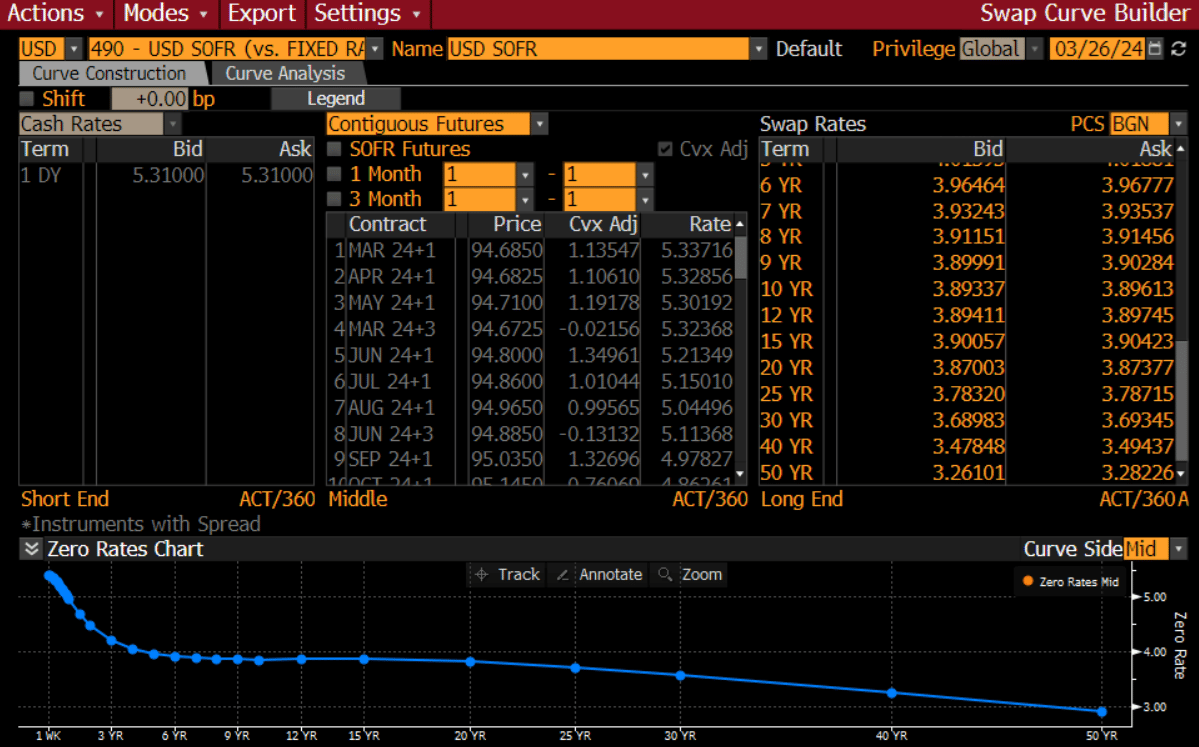

USD SOFR Yield Curve Calibration

An Excel workbook with video training to demonstrate how to:

Calibrate a USD SOFR yield curve from market swap quotes

Generate forward rates and discount factors for pricing

Price interest rate swaps directly from your curve

Compute and interpret swap risk metrics using the curve’s Jacobian—essential for real-time risk and model sensitivity analysis

Excel Workbook: https://payhip.com/b/PCNBk

Credit Model Calibration

An Excel workbook to demonstrate how to calibrate a credit curve. It includes:

Credit curve calibration using market CDS inputs.

Full pricing and repricing of CDS calibration instruments

Full implementation of multivariate Newton-Raphson Algorithm

Analytical and numerical computation of the Jacobian matrix

Bespoke CDS pricing using the hazard rates i.e. curve calibration outputs

Excel Workbook: https://payhip.com/b/9mTtc

Keywords:

YouTube, Training, Software, Live Algo Trading, IB Broker, Python API, American Option Trading, Monte Carlo Simulation, Exotic Options, USD SOFR Curves, Yield Curve Calibration, Credit Curve Calibration

Exclusive Algo Quant Store Discounts

Algo Trading & Quant Research Hub

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA.

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]