- AQH Weekly Deep Dive

- Posts

- FX Arbitrage & Cross Currency Basis

FX Arbitrage & Cross Currency Basis

AlgoQuantHub Weekly Deep Dive

Welcome

Welcome to AlgoQuantHub’s Weekly Deep Dive into Algo Trading & Quant Research!

AlgoQuantHub includes the latest hands-on quant tutorials, videos and research, helping you bridge the gap between theory and real-world quant practice. All delivered by this newsletter! Each week I will deliver a targeted deep dive into a feature topic.

Last week for our market’s article we discussed the impact of Trump’s ‘Big Beautiful Bill’ and ratings downgrades on US Bond markets and for our technical article we looked at the Bond Total Return swaps as a tool to maximize profits and minimize cost i.e. increase leverage and reduce capital costs using margin.

This weeks’ feature article looks at FX arbitrage and the persistent cross-currency basis and why Covered Interest Rate Parity (CIP) breaks down. We also provide many links to detailed market research on this topic

Digital Download Voucher

In this week’s newsletter we give readers a digital download voucher for the first 25 users https://payhip.com/AlgoQuantHub for use in AlgoQuantHub’s digital download store.

25% off total order amount

Code: JM9H2RZXK1

Table of Contents

Feature Article - FX Arbitrage and the Persistent Cross-Currency Basis

In global FX and rates markets, traders and quant desks have long relied on the principle of Covered Interest Rate Parity (CIP) to price forwards and cross-currency swaps. CIP states that, in efficient markets, the difference between interest rates in two currencies should be exactly offset by the forward FX rate, leaving no room for arbitrage. This is a foundational concept for banks, hedge funds, and corporates managing currency risk, and the formula is:

F = S × ( 1 + Rf ) / ( 1 + Rd )

Where:

F = forward exchange rate

S = spot exchange rate

Rf = foreign interest rate

Rd = domestic interest rate

Example:

Suppose EUR/USD spot is 1.10, USD rates are 5%, and EUR rates are 3%. CIP predicts a forward rate of:

F=1.10 × 1.03 / 1.05 ≈ 1.08

In theory, this means no arbitrage: borrowing in EUR, swapping to USD, and investing at the USD rate should yield the same as simply investing in EUR.

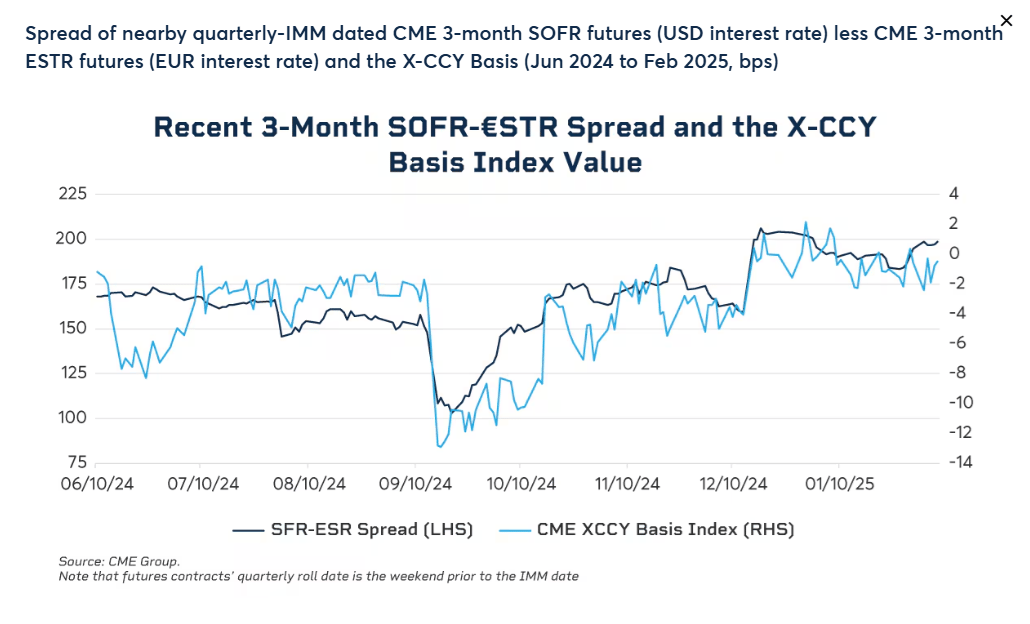

But in practice, the cross-currency basis—the gap between the observed forward rate and the CIP-implied rate—often persists and can be significant.

Why? Regulatory costs, balance sheet constraints, and uneven access to funding (especially in USD) mean arbitrage is not frictionless. For example, if the EUR/USD basis is -40bps, borrowing USD via a swap is 40bps more expensive than CIP predicts. This is not just a quirk: it’s a signal of real funding stress and market segmentation.

Trading and Arbitrage Opportunities:

Basis Arbitrage: When the market basis deviates from theoretical, traders can structure offsetting positions to capture the spread—borrowing in the cheap currency, swapping, and investing in the expensive one. In reality, exploiting these gaps requires scale, access to balance sheet, and careful risk management.

Relative Value Trades: Traders can take views on the shape of the basis curve (e.g., 1Y vs. 5Y EUR/USD basis) or between different currency pairs (EUR/USD vs. GBP/USD), expressing macro or liquidity views.

Macro Plays: Anticipating central bank interventions or shifts in liquidity, traders can position for basis tightening or widening, especially around stress events or policy changes.

Risk Management: Hedgers and prop desks use derivatives, cross-currency swaps, and now exchange-traded basis futures to manage exposure, diversify, and hedge basis risk.

Takeaway:

The cross-currency basis is not just a theoretical anomaly—it’s a real, tradeable signal of global funding pressures and market segmentation. For traders, understanding the drivers and dynamics of the basis opens up a range of arbitrage and relative value opportunities, but also demands robust risk management and market access.

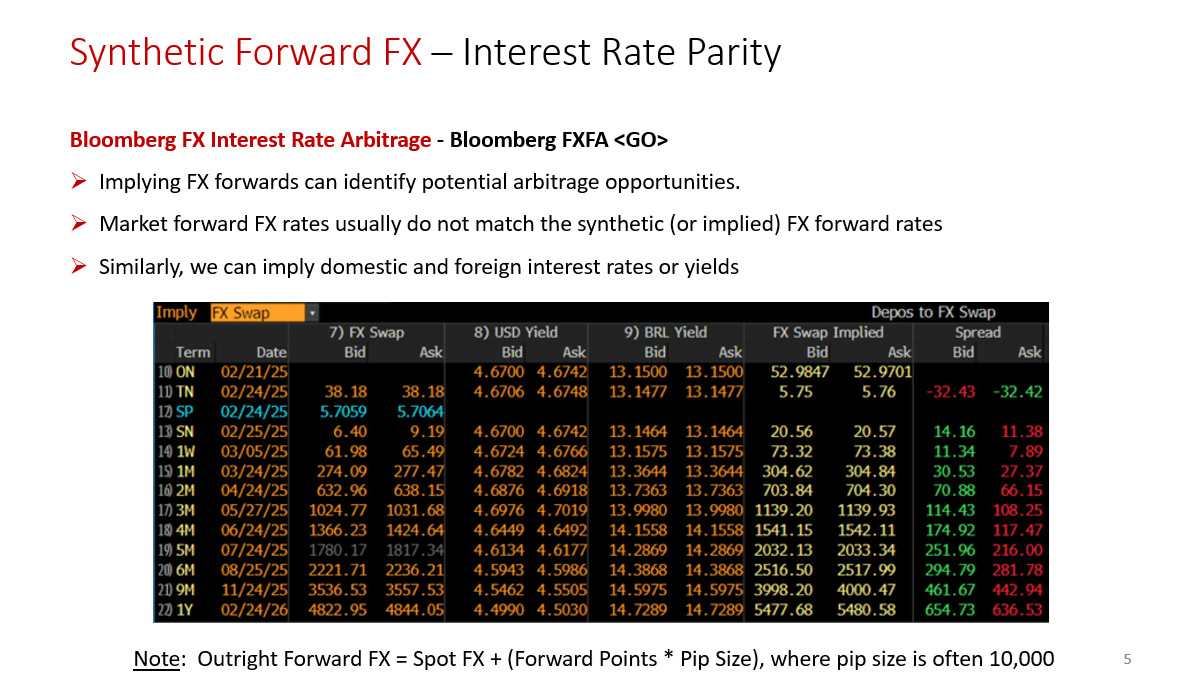

Synthetic Forward FX

In the article Synthetic Forward FX Replication & Collateralized Discount Factors we provide a comprehensive framework for pricing cross-currency swaps and outline the procedure to calculate discount factors that are adjusted for the type of collateral posted. The paper first revisits the interest parity formula, then adapts it for Xccy pricing to derive the forward FX invariance formula. It further explains how to calibrate USD-collateralized discount factors using Xccy swap market data and extends the approach to non-USD collateralized scenarios using forward FX or Xccy swap inputs.

This methodology is highly relevant for identifying FX arbitrage opportunities—particularly those involving cross currency basis trading—because it enables practitioners to accurately compute the theoretical fair value of forward FX rates under various collateral agreements. By comparing these synthetic forward rates to observed market prices, traders and quantitative analysts can systematically detect and quantify arbitrage opportunities arising from deviations in the cross currency basis, thus supporting more robust and transparent FX arbitrage strategies

Click on the image(s) below for more info!

Futher Reading

CME Group: How U.S.-EU Relations Could Impact the Cross Currency Basis

Number Analytics: The Final Guide to Cross Currency Basis Explained

Number Analytics: A Quick Guide to Cross Currency Basis Simplified

Clarus FT: Cross Currency Swaps Review 2024

AlphaPicks: Global Primer Series: Cross Currency Basis

CME Group: Understanding EUR/USD Cross-Currency Basis Futures

Frontier Advisors: Cross currency basis swaps

Feature Video - Interest Rate Swaps Explained

Subscribe to AlgoQuantHub’s Quant YouTube Channel!

Whether you're a finance professional, a student, or simply curious about the mechanics behind modern financial markets, understanding interest rate swaps is essential. Swap transactions are embedded in most mortgages, personal- and corporate loans. Banks and lenders manage the swap transaction and pass on the transaction costs.

In this video, we break down the concept of interest rate swaps—one of the most widely used derivatives in the world—into clear, accessible terms. You'll discover how these contracts allow two parties to exchange fixed and floating interest payments, why institutions use them to hedge risk or reduce borrowing costs, and how swaps are structured and valued in practice. Join us as we demystify the mechanics, motivations, and real-world applications of interest rate swaps, equipping you with the knowledge to navigate this critical area of finance with confidence.

Feature Download - Interest Rate Markets Training Bundle

Visit AlgoQuantHub’s Digital Download Store!

This week we feature the Interest Rate Markets Training Bundle, which contains Excel workbooks, PowerPoint and PDF training materials for interest rate markets including the following,

IR Markets Overview

Interest Rate Swaps

Cross Currency Swaps

Credit Default Swaps

Quanto Credit Default Swaps

This comprehensive training bundle covers the fundamentals of interest rate markets and provides step-by-step guidance on pricing key instruments, including interest rate swaps (IRS), cross-currency swaps (XCCY), credit default swaps (CDS), and quanto CDS.

Feature Book - Algorithmic Trading, Winning Strategies and their Rationale

Ernest P. Chan’s Algorithmic Trading: Winning Strategies and Their Rationale offers a practical guide to developing systematic trading strategies, focusing primarily on mean reversion and momentum approaches. The book covers the entire workflow of quantitative trading—from identifying viable strategies and rigorous backtesting to setting up automated execution systems and managing risk. Chan explains the rationale behind each strategy, demonstrates how to test and refine them, and addresses real-world implementation issues, supported by clear examples and MATLAB code.

Structured to reflect the steps needed to build a quantitative trading business, the book also delves into advanced topics such as regime switching, factor models, and psychological aspects of trading. Its emphasis on simple, robust strategies grounded in the scientific method makes it especially useful for quants and practitioners who want to understand not just what works, but why it works, and how to adapt strategies to changing market conditions.

Click on the image below for more info!

Useful Links

Quant Research

Links to my Quant Research

SSRN Research Papers

https://ssrn.com/author=1728976

GitHub Quant Research

https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Linked to learning resources for Financial Markets

Subscribe to my Quant YouTube Channel

https://youtube.com/@AlgoQuantHub

Algorithmic Trading & Quant Research Hub

https://payhip.com/AlgoQuantHub

Follow me on Linked-In

https://www.linkedin.com/in/nburgessx/

Explore my Quant Website

https://nicholasburgess.co.uk/

Read my Quant Book - Low Latency IR Markets

https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

My AlgoQuantHub (AQH) newsletters showcase the latest hands-on quant tutorials, videos and research, helping you bridge the gap between theory and real-world quant practice.

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

In this newsletter we deep dive into the world of algo trading and quant research with a focus on implementation and getting things done for real, and includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]