- AQH Weekly Deep Dive

- Posts

- How to Become a Quant? - The What, Why and How

How to Become a Quant? - The What, Why and How

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

AlgoQuantHub brings you the latest hands-on quant tutorials, insightful videos, and cutting-edge research—designed to bridge the gap between quantitative theory and practical implementation in real markets. This newsletter delivers actionable knowledge right to your inbox, featuring targeted explorations of key topics each week.

Last week, we focused on techniques for supercharging pricing and risk analytics for electronic markets. We learned about low-latency models and how to accelerate computations to produce real-time portfolio risk using the Jacobian approach.

This week, we’ll learn how to land a Quant job. We take you through the details of what is a Quant, what they do, how to become a Quant, CVs, the interview process and why become a Quant.

Bonus content, Quants use advanced maths, programming, and financial knowledge to develop models and strategies for financial markets—a career that offers high pay and strong growth prospects for those with STEM backgrounds. Here, we provide free essential resources to help you break into Quant Finance.

Stay tuned for impactful insights—delivered weekly to help you master quant finance and algorithmic trading.

Table of Contents

Exclusive Quant Discounts

In this week’s newsletter we give readers a digital download discounts for use in AlgoQuantHub’s digital download store https://payhip.com/AlgoQuantHub

Discount - Expiry 25th July 2025

30% off total order amount

Code: 6QTBPS1GUL

Feature Article - Want to Become a Quant? - The What, Why and How

What is a Quant?

Quantitative finance is a highly lucrative and intellectually stimulating field at the intersection of mathematics, computer science, and finance that focuses on using rigorous quantitative methods to analyse and predict financial markets. Professionals in this arena, known as ‘Quants’, develop and implement mathematical models, sophisticated algorithms, and data-driven strategies to gain insights into financial behaviours, optimize trading, and manage financial risk.

What do Quants do?

Quants work at hedge funds, proprietary trading firms, asset management companies (the ‘Buy Side’) or investment banks (the ‘Sell Side’). There are different types of Quants namely,

Quant Traders - Design, implement, and execute algorithmic trading strategies, often with a focus on automation and market efficiency.

Quant Researchers - Develop mathematical models to predict market movements. Predominantly found on the buy side, they leverage Python for predictive analytics, machine learning, and AI-driven research.

Quant Analysts - Build and maintain pricing models and risk analytics for trading desks. Typically, on the sell side, they use C++ to deliver low-latency solutions for electronic market making, live risk management, and present value calculations.

Quant Strategists - Work closely with trading teams to provide quantitative models, pricing, and risk support, bridging the gap between research and execution.

Quant Developers - Design the software and technology infrastructure that enables traders to implement and risk manage trading strategies efficiently and securely.

How to become a Quant?

Firstly, to become a Quant one requires the right educational background a postgraduate master’s degree (MSc.) in a STEM field such as Mathematics, Engineering, Computer Science, Physics, Finance is required.

Secondly, essential skills needed include: Probability & Statistics, Stochastic Calculus, Linear Algebra and an understanding of Optimization Techniques.

Thirdly, most firms expect programming knowledge and proficiency in C++ and Python for ‘Sell Side’ and ‘Buy-Side’ roles respectively. Often one requires a knowledge of both.

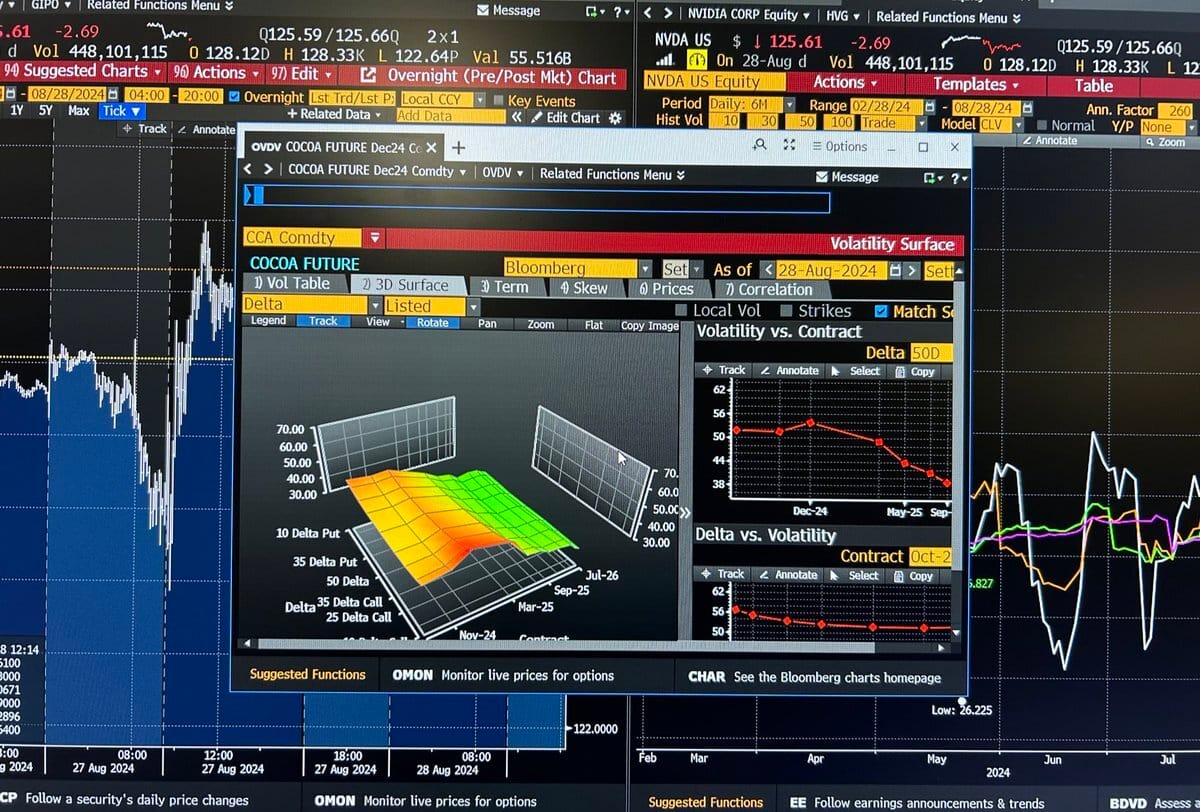

Fourthly, financial knowledge and an understanding of financial instruments and market micro structure is required. Popular concepts include: the Black-Scholes model, Volatility Models (e.g. Local Vol, SABR, Heston, Stochastic Local Vol), Market Microstructure and Order Book Dynamics, Yield Curve Models, Bond, Swap, Credit and Derivative Pricing. Generally, some practical experience working on such models will be expected.

Quant Interviews

Exam style interviews are often conducted that are highly challenging consisting of questions on: Mathematics, Brain Teasers, Coding Challenges, Finance and Trading Concepts and Problem-Solving.

Quant CVs

Due to high demand, most Quant CVs are initially scanned and often hiring managers spend approx. 30 seconds per CV. Many hiring managers quote TLDR - ‘Too Long Didn’t Read’ as the main reason for not interviewing a candidate. Many CVs are filtered and screened using SEO - Search Engine Optimization software, where only CVs with certain keywords are accepted, usually the keywords are requirements listed in the job post.

Why become a Quant?

There are many reasons to become a Quant including: high salary potential, work projects are intellectually challenging & rewarding, working with cutting-edge technology (including machine learning and artificial intelligence), excellent career growth potential.

Keywords

Quant, Finance, Markets, Trading, Strategies, Analysis, Research, Pricing, Hedging, Risk Management, Coding, Mathematics, Models

Bonus Content - Essential Quant Resources to Break into Quant Finance

Unlock a quant finance career and master a blend of advanced mathematics, programming, and market strategy — with the right resources at your fingertips, you can set yourself apart from the competition. From building a standout CV and honing technical skills with industry-leading books and coding platforms, to advancing your expertise through elite recommended training programs. The resources presented here provide you with everything you need to excel as a quant—whether you’re preparing for high-stakes interviews, developing real-world trading strategies, or seeking to accelerate your Quant Finance journey.

How to Become a Quant?

The Ultimate Quant Guide

Quant CVs

Useful website for Quant resume writing

Quant CV Examples & Templates

Books

The below books I have personally found the very useful.

Broad Financial Markets Guide - Options, Futures and Other Derivatives

Quant Interviews - Heard on The Street: Quantitative Questions from Wall Street Job Interviews

Options Pricing with Code - The Complete Guide to Option Pricing Formulas

Options Market Microstructure - Option Volatility & Pricing

With Excellent Video Classes & Python Code - Mathematical Modeling and Computation in Finance

Shows How to Manage Demo/Live Trades with IB Broker API - Python for Algorithmic Trading Cookbook

Features Trading Strategies (Rare to Find in Finance Books) - Algorithmic Trading: Winning Strategies and Their Rationale

Recommended Courses

For professionals pursuing quant finance careers, the Certificate in Quantitative Finance (CQF) and QuantInsti courses stand out for their strong industry reputation and practical focus. CQF is highly valued for its in-depth training in quantitative analysis, financial engineering, and advanced programming, while QuantInsti specializes in hands-on courses for algorithmic trading, machine learning, and financial programming. Both programs equip quants with the technical and applied skills needed to excel in today’s fast-evolving finance sector.

Coding Practice

Excellent coding resources.

Free Online C++ Emulator - Can select Python & other languages (top-right)

Useful Links

Quant Research

Links to my Quant Research

SSRN Research Papers

https://ssrn.com/author=1728976

GitHub Quant Research

https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Links to learning resources for Financial Markets

Subscribe to my Quant YouTube Channel

https://youtube.com/@AlgoQuantHub

Algorithmic Trading & Quant Research Hub

https://payhip.com/AlgoQuantHub

Follow me on Linked-In

https://www.linkedin.com/in/nburgessx/

Explore my Quant Website

https://nicholasburgess.co.uk/

Read my Quant Book - Low Latency IR Markets

https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

My AlgoQuantHub (AQH) newsletters showcase the latest hands-on quant tutorials, videos and research, helping you bridge the gap between theory and real-world quant practice.

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

In this newsletter we deep dive into the world of algo trading and quant research with a focus on implementation and getting things done for real, and includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]