- AQH Weekly Deep Dive

- Posts

- American Option Trading

American Option Trading

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

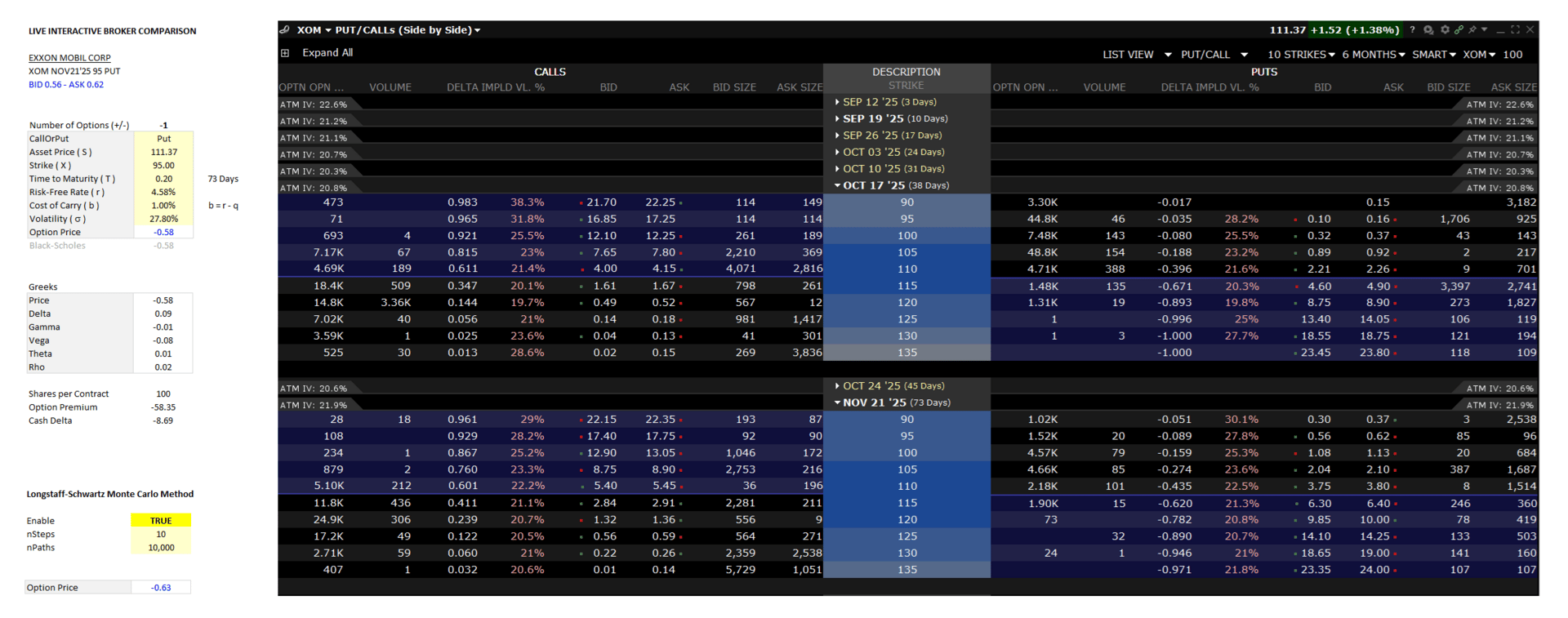

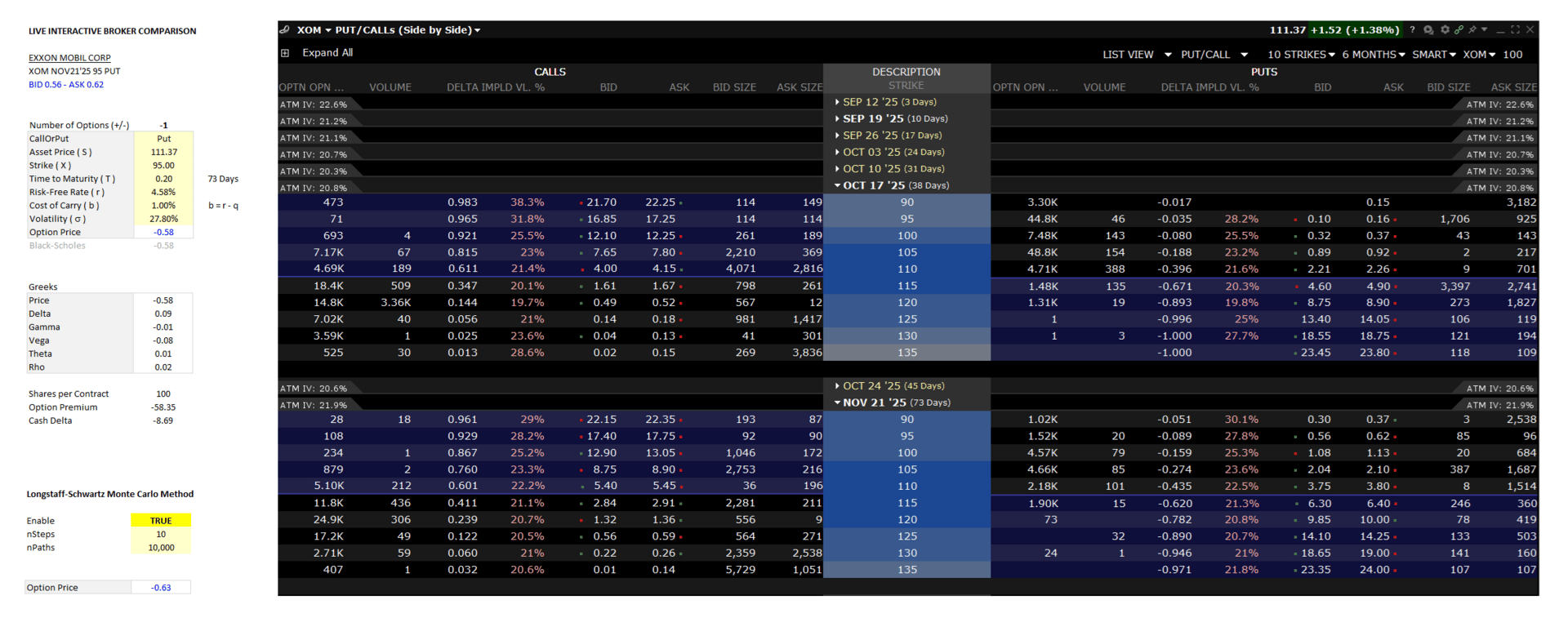

Last week, we unpacked core machine learning methods for algorithmic trading with hands-on Python examples. This week, we turn to the world of American options, putting pricing theory to the test against live markets and option chain quotes on Interactive Brokers (IBKR).

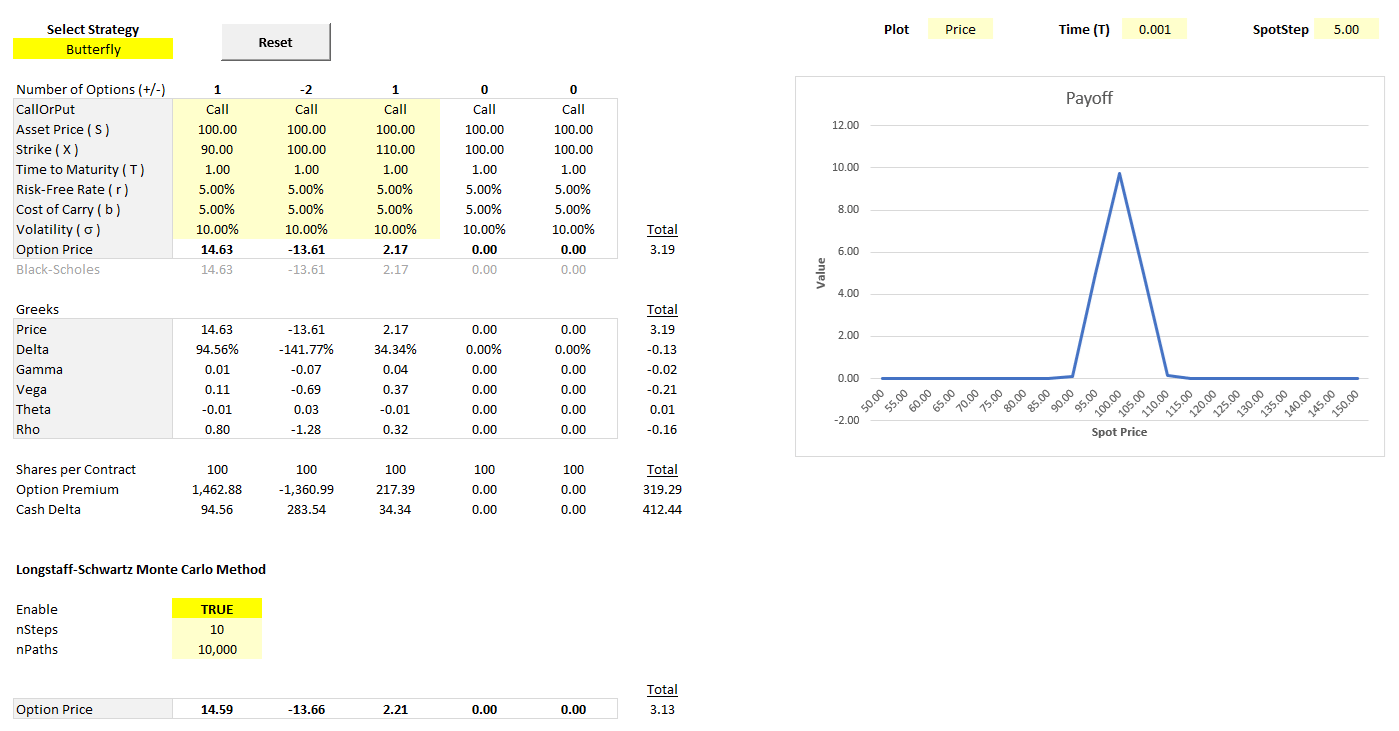

Bonus content, we showcase option pricing in Excel and highlight trading strategies such as the box, butterfly, iron condor, straddle, and strangle—plus more advanced structures.

Table of Contents

Exclusive Algo Quant Store & Discounts

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA

Feature Article: American Option Trading - Models, Pricing & Practice

Introduction to American Option Pricing

American options remain one of the most challenging derivatives to value precisely. Unlike European options, which can only be exercised at maturity, American options allow the holder to exercise at any time up to expiry. This flexibility—while valuable—makes pricing more complex, as the model must account not only for the payoff at maturity but also for the possibility of optimal early exercise. The mathematics of this problem leads to a free boundary condition, where the decision to exercise or hold must be continuously evaluated.

When to Exercise American Options?

A key question for traders is when to exercise, and when to hold. For most options, immediate exercise is rarely optimal. For American calls on non-dividend-paying stocks, it is almost never optimal to exercise early, since doing so forfeits any remaining time value. Selling the option in the market is almost always superior. The exception comes with dividend-paying stocks, where exercising just prior to a dividend can be optimal. Similarly, for puts, early exercise can sometimes be optimal if the option is deep in-the-money and interest earned on the strike outweighs the remaining time value. But the general principle holds: as long as the option has significant time value, selling it is better than exercising it prematurely.

Low Latency Pricing Approximations

Among approximation methods, the Bjerksund–Stensland (1993, 2002) approach is widely used by practitioners. Their method reduces the free-boundary exercise problem into a tractable analytical approximation, providing fast and fairly accurate prices. The idea is to define a critical exercise boundary as a function of time to maturity, volatility, and dividends, and then approximate the value of the American option by piecing together simpler European option components. It is not exact, but it offers speed, closed-form intuition, and accuracy good enough for trading applications where rapid pricing across large option chains is necessary.

Accuracy Comes with a Cost

The Longstaff–Schwartz Least Squares Monte Carlo (2001) method is a widely used benchmark for pricing American options, though it can be computationally intensive due to its simulation and regression steps. The method simulates thousands of possible price paths and works backward in time, at each step estimating the continuation value of the option using regression on simulated payoffs. This allows the algorithm to determine the optimal stopping rule (exercise vs hold) based on expectation rather than guesswork. While more demanding than approximation formulas, it is highly flexible—capable of handling complex payoffs, multiple factors, and path-dependent features where closed-form methods fail.

Conclusion: Speed Versus Accuracy

In practice, traders and risk managers often balance speed versus accuracy. Closed-form approximations like Bjerksund–Stensland are preferred for real-time pricing across thousands of strikes and maturities, while Monte Carlo methods like Longstaff–Schwartz are better suited for exotic payoffs, risk management scenarios, or validating model assumptions. Other methods exist, such as binomial and finite-difference methods, which remain useful teaching tools and practical in small-scale contexts, though they may struggle with efficiency at scale. Best practice today is often a hybrid approach: fast approximations for quoting and screening, Monte Carlo or PDE-based methods for risk analysis and verification.

Recommended Resources

1. American Option Analytics Excel Workbook

An American Options Excel workbook is available click-here, featuring fully implemented Bjerksund–Stensland and Longstaff–Schwartz pricing models. It matches live IBKR option chain quotes and includes many built‑in trading strategies from straddles to iron condors.

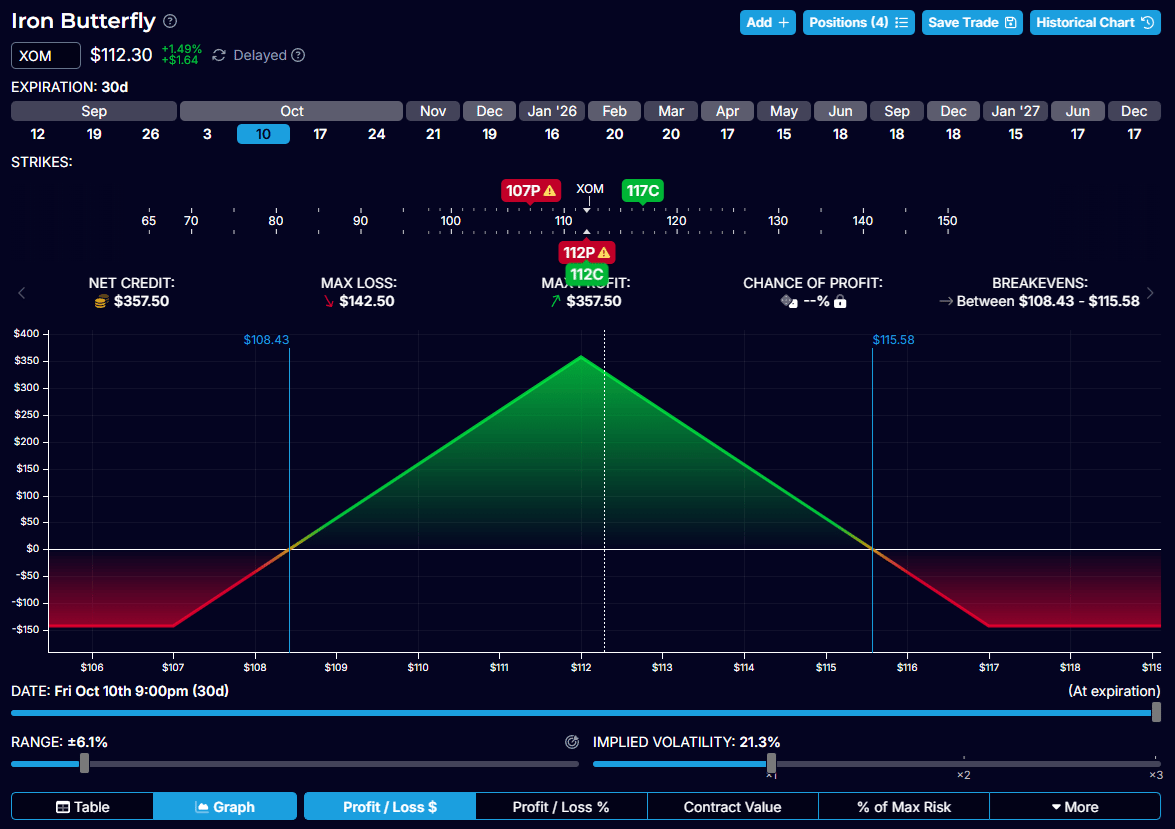

2. OptionStrat - Free Option Trader’s Toolkit

OptionStrat click-here is the next-generation options profit calculator and flow analyzer. Through continual monitoring and analysis, OptionStrat uncovers high-profit-potential trades you can't find anywhere else — giving you unmatched insight into what the big players are buying and selling right now.

3. Free Options Trading Education from Interactive Brokers

For expert-led video courses, webinars, podcasts and the latest options market insights and more click-here.

Keywords:

Trading American Options, Exercise, Continue to Hold, Pricing Models, Bjerksund-Stensland, Longstaff-Schwartz, Low Latency, Fast Approximations, Accuracy, Monte Carlo, Least Squares, Regression, Pricing, Risk, Trading Strategies

Bonus Content: Option Trading Strategies

Options offer investors flexible tools to tailor payoffs for different market scenarios. Strategies range from conservative income plays to speculative bets—plus one unique method, the box spread, which functions as a synthetic loan through options.

1. Low-Risk Income Trading Strategies

Box Spread

A synthetic loan strategy, where the box spread combines a bull call spread and a bear put spread at the same strikes and expiry to create a guaranteed fixed payoff equal to the strike difference. Its cost today reflects the present value of this payoff, effectively acting as a risk-free synthetic loan or investment at the market’s implied interest rate. Institutions often use this for cost-efficient borrowing or lending, locking in near-risk-free returns via options rather than traditional credit lines.

Covered Call

A covered call combines owning the underlying stock with selling call options on it to generate steady income from option premiums. This strategy suits investors seeking to boost returns in stable or modestly rising markets while accepting limited upside since shares may be called away at the strike price.

Cash-Covered Put

Selling a put option while holding enough cash (or sufficient margin) to buy the stock offers attractive premium income and a chance to purchase shares at a discount if assigned. It’s ideal for investors willing to own the stock at a lower price while earning income as compensation for the risk.

Collar

A collar protects existing stock gains by buying a put option for downside insurance while selling a call option to offset the cost. This strategy limits both losses and gains, providing a defined risk-reward range in volatile or neutral markets.

2. Medium-Risk Spreads

Vertical Spread

A vertical spread involves buying and selling options of the same type (call or put) and expiry but with different strike prices. This defined-risk strategy suits traders with a directional view, offering a low-cost way to profit from moderate price moves while capping both potential gains and losses.

Calendar Spread

A calendar spread buys a longer-dated option and sells a shorter-dated option at the same strike, capitalizing on time decay and volatility changes. It’s ideal for traders expecting stable prices in the near term but shifts later.

Diagonal Spread

The diagonal spread is a flexible blend of calendar and vertical spreads, combining options with different strikes and expirations. It offers tailored exposure to both direction and time, allowing nuanced bets on price and volatility dynamics.

Butterfly Spread

The butterfly spread is a range-bound, multi-leg strategy built by buying and selling options at three strikes. It offers limited risk and reward, designed to profit from low volatility when the underlying stays near the middle strike.

Iron Condor

The iron condor sells an out-of-the-money strangle and hedges with further out-of-the-money options, generating steady income if the asset trades within a wide range. Popular for its defined risk and frequent, modest profits in calm markets.

3. High-Risk/High-Reward Strategies

Straddle

A straddle involves buying a call and a put option at the same strike and expiry, betting on a big price move in either direction. It’s ideal when volatility is expected to surge but direction is uncertain, offering unlimited profit potential with limited loss equal to the premiums paid.

Strangle

The strangle is a cost-efficient variation of the straddle, buying out-of-the-money calls and puts with different strikes but the same expiry. It profits from significant price swings while requiring a smaller initial premium, though it demands a bigger move to be profitable.

Risk Reversal

This strategy pairs selling a put and buying a call (or vice versa) to take a directional view with limited upfront cost. Commonly used by institutions to gain leveraged bullish or bearish exposure, it combines upside potential with downside risk tied to the sold leg.

Conclusion and Recommended Resources

To deepen your trading knowledge and execute these strategies confidently, I recommend the following resources:

1. American Option Analytics Excel Workbook

This practical workbook features fully implemented Bjerksund–Stensland and Longstaff–Schwartz pricing models for American options, verified against live Interactive Brokers (IBKR) option chains. It also includes a variety of built-in trading strategies such as straddles, iron condors, and more. Find it here: American Options Excel Workbook.

2. OptionStrat - Free Option Trader’s Toolkit

OptionStrat is an advanced options profit calculator and flow analyzer that constantly monitors the market to uncover high-profit-potential trades. It provides unmatched insight into what institutional traders are buying and selling in real time. Explore it here: OptionStrat.

Keywords

Trading Strategies, Options, Derivatives, Generate Income, Hedging, Speculate, Box, Cash-Covered Put, Vertical Spread, Calendar Spread, Diagonal Spread, Butterfly Spread, Iron Condor, Collar, Straddle, Strangle, Risk Reversal.

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]