- AQH Weekly Deep Dive

- Posts

- Bond Repurchase Agreements (Repos) and Securities Financing

Bond Repurchase Agreements (Repos) and Securities Financing

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

Last week, we discussed the quant interview process and the essential C++ questions you must know. This week, we explore and dive into bond repurchase agreements (Repos) and securities financing.

Bonus content, dive into the cash futures basis trading strategy—a sophisticated arbitrage technique where bond repos finance the underlying cash bond position, allowing traders to capitalize on the price convergence between the bond and its futures contract. Explore how this strategy leverages repo markets, the crucial role of the cheapest-to-deliver bond, implied repo rates, and net basis to unlock trading opportunities many overlook.

Table of Contents

Exclusive Algo Quant Store & Discounts

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA

Feature Article: Bond Repos - The Hidden Engine of Financial Markets

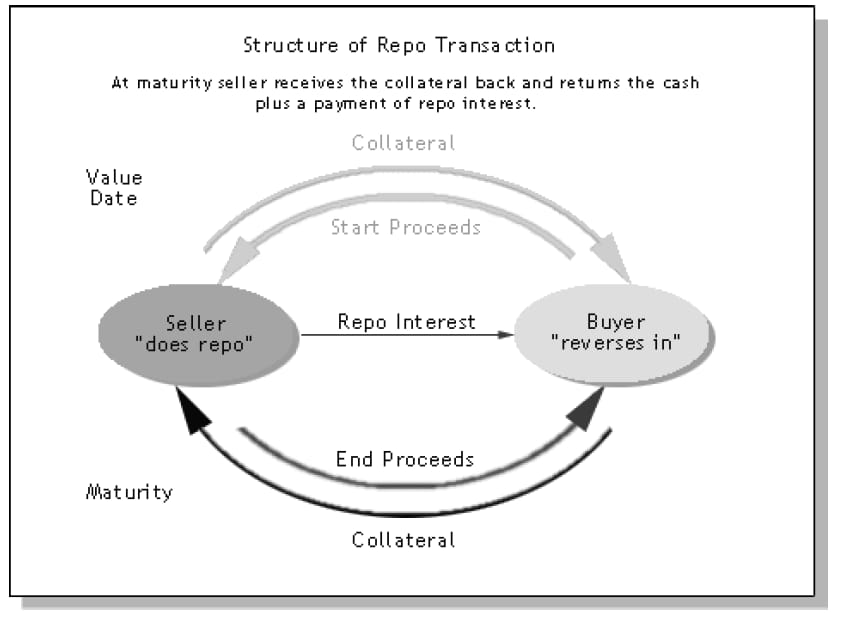

Bond repurchase agreements, or repos, are among the most essential yet least understood instruments in modern finance. A repo is, in essence, a short-term secured loan: one party sells government bonds or similar high-quality securities to another, with a commitment to repurchase them later at a slightly higher price. The difference between the sale and repurchase prices represents the interest on the loan, known as the repo rate. Though simple in design, repos underpin the day-to-day liquidity of global markets, support the functioning of bond trading, and serve as a key tool for central banks in managing monetary policy.

Structure of a Repo Transaction

Why Are Repos Traded?

Repos provide distinct advantages to both borrowers and lenders.

For cash borrowers (dealers, banks): repos offer access to reliable, low-cost funding secured by safe collateral.

For cash lenders (money market funds, institutions): repos enable short-term, collateralized investments that remain relatively low risk.

For market makers: repos finance large bond inventories and hedge trading risks, keeping secondary markets active.

For central banks: repos and reverse repos inject or withdraw liquidity from financial markets, influencing short-term interest rates.

In essence, the repo market lets money flow efficiently between those needing cash and those with excess liquidity.

Key Terms and Market Structure

Several important features define a repo agreement:

Collateral Type: can be general collateral—any eligible government bond—or special collateral, a highly sought-after security that trades at unusually low repo rates.

Haircut (or initial margin): a safety buffer where the cash lent is slightly less than the collateral’s market value to protect lenders from price drops.

Maturity: repos can be overnight (one day), term (fixed duration such as one week or month), or open (no fixed end date, terminable by notice).

Settlement: many use a tri-party system where a clearing bank manages cash and collateral flows, valuations, and margin calls.

These structures provide flexibility but introduce risks such as counterparty default, collateral volatility, and market liquidity concerns.

These features give repos flexibility but also create risks that participants must manage, particularly counterparty risk, collateral risk, and liquidity risk.

Central Banks and Repos

Central banks use repos actively to implement monetary policy. For example:

When stimulating the economy, they inject cash through repos by buying securities, lowering short-term rates and encouraging lending.

When tightening policy, they use reverse repos to withdraw cash and reduce liquidity.

Repos thus serve as the bridge between central bank decisions and the interest rates seen across the economy.

Example: Shorting a US Treasury Bond with Repo Financing

A trader expects Treasury prices to fall and shorts $10 million face value of the U.S. Treasury 2.5% due February 2036.

Step | Clean Price | Accrued Interest | Dirty Price | Cash Flow |

|---|---|---|---|---|

Initial short sale | 101.20 | 0.60 | 101.80 | +$10,180,000 |

Repo financing (1 week at 2.50%) | – | – | – | –$4,946 (interest) |

Repurchase after 7 days | 100.30 | 0.70 | 101.00 | –$10,100,000 |

At maturity, the trader pockets $75,054 profit, calculated as $10,180,000 received at the short sale, minus $10,100,000 to repurchase the bonds, minus $4,946 in repo interest. The gain reflects both the capital gain (bond prices falling from 101.20 to 100.30) and the net carry, the balance between coupon accrual and repo financing costs.

The breakeven clean price is the level at which the cost of carry exactly offsets coupon accrual. Using the forward pricing relationship:

Forward clean price = Spot clean price + Funding cost + (Spot accrued − Forward accrued)

This gives, 101.20 + 0.05 − 0.77 = 100.48. Therefore, if the bond ends below 100.48, the short is profitable; above this level, the trade loses money.

Why Bond Repos Matter?

Bond repos form the backbone of financial markets. They enable massive daily funding and trading volumes, maintain liquidity, and translate policy decisions into market realities. For anyone working in or around fixed income, a sound understanding of repos is indispensable.

Further Reading

- Alpha Picks: Global Primer Series - Repo Markets

- BlackRock: Understanding Repurchase Agreements

- Corporate Finance Institute: Repurchase Agreement (Repo)

- Financial Edge: Capital Markets Training Resource

- ICMA: Repo FAQ

- Investopedia: Repurchase Agreements Explained

Keywords

Repurchase Agreement, Repo, Reverse Repo, Repo Rate, Collateral, Haircut, Initial Margin, General Collateral (GC), Special Collateral, Overnight Repo, Term Repo, Open Repo, Breakeven Price

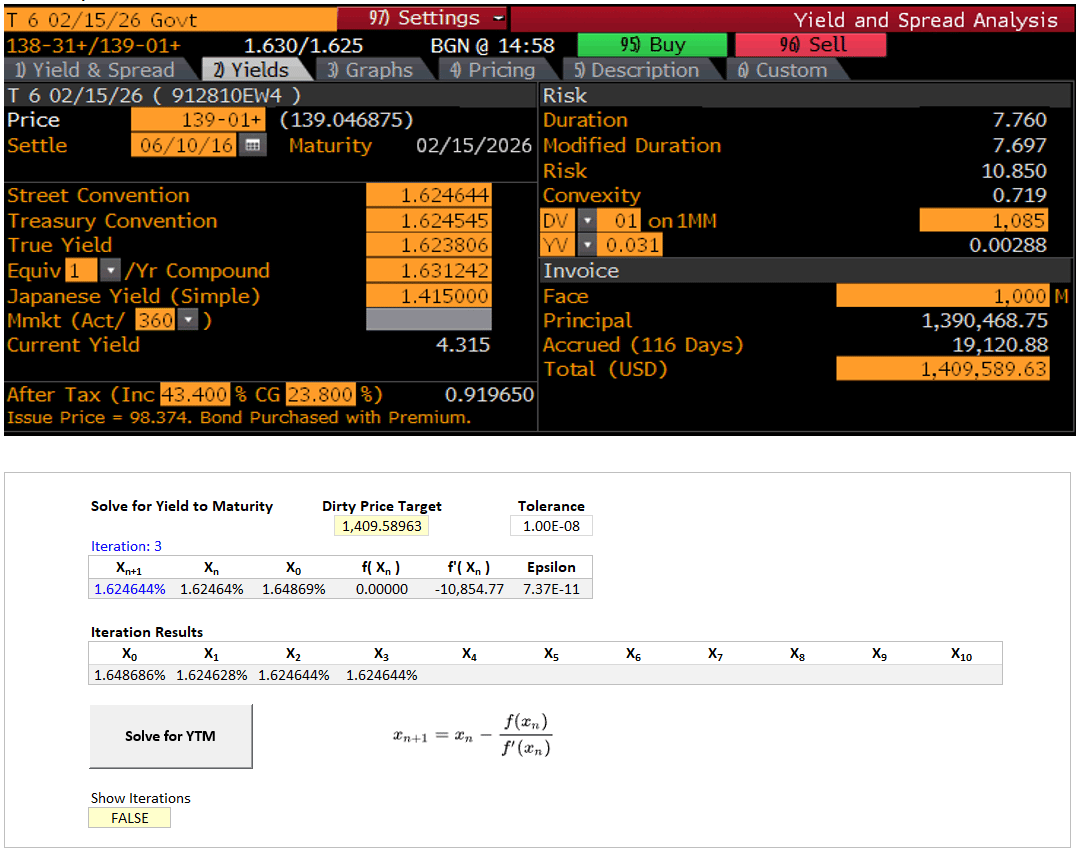

Feature Video - Bond Pricing & Risk

In this video, we break down the fundamentals of pricing a US Treasury bond and explain how to measure its risk using DV01—the dollar value of a one basis point change in yield. You'll learn how to calculate clean and dirty prices, and how accrued interest factors into bond valuation. Using real market examples, we also explore how yield to maturity (YTM) is derived. Whether you’re new to bonds or looking to deepen your understanding, this guide will equip you with practical tools for evaluating bond pricing and risk effectively.

Excel Workbook & PDF Training Guide

Additionally, the Bond Excel spreadsheet click-here demonstrates how to price a US Treasury Bond to exactly match the live tradable price shown in Bloomberg. Using a live market example, it calculates accrued interest, clean and dirty prices. It also shows how to solve for the yield to maturity (YTM) and compute the present value of the bond’s cash flows.

To evaluate bond cash flows and their present value, we must find the yield to maturity or internal rate of return since there is no closed-form solution. This requires an optimization algorithm like Newton-Raphson, needing an initial guess for YTM. The workbook provides a highly accurate approximation formula for YTM to serve as this initial guess, enabling low latency calculations.

Using this, the spreadsheet demonstrates how to compute the present value of any investment in the bond and assess the DV01 risk—the change in investment value for a one basis point fall in bond yield.

Bonus Content: Cash Basis Trading Strategy

In this video, we explore bond futures and the cash basis trading strategy—an arbitrage approach that blends bond repos with futures contracts to capture pricing inefficiencies. You’ll learn how bond repos are used to finance bond purchases while simultaneously selling futures, enabling traders to profit as prices converge toward delivery. Key concepts covered include implied repo rates, bond baskets, net basis, and the crucial cheapest-to-deliver bond. Whether you’re new to bond futures or looking to refine your trading strategies, this video provides a clear, practical guide.

Keywords:

Bond Repo, Bond Futures, Cash Basis, Trading Strategy, Implied Repo Rates, Bond Basket, Net Basis, Cheapest to Deliver

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]