- AQH Weekly Deep Dive

- Posts

- Gold Rush Edition: How to Invest in Gold – Stacking Coins vs Tracking ETCs

Gold Rush Edition: How to Invest in Gold – Stacking Coins vs Tracking ETCs

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

Last week, we gave an overview of bond repurchase agreements (Repos) and securities financing. This week, we dive into the new gold rush, exploring investment opportunities through coin stacking and ETC tracking - pitting physical gold and silver against their modern rivals, exchange-traded commodities (ETCs).

Bonus content: In this section, we outline live gold trading strategies across physical bullion, gold ETCs, and mining stocks — offering indirect exposure, dividend income, and access to options markets for enhanced returns. To support your trading, I’ve also included an Excel workbook for live option pricing, risk management, and strategy building. Everything discussed here I have personally and recently traded profitably.

Table of Contents

Exclusive Algo Quant Store & Discounts

Algo Trading & Quant Research Hub

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA

Feature Article: Stacking vs Tracking - Physical Gold / Silver vs ETCs?

1. The New Gold Rush: The Safe Haven Boom You Can’t Miss

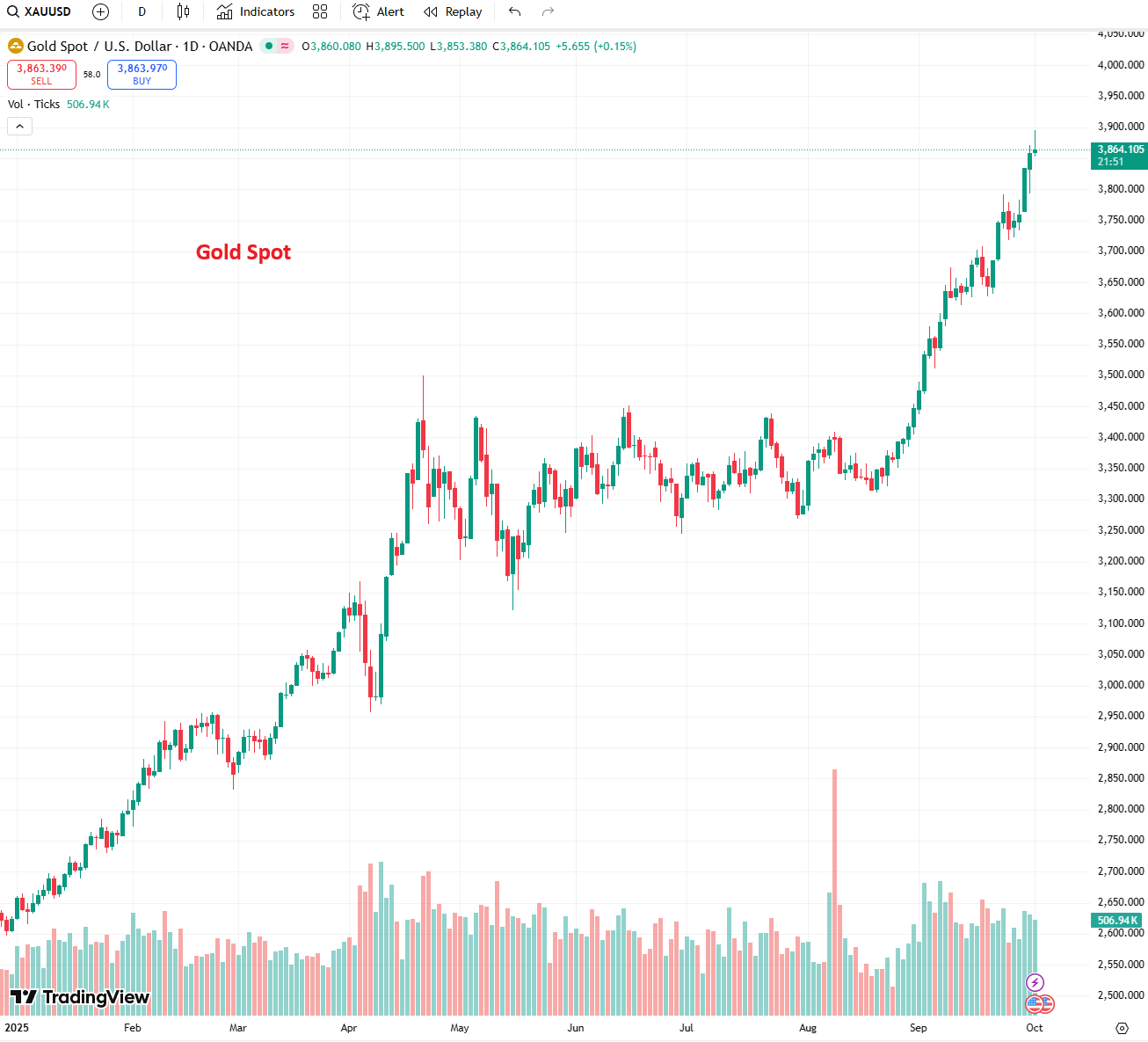

Gold and silver are once again at the centre of a global investment rush, propelled by a potent mix of macroeconomic drivers. Expectations of U.S. interest-rate cuts, persistent inflation pressures, a weaker dollar, heightened geopolitical risks, and sustained central bank demand have created a powerful bid for safe-haven assets. The result has been remarkable: in 2025, gold has surged beyond $3,800 per troy ounce (+40% YTD), while silver has climbed above $47 (+55% YTD), outpacing gold in percentage terms. Silver’s moves highlight its long-standing reputation as “gold on leverage” — a smaller, more volatile market that amplifies gold’s trajectory while also drawing strength from industrial demand in sectors such as electronics and solar energy. Analysts now see gold advancing to $4,000/oz, while silver could retest $50/oz. With double-digit returns already delivered this year and plenty of upside still on the table, this is simply too big an opportunity for investors to miss.

2. Investing in Physical Gold and Silver

For UK investors, physical bullion remains one of the most tangible and secure ways to gain exposure to precious metals. The 1 oz Gold Britannia coin is among the most popular choices, minted by The Royal Mint since 1987. Each coin contains a full troy ounce of fine gold, with 22ct or 24ct purity depending on the year, and features Britannia — a female warrior holding a trident and shield, symbolising Britain. The Gold Britannia is highly regarded for its legal tender status, internationally recognised design, and tax advantages, making it an appealing option for online and offline investors alike. Gold bars, available from 1g to 1kg, are another avenue, minted in 999.9 pure 24ct gold by world-renowned LBMA-approved manufacturers such as PAMP, Metalor, Umicore, Credit Suisse, and the Royal Mint, and supplied with certificates guaranteeing authenticity.

Key considerations for UK investors:

Gold Britannias: Legal tender in the UK; Capital Gains Tax (CGT) & VAT exempt. A modest trading premium of around 2% applies, making them ideal for mid- to long-term investment.

Gold Bars: CGT exempt but subject to 20% VAT. Premiums vary depending on size and manufacturer but are generally comparable to coins.

Silver Bullion: CGT exempt but VAT of 20% applies. Silver trades with higher premiums, typically around 10%, reflecting minting and transaction costs.

Pros: Physical gold and silver provide direct ownership, legal recognition, and in the case of UK coins, tax advantages. They are tangible assets that historically retain value in times of market volatility and currency uncertainty.

Cons: Trading physical bullion incurs premiums, making frequent buying and selling costly. Gold and silver are therefore generally unsuitable for short-term trading and are better suited to mid- to long-term strategies. Storage, insurance, and delivery logistics are additional considerations, though reputable dealers offer fully insured, discreet, and trackable services.

3. Investing in Gold and Silver ETCs

For investors seeking liquidity and trading flexibility, gold and silver ETCs (Exchange Traded Commodities) — as well as proxy mining companies — offer an attractive alternative to physical bullion. These instruments are highly liquid, with modest transaction costs, and allow investors to gain exposure to the metals without the need for storage, insurance, or handling logistics. Some of the main ETCs include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU) for gold, iShares Silver Trust (SLV) for silver, and in the UK specifically, Invesco Physical Gold ETC (ISGLP). In cases where ETCs are limited or unavailable, well-established mining stocks serve as a practical proxy. Companies such as Kinross Gold Corporation (KGC) for gold and First Majestic Silver (AG) for silver provide indirect exposure to metal prices, while also offering additional advantages: they pay dividends and have active options markets. This opens up opportunities for strategies such as trading covered calls to generate extra income or using cash-covered short puts to potentially purchase shares at a discount. Compared with physical bullion, ETCs and mining stocks are ideal for investors seeking trading flexibility, income generation, and the ability to implement option-based strategies, though they carry different risk profiles, including operational and market risks associated with the underlying companies.

Further Reading

- Hatton Garden Metals - Gold Buying Guide

- IBKR Quant - Why Gold and Why Now?

Keywords

Gold Rush, Safe Haven, Gold, Silver, Stacking, Tracking, Physical, ETCs, Mining Stocks, CGT, VAT, Tax, Dividends

Advert: Unlock the Future of Trading with Algorithmica

Imagine making smarter trades, pricing with pinpoint accuracy, and cutting your development time down to a fraction. Algorithmica delivers real-time analytics and risk management solutions that top traders and institutions rely on worldwide. Our software isn’t just good—it’s the best in the world, designed to give you the edge that turns opportunities into profit. Don’t settle for slower, outdated systems. Transform your trading today.

Click-here to contact us and experience the power of Algorithmica.

Keywords:

World Class, Trading Software, Quantitative Analytics, Risk Management, Financial Data

Bonus Content: Gold Trading Strategies

Let’s start with a foundation: for medium- to long-term wealth preservation, it makes sense to allocate some funds to physical gold coins, such as UK Gold Britannias. These coins offer tax-free capital gains and VAT advantages, making them an ideal way to invest in gold while you ride out market volatility over time. Physical coins provide the ultimate safe-haven exposure — stable, tangible, and tax-efficient.

For investors seeking trading opportunities, there are several strategies to enhance returns:

1. Direct Exposure via Gold or Silver ETCs

Investing in gold or silver ETCs provides immediate exposure to the metals without the need for physical storage. Silver ETCs have historically offered higher percentage returns than gold but come with greater volatility, so investors should consider their risk tolerance. One straightforward approach is a buy-write strategy, where you purchase the ETC and simultaneously sell covered calls. This allows you to capture metal price appreciation while generating premium income, balancing growth and income.

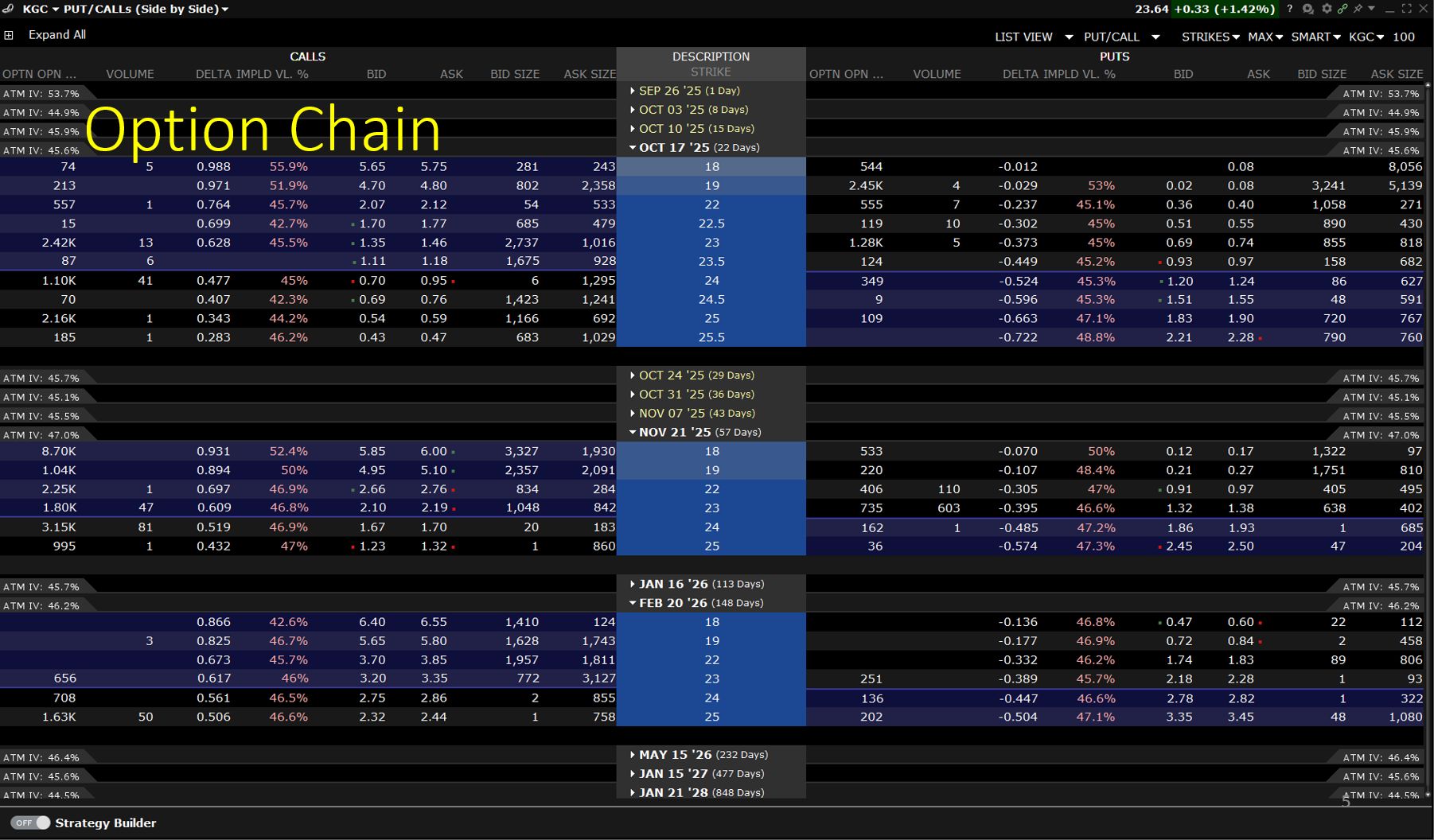

2. Gold Mining Stocks with Covered Calls

For those interested in equities, mining companies like Kinross Gold (KGC) offer indirect exposure to gold prices and additional benefits. By purchasing KGC stock, investors receive quarterly dividends (approximately $0.03 per share) while maintaining upside exposure to the stock. Selling a series of covered calls against the shares generates additional income until the stock is called away at your target profit level. This “wheel-style” strategy is straightforward, capital-efficient, and benefits from both dividends and premium collection.

3. Poor Man’s Covered Call (PMCC)

For investors looking to leverage capital efficiently, the PMCC is a powerful alternative. Instead of buying the stock outright, you purchase long-dated, deep ITM calls on KGC with a delta around 90%, effectively replicating a long stock position. You can then sell a series of shorter-term calls against this position to generate income until the synthetic position is called away at your target profit level. The PMCC offers similar income potential to a traditional covered call while significantly reducing initial and maintenance margin requirements, making it a capital-efficient way to enjoy leverage without full stock ownership.

Keywords:

Trading Strategies, Physical, Gold, Silver, ETCs, Mining Stocks, Options, Covered Call, PMCC, Dividends, Maintenance Margin, Leverage

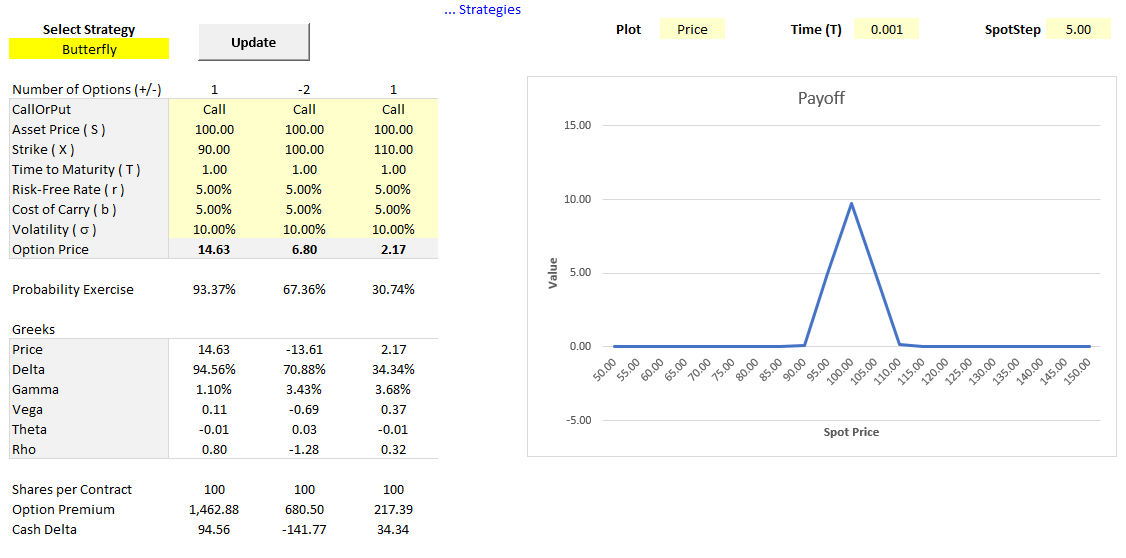

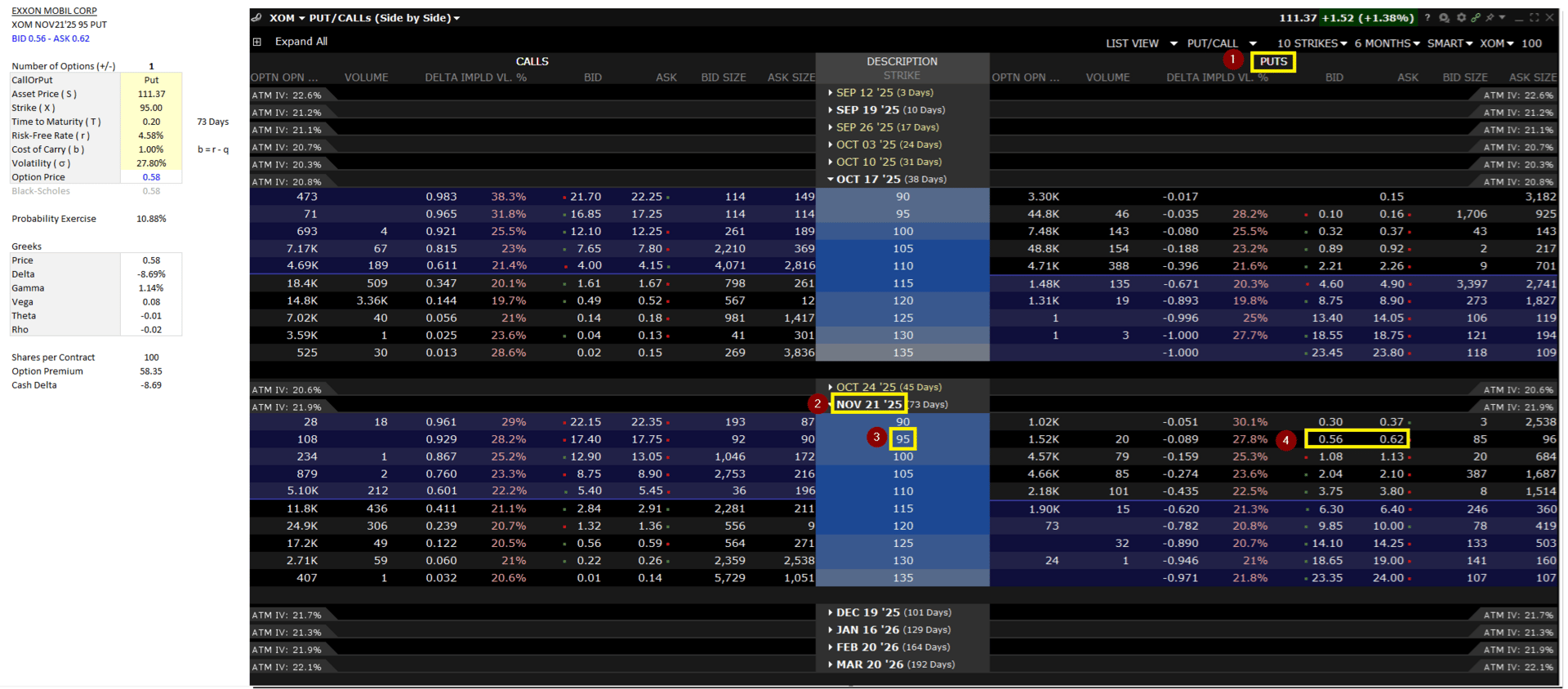

Excel Workbook: Live Options Pricing, Risk & Trading Strategies

A practical tool for quants, traders, and students of derivatives.

Unlike many purely theoretical models, this workbook bridges the gap between textbook formulas and real-world trading. It can be a valuable companion in both learning environments and for supporting live trading decisions. This workbook supports and is useful for,

a) Live Trading: results are benchmarked against live Interactive Brokers (IBKR) option chains, demonstrating that the pricing aligns closely within observed bid-offer spreads.

b) Analyse Trading Strategies: price, structure and study a wide range of option structures, including Box spreads, Calendar spreads, Vertical spreads, Iron Condors, Butterflies, Straddles, Strangles, and more.

c) Price American Options: We show how to price American Options using both the analytical Bjerksund–Stensland approximation and the Longstaff–Schwartz Least Squares Monte Carlo (LSM) method.

d) Greeks for American options: we compute and provide crucial sensitivities for risk management.

Available Here:

American Options - Live Pricing, Risk & Trading Strategies

Keywords:

Interactive Brokers, Live Options Pricing & Greeks, Risk, Trading Strategies, European Options, American Options

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]