- AQH Weekly Deep Dive

- Posts

- Monte Carlo for Exotic Option Pricing

Monte Carlo for Exotic Option Pricing

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

Last week, we presented a low-risk options trading strategy where we sold put options on reputable stocks for income generation to get paid to buy stocks at a discount. If assigned we can sell covered calls to both exit the position and generate additional income. This week, we outline how to use Monte Carlo Simulation to price vanilla and exotic options.

Bonus content, we provide examples of how to price options using the Monte Carlo approach in both C++ and Python. To demo the robustness of the approach, we compare and test price results against the well-known Black-Scholes formula for European option pricing.

Table of Contents

Exclusive Quant Discounts

Get 25% off all purchases at AlgoQuantHub’s digital store with code 3NBN75MFEA

Feature Article: Monte Carlo Option Pricing — A Powerful Quantitative Tool

Monte Carlo simulation is a cornerstone technique in quantitative finance for pricing complex financial derivatives, especially where closed-form solutions do not exist or are difficult to obtain. At its core lies the idea of simulating numerous possible future paths for the underlying asset’s price—typically modeled by a stochastic process such as Geometric Brownian Motion (GBM)—and then computing discounted expected payoffs across these paths under the risk-neutral measure.

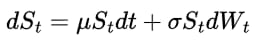

The GBM model allows us to estimate or predict future stock paths and is used for derivative pricing, risk management, trading strategy backtesting and forecasting. GBM describes the evolution of the stock price S via a stochastic differential equation (SDE) under the real-world measure P,

Geometric Brownian Motion SDE

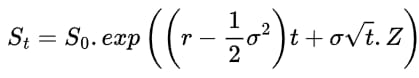

where μ is drift, σ is volatility, and Wt is a Brownian motion. The solution to this SDE can be transformed into an expression that simulates stock prices at any future time t (see resources section below for more info) for a given standard normal random variable Z,

Solution to GBM SDE

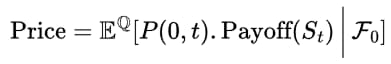

The resulting expression operates under the risk-neutral measure Q, where St is a martingale. Importantly, this means the fair price of any derivative is its discounted expected payoff—this is foundational to the risk-neutral pricing framework. Using P(0,t) to represent the discount factor, we write this as,

Martingale Representation Theorem

The final result is that we can price derivates by computing their discounted payoffs using a modest number of simulated normal random variates Z and then taking the average.

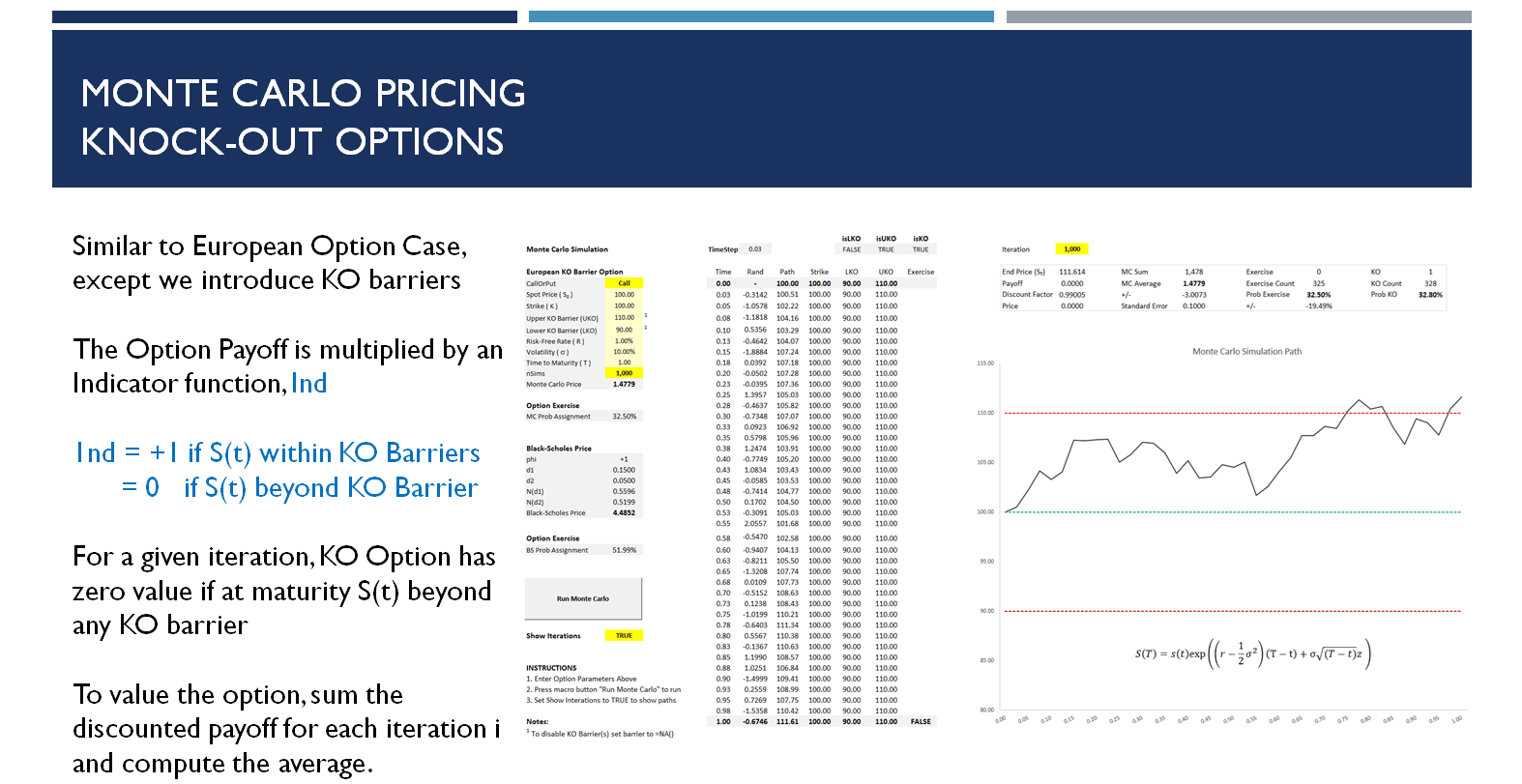

Monte Carlo simulations excel in versatility and intuitiveness. They easily extend to path-dependent payoffs such as Asian and barrier options, where other pricing methods struggle. While American options—due to early exercise features—require more specialized approaches like finite difference PDEs or binomial trees, regression techniques such as Longstaff-Schwartz provide Monte Carlo-compatible solutions. Monte Carlo is a hallmark tool in quantitative finance due to its conceptual clarity and broad applicability in pricing and risk management.

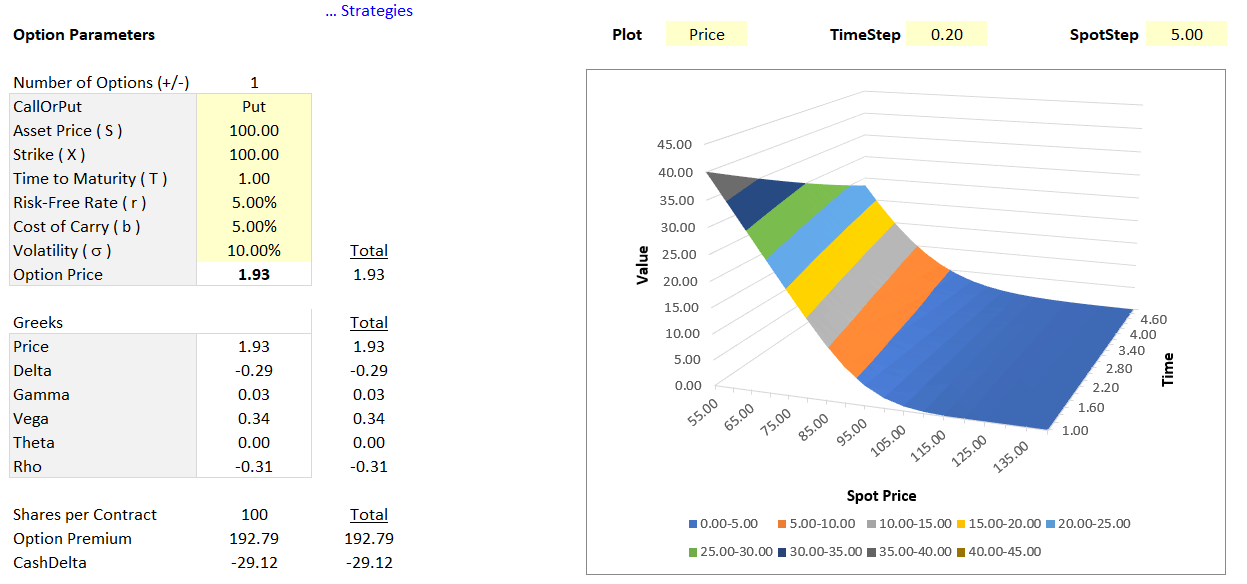

Option Pricing Training & Resources

Advanced Pricing Tools - by AlgoQuantHub

European Option Pricing - Guide and Excel workbook.

Monte Carlo Simulation for Option Pricing - Theory & Practice Guide

Comes with Excel Workbook, C++ and Python Code for Option Pricing

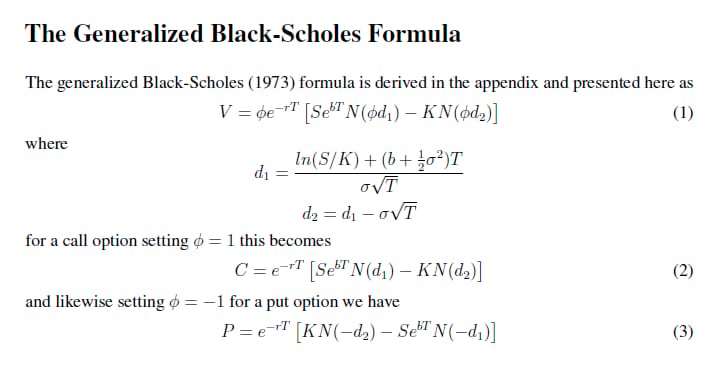

Generalized Black Scholes Formulas |

Recommended Reading

Monte Carlo Methods in Financial Engineering by Paul Glasserman

Monte Carlo Methods in Finance by Peter Jackel

Keywords

Derivatives, Options, Pricing, Monte Carlo, Simulation, Forecasting, Martingale, GBM, SDE, Expectations, Discount Factor, Payoff, Real-World Measure, Girsanov’s Theorem, Risk-Neutral Measure, Arbitrage-Free

Bonus Content: Monte Carlo Option Pricing in Practice with C++ and Python

To bring the theory to life, consider the following concise C++ implementation of Monte Carlo pricing for European options. The code simulates terminal prices using GBM under the risk-neutral measure, with the Mersenne Twister RNG generating standard normal draws. The Black-Scholes analytical price serves as a benchmark.

While the C++ native Mersenne Twister Random Number Generator (RNG) works well for many tasks, advanced quant users should consider the Sobol Brownian Bridge RNG available from opensource libraries such as QuantLib. These quasi-random sequences improve convergence significantly—often requiring significantly less simulations (e.g., 5,000 vs 20,000) to achieve the same accuracy.

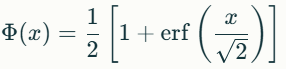

The Black-Scholes formula uses the normal cumulative distribution function (CDF), efficiently implemented via the error function (erf). This approximation provides accurate and rapid calculations of the European option price’s theoretical benchmark.

Monte Carlo’s strength extends far beyond vanilla options, enabling pricing of path-dependent and exotic derivatives where analytic formulas fail. However, care must be taken with American options, where early exercise features pose challenges; Monte Carlo methods can be adapted via regression-based approaches like Longstaff-Schwartz to handle such complex features.

C++ Code: European Option Pricing using MC Simulation

Below we present a short and fully-functional Monte Carlo option pricing C++ code. The code prices a European option using numerical Monte Carlo simulation and compares simulated results to the exact result from the closed-form Black-Scholes solution. To run simply click-here and select run on the menu-bar.

Random Number Generation

MC simulation requires that we generate random numbers, we do this using the C++ native Mersenne Twister random number generator as shown below.

#include <random>

using namespace std;

// Initialize Mersenne Twister RNG with fixed seed

mt19937 generator(123456);

normal_distribution<double> normsdist(0, 1);

// Generate a Random Number

double z = normsdist(generator);Normal Cumulative Distribution Function (Normal CDF)

The Black-Scholes formula requires the compuation of the standard normal cumulative distribution function (Normal CDF), which we can compute using the error function (erf) from the header #include <cmath> as shown below.

Standard Normal CDF

Black-Scholes Formula

The Monte Carlo pricing routine works for both vanilla and exotic options. To test the pricing routine we price European call and put options using the Black-Scholes formula, which has an exact closed-form solution. We compare the Monte Carlo price results with the analytical solution from the Black-Scholes formula, note we set the indicator function phi to +1 for a call and -1 for a put option.

Black-Scholes Formula

Monte Carlo Results

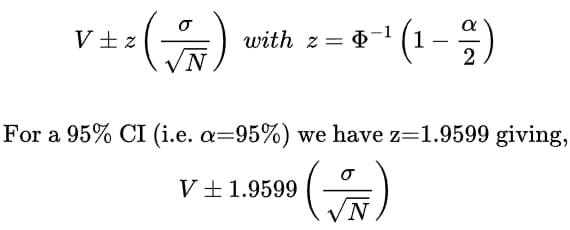

The error between the Monte Carlo simulated result and the closed-form exact solution is determined by the sample standard deviation with the sample size N equal to the number of simulations. This is called the standard error and is calculated as SE = vol / sqrt(N). It can be used to form a confidence interval (CI) as follows CI = V ± z . SE, where z is the z-score or critical value from the normal distribution e.g. for a 95% confidence interval we have z = ±1.9599.

Monte Carlo Confidence Interval

Running the C++ Code

Finally, I present the C++ code for the Monte Carlo code below, which has been preloaded on a free cloud-based C++ compiler. To run click-here and press run on the menu-bar.

#include <iostream>

#include <cmath>

#include <random>

using namespace std;

// Normal CDF using Error Function, erf

double norm_cdf(double x)

{

return 0.5 * (1 + erf(x / sqrt(2)));

}

// Enum for option type

enum OptionType { Call, Put };

// Black-Scholes formula for European options

// s0 = initial stock price, k = strike, r = interest rate

// v = implied volatility, t = time to expiry (years)

double blackscholes(OptionType type, double s0, double k, double r, double v, double t)

{

double d1 = (log(s0/k) + (r + 0.5*v*v) * t) / (v*sqrt(t));

double d2 = d1 - v * sqrt(t);

double sign = (type == Call) ? 1.0 : -1.0;

double nd1 = norm_cdf(sign * d1);

double nd2 = norm_cdf(sign * d2);

return sign * (s0 * nd1 - k * exp(-r*t) * nd2);

}

// Monte Carlo pricing of European option

double montecarlo(OptionType type, double s0, double k, double r, double v, double t, int nSims = 10000)

{

// Mersenne Twister RNG with fixed seed

mt19937 generator(123456);

normal_distribution<double> normsdist(0, 1);

// Run Monte Carlo Simulations

double sign = (type == Call) ? 1.0 : -1.0;

double price = 0.0;

for (int i = 1; i <= nSims; ++i)

{

// Generate Standard Normal Random Number, z

double z = normsdist(generator);

// Use GBM for Stock Price at Time t

double st = s0 * exp((r - 0.5*v*v) * t + v*sqrt(t)*z);

double payoff = max(sign * (st - k), 0.0);

// Martingale Price equals Discounted Payoff

price += payoff * exp(-r*t);

}

// Average Price

return price / nSims;

}

int main()

{

// European Call, S=100, K=100, r=1%, vol=10%, t=1 Year

// Expected Price: 4.485236

double bs = blackscholes(Call, 100, 100, 0.01, 0.1, 1.0);

double mc = montecarlo(Call, 100, 100, 0.01, 0.1, 1.0, 20000);

printf("%s%.6f\n", "Monte Carlo Price: ", mc);

printf("%s%.6f\n", "Black-Scholes Price: ", bs);

return 0;

}Python

The equivalent code in Python is shown below.

# Geometric Brownian Motion simulation & Monte Carlo option pricing notebook

import numpy as np

import matplotlib.pyplot as plt

from scipy.stats import norm

from scipy.stats import lognorm

# Black-Scholes analytic price

def black_scholes_price(call_put_flag, S0, K, r, sigma, T):

d1 = (np.log(S0 / K) + (r + 0.5 * sigma**2)*T) / (sigma * np.sqrt(T))

d2 = d1 - sigma * np.sqrt(T)

if call_put_flag == 'call':

price = S0 * norm.cdf(d1) - K * np.exp(-r*T) * norm.cdf(d2)

else:

price = K * np.exp(-r*T) * norm.cdf(-d2) - S0 * norm.cdf(-d1)

return price

# Monte Carlo simulation of future price S(T) under risk-neutral GBM

def simulate_gbm(S0, r, sigma, T, nSims, seed=12345):

np.random.seed(seed)

Z = np.random.normal(size=nSims)

ST = S0 * np.exp((r - 0.5 * sigma**2)*T + sigma * np.sqrt(T) * Z)

return ST

# Monte Carlo pricing for European options

def monte_carlo_price(call_put_flag, S0, K, r, sigma, T, nSims):

ST = simulate_gbm(S0, r, sigma, T, nSims)

if call_put_flag == 'call':

payoffs = np.maximum(ST - K, 0)

else:

payoffs = np.maximum(K - ST, 0)

discounted_payoff = np.exp(-r * T) * payoffs

price = discounted_payoff.mean()

std_error = discounted_payoff.std() / np.sqrt(nSims)

return price, std_error

# European Option Parameters

S0 = 100 # initial stock price

K = 100 # strike price

r = 0.01 # risk-free rate

sigma = 0.1 # volatility

T = 1.0 # time to maturity

nSims = 10000

# Compute Black-Scholes price

bs_price_call = black_scholes_price('call', S0, K, r, sigma, T)

print(f"Black-Scholes call price: {bs_price_call:.6f}")

# Compute Monte Carlo price and standard error

mc_price, standard_error = monte_carlo_price('call', S0, K, r, sigma, T, n)

print(f"Monte Carlo price with {nSims} simulations: {mc_price:.6f} ± {standard_error:.6f}")

Monte Carlo Simulation Results

Keywords

Derivatives, Option Pricing, European, Vanilla, Exotics, Monte Carlo, Simulation, Black-Scholes, Closed-Form, Analytical, Solution, Random Number Generators, Mersenne Twister, Sobol Brownian Bridge, Normal Cumuluative Distribution Function, CDF, Error Function, Programming, C++, CPlusPlus, Python, Standard Error

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]