- AQH Weekly Deep Dive

- Posts

- Mastering Portfolio Management: Your Guide to Creating High-Return, Tax-Resilient Passive Portfolios

Mastering Portfolio Management: Your Guide to Creating High-Return, Tax-Resilient Passive Portfolios

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

This Week, we deep dive into how to create passive portfolios that maximize returns, minimize risk & minimize taxes. All the materials presented are from live trading and portfolio management.

Bonus Content, we dive even deeper into portfolio management with a practical guide to illustrate how professionals improve portfolio outcomes.

All materials are for informational purposes only and do not constitute investment advice. Figures are illustrative and intended to demonstrate structural effects rather than forecast performance.

Table of Contents

Feature Article: How to Optimize Passive Portfolios to Maximize Returns, Minimize Risk & Taxes

Passive portfolios succeed when they are designed to survive time. Markets do not move in straight lines, and even strong long-term trends experience drawdowns of 10–20% or more. A professionally engineered passive portfolio therefore builds in wiggle room: sufficient diversification, liquidity, and downside controls to allow positions to recover and generate attractive returns without forcing sales at precisely the wrong moment. The objective is not to avoid volatility — is neither realistic nor desirable as excessive trading only increases transaction costs — but to ensure volatility does not translate into permanent capital loss or unnecessary tax realisation.

Tax Efficiency - Asset Allocation & Exchange Traded Funds (ETFs)

Tax is where outcomes diverge dramatically. For high earners and high-net-worth investors, marginal tax rates on income and realised gains can easily reach 40–50%. At those levels, a seemingly attractive 10% gross return quietly degrades into 5–6% after tax — before inflation. Over multi-year horizons, this dominates performance. This is why professional passive portfolios are often built primarily using accumulating ETFs, where income is unrealized, reinvested internally and hence taxation is deferred. Both asset allocation and the choice of instrument determine whether returns quietly grow in the background or leak away to taxes every year.

Sovereign Bonds, Options & Tail Risk Controls

Combined with high-quality sovereign bond exposure and explicit tail-risk controls — such as small allocations to long, out-of-the-money index puts — a portfolio gains robustness without sacrificing upside participation.

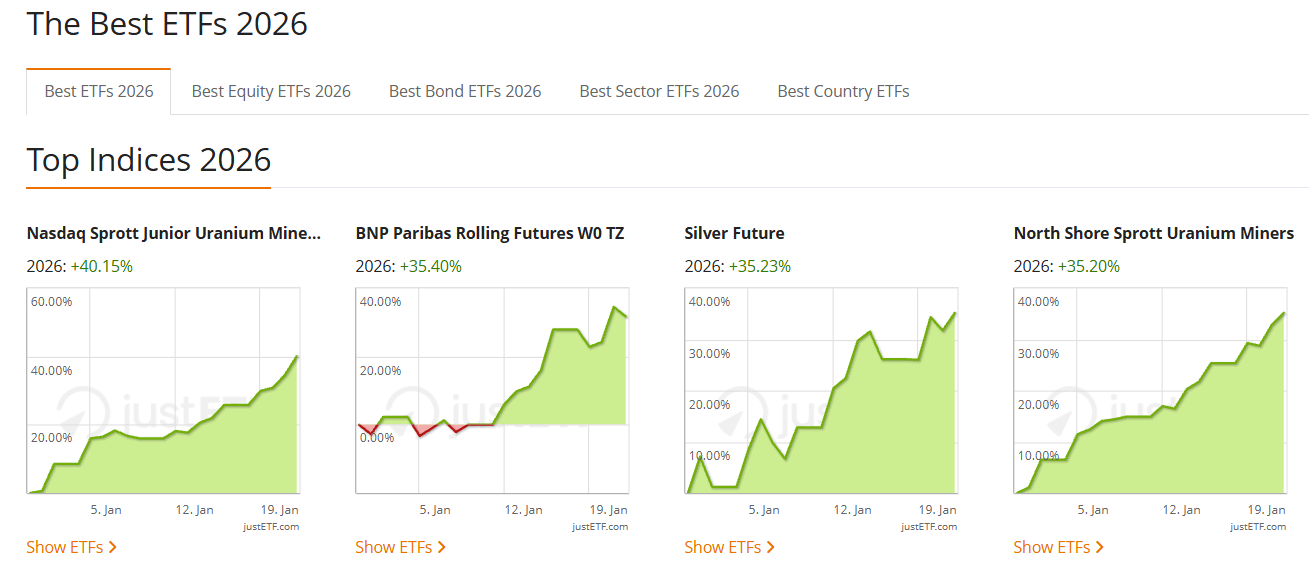

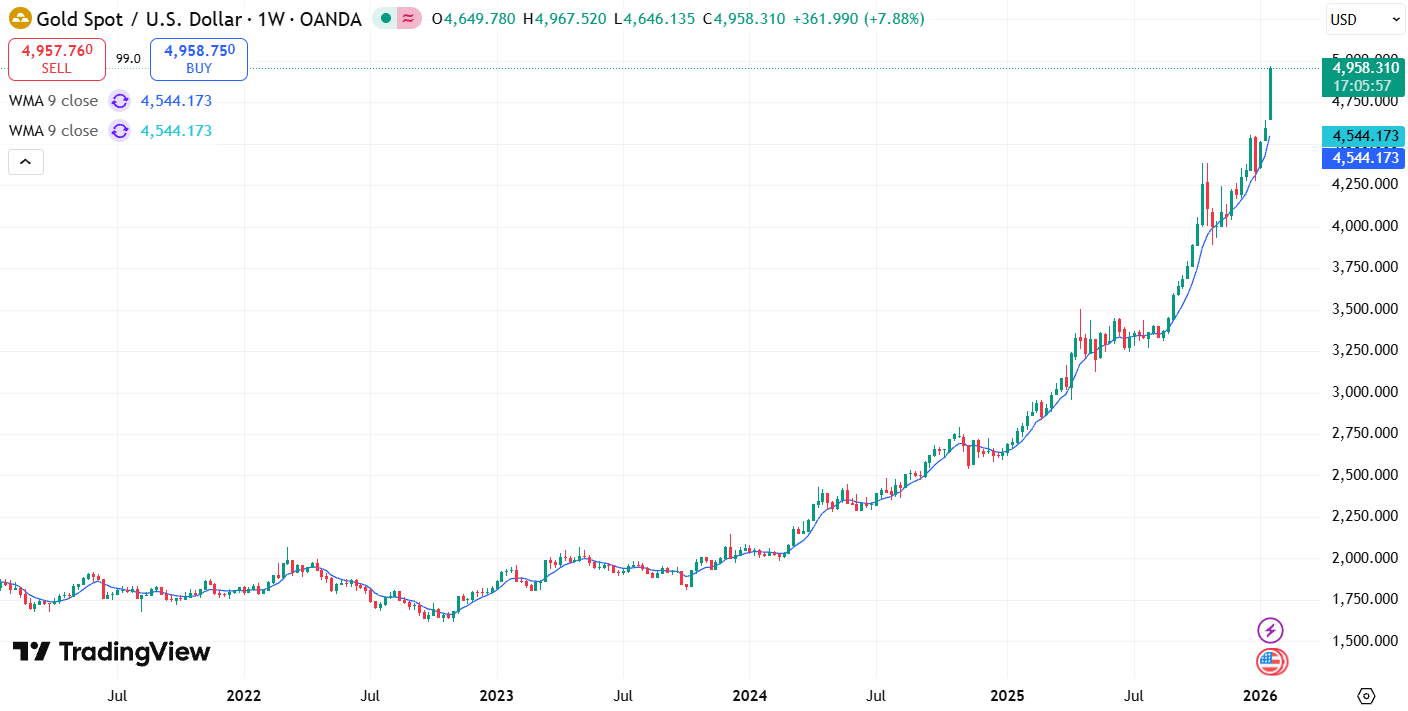

Commodities - Diversification, Drawdown Resilience & Inflation Hedging

Commodities play an important supporting role. Gold, in particular, has achieved phenomenal gains over the last year, with 2025 returns exceeding 25%, while silver also recorded impressive gains around 35%, making both metals some of the strongest-performing asset classes. A modest allocation — typically 5–10% of a portfolio — provides diversification, drawdown resilience, and a partial hedge against inflation and monetary instability. In a professionally constructed portfolio, precious metals are not speculative; they are structural stabilisers.

Dollar Cost Averaging (DCA) & Selling Puts to Buy on Market Lows

Finally, DCA systematically spreads purchases over time, reducing the risk of mistimed entries, while selling cash-covered puts allows you to get paid to buy assets at lower levels during market dips, effectively combining disciplined investing with execution.

Keywords: Portfolio Management, Passive Investing, ETFs, Accumulating ETFs, Gold Allocation, Silver Allocation, Risk Management, Tax-Efficient Investing

Bonus Article: An Illustration of How Professionals Improve Portfolio Outcomes

Financial Markets & Headline Returns

Headline market performance often looks impressive until tax and implementation are applied. Recently, broad equity markets delivered high single to low double-digit returns, while commodities such as gold returned over 25% and silver 35% in 2025. On paper, a diversified passive portfolio might show returns in the 8–12% range.

An Illustration: How much money can we make?

For a USD 1,000,000 portfolio, that equates to roughly USD 80,000–120,000 per year (approx. USD 6,500–10,000 per month). After tax, inefficient implementation can easily reduce this to USD 45,000–65,000 (approx. USD 4,000–5,500 per month). Structured correctly — using accumulating ETFs, tax-aware instruments, and controlled income overlays — a significantly larger share of returns remains unrealised and compounding.

Professional Trading & Execution

Professional portfolios also improve entry and income without abandoning a passive framework. Rather than deploying capital all at once, market entries can be managed using cash-covered put selling, allowing the portfolio to earn income while waiting to acquire assets at more attractive levels. Once positions are established, selective covered call selling can further monetise volatility or reduce cost basis — an approach often referred to as the wheel strategy. During higher-volatility regimes, drawdowns can be actively managed using collar structures, where upside is partially monetised to fund explicit downside protection. These tools are not speculative overlays, but mechanical methods for smoothing returns and controlling risk over the medium term.

Live Trading & Portfolio Management

All concepts discussed across these newsletters are grounded in real-world implementation. The mathematics, programming, pricing models, and risk analytics are not theoretical exercises — they are operational systems used to manage live portfolios across electronic markets. Readers interested in deeper technical detail may find the following notes useful:

Keywords: Passive Portfolio, Gold Strategy, Silver Strategy, Options Income, Wheel Strategy, Collar Strategy, Quant Portfolio Construction

Exclusive Algo Quant Store Discounts

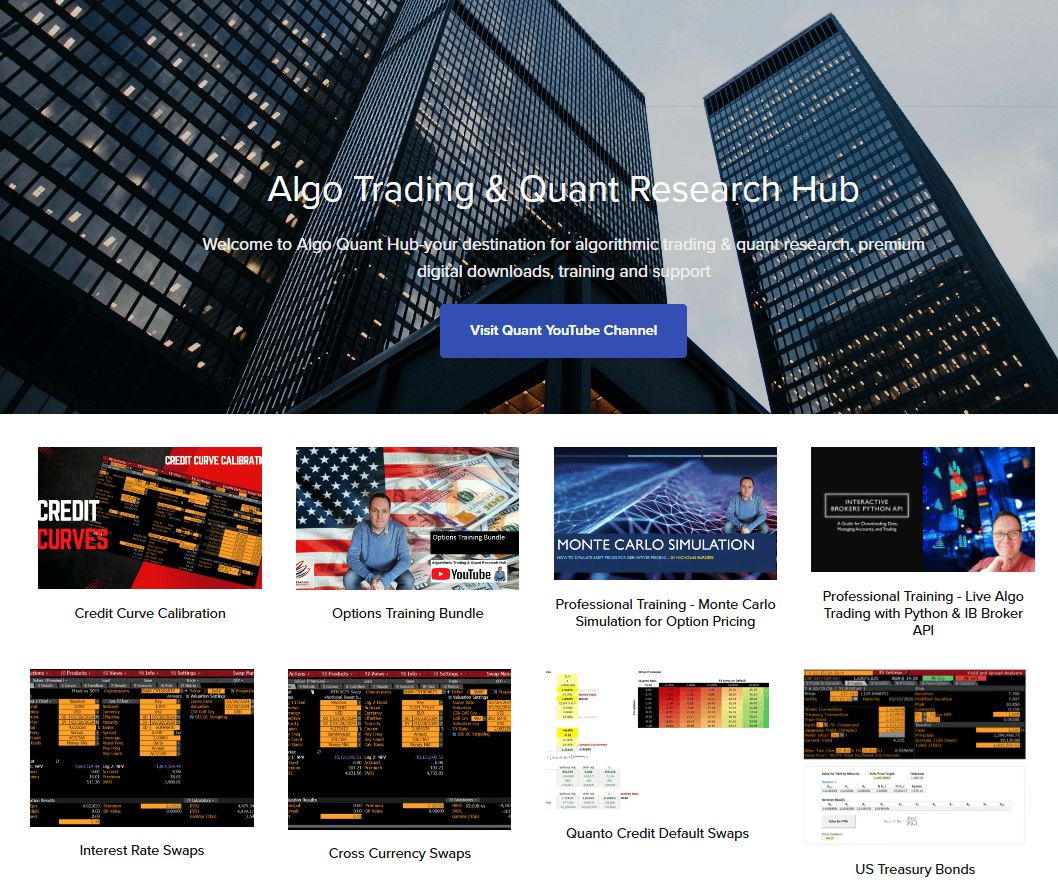

Algo Trading & Quant Research Hub

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA.

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]