- AQH Weekly Deep Dive

- Posts

- Options Trading - Selling Puts for Income, Getting Paid to Buy Low

Options Trading - Selling Puts for Income, Getting Paid to Buy Low

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

Last week, we discussed how to connect trading algorithms directly to financial markets for live trading using the Interactive Brokers Python API. This week, we present a trading idea and review a low-risk options trading strategy where we sell put options on reputable stocks for income generation and get paid to buy stocks at a discount and using the ‘Wheel Strategy’ we can trade covered calls to generate additional income.

Bonus content, we look at techniques to significantly enhance options trading strategies and gain a quantitative edge by modelling implied volatility dynamics and rigorously estimating option exercise and assignment probabilities.

Table of Contents

Exclusive Quant Discounts

Get 25% off all purchases at AlgoQuantHub’s digital store with code 3NBN75MFEA

Feature Article: Selling Put Options for Income, Getting Paid to Buy Low

Imagine a trading strategy that puts money in your pocket while you wait — and even gives you the chance to own great stocks at a discount. That’s the power of short put selling, a low-risk, income-focused approach that suits neutral to mildly bullish market views perfectly. By selling cash-secured put options on stocks you already want to own, you collect premiums upfront—essentially getting paid to buy shares below market price if assigned. If the stock stays above the strike price, you keep the premium as pure income. This means you either earn steady cash flow or buy great stocks cheaper than today’s market price. It’s a strategy that rewards patience and discipline, providing an income engine that works quietly in the background of your portfolio.

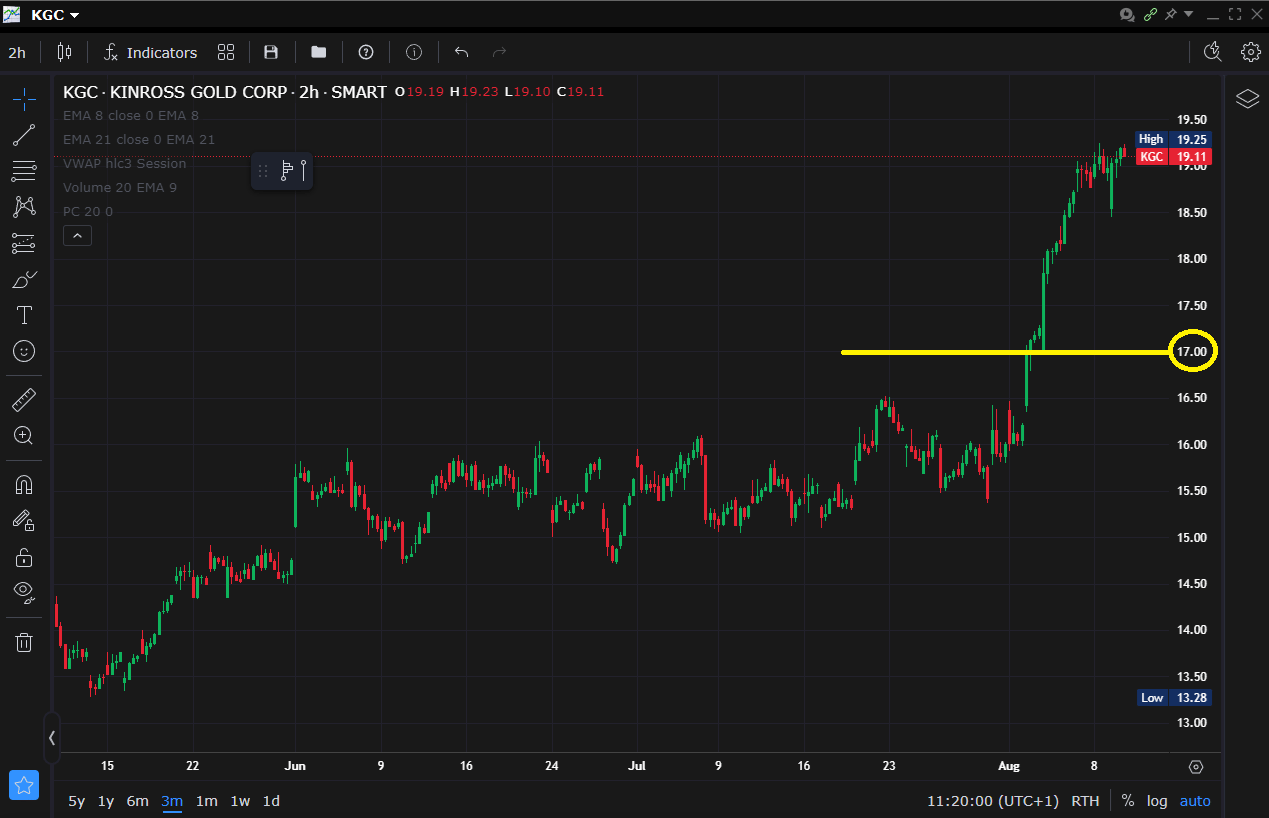

Kinross Gold Corporation (KGC), Very Bullish, Price Move from $16 to $19

Picking the right stocks is critical. Focus on fundamentally strong companies you trust long-term, with good liquidity and attractive valuations. Look for opportunity when implied volatility is elevated, as this tends to boost put premiums and enhance your income potential. Use probability tools to estimate your risk and the likelihood of assignment, balancing premium income against your readiness to own shares. The market offers you payment for patiently waiting; you just need a clear plan and disciplined execution to capture it.

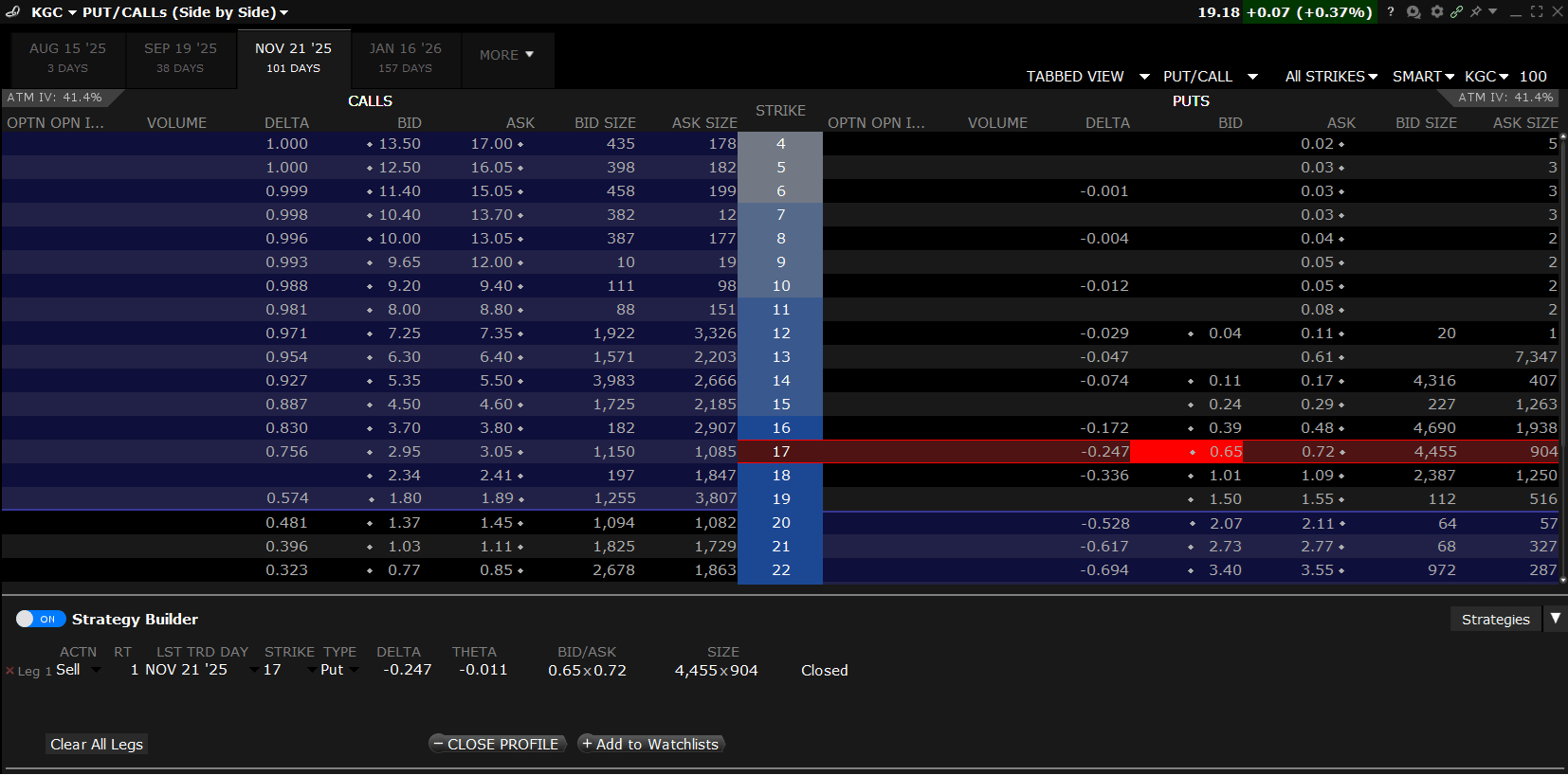

KGC Option Chain, Short Nov25 17 Put, Bid 0.65 - Ask 0.72

Short put selling works best when you’re happy to own the stock at your chosen strike and have the cash to fund it. By focusing on fundamentally solid companies, setting strike prices at attractive buy levels, and avoiding over-concentration, you keep risk anchored in the stock, not the option. This strategy pays you to wait—either the put expires worthless and you keep the premium, or you acquire shares at a discount. With disciplined execution and active monitoring, it can be run as a repeatable, low-risk income engine.

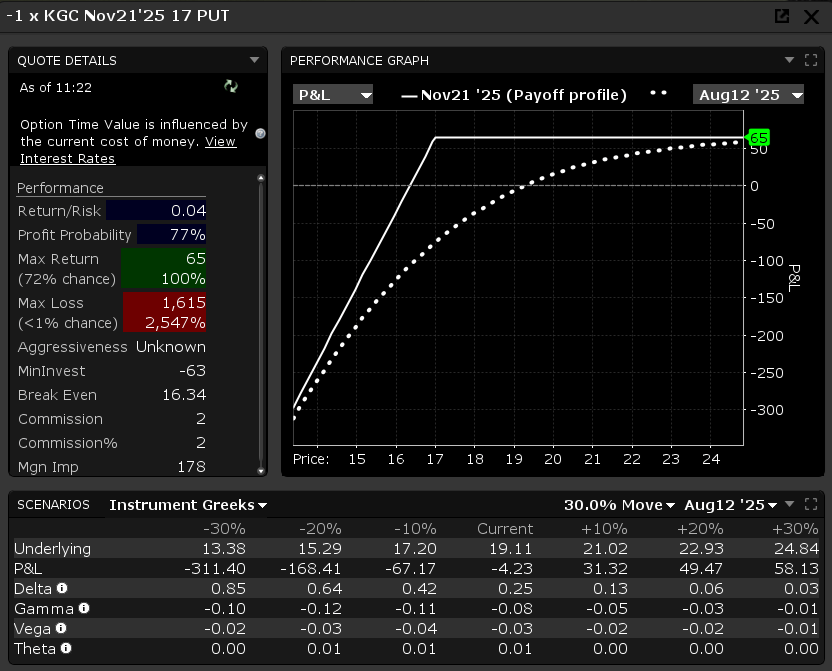

KGC, Short Nov25 17 Put, Payoff Profile

This strategy is income generation made practical—a low-risk way to build cash flow and equity incrementally without relying on market timing. If you’re looking to deepen your toolkit and harness options for real, consistent income, short put selling deserves your attention. For those keen to explore more, the work of Lee Lowell and his Smart Option Seller site offers invaluable insights to elevate your approach further. Embrace the put seller’s edge: get paid to buy low, rebuild your portfolio with conviction, and turn market uncertainty into opportunity.

For additional income we can employ the wheel strategy. It is an income-focused options approach that cycles between selling cash-secured puts and covered calls. You start by selling puts to potentially acquire stock at a discount—strike price minus the premium collected. If assigned, you transition to selling covered calls at strike prices above your cost basis, generating additional income while setting a target exit level. This creates a repeatable framework for managing positions and collecting steady premiums through changing market conditions.

By rotating between puts to enter positions and calls to profitably exit or enhance returns, the wheel strategy smooths portfolio performance, mitigates assignment anxiety, and turns stock ownership into a continuous yield opportunity. It enables disciplined, structured premium collection while aligning exits with favourable stock movements—making it a powerful tool for income-focused traders.

Trade Idea – Kinross Gold Corp (KGC)

Kinross Gold Corp (KGC), a leading gold miner, has just delivered strong earnings, supported by a bullish surge in underlying gold prices. After consolidating in the $15–$16 range, the stock has broken out sharply to the $19 level, with analyst price targets in the $20 region.

One strategy to consider is selling the November 2025 $17 put options with a bid of $0.65 (equivalent to $65 per contract, with each contract covering 100 shares). The premium is collected upfront, providing immediate income. If KGC’s price pulls back to $17, you would be obligated to purchase the shares at an attractive entry point — below current market levels and comfortably under medium- to long-term target prices. This trade offers a combination of income generation and the potential to acquire a fundamentally strong stock at a discount.

Further Reading & Resources

The Options Playbook - https://www.optionsplaybook.com/

The Option Trader’s Toolkit - https://optionstrat.com/

The Smart Option Seller - https://www.youtube.com/@leelowell

Keywords

Options, Trading, Selling Puts, Short, Volatility, Premium, Income, Buying Low, Assignment, Cash Covered Puts, Covered Calls, Wheel Strategy

Bonus Content: Gaining a Quant Edge using Volatility Modelling & Assignment Probabilities

Short put selling is an elegant strategy to generate income while positioning to buy stocks at a discount. From a quantitative perspective, this approach can be enhanced significantly by modelling implied volatility dynamics and rigorously estimating assignment probabilities—key levers that determine option premiums and risk-reward profiles in practice.

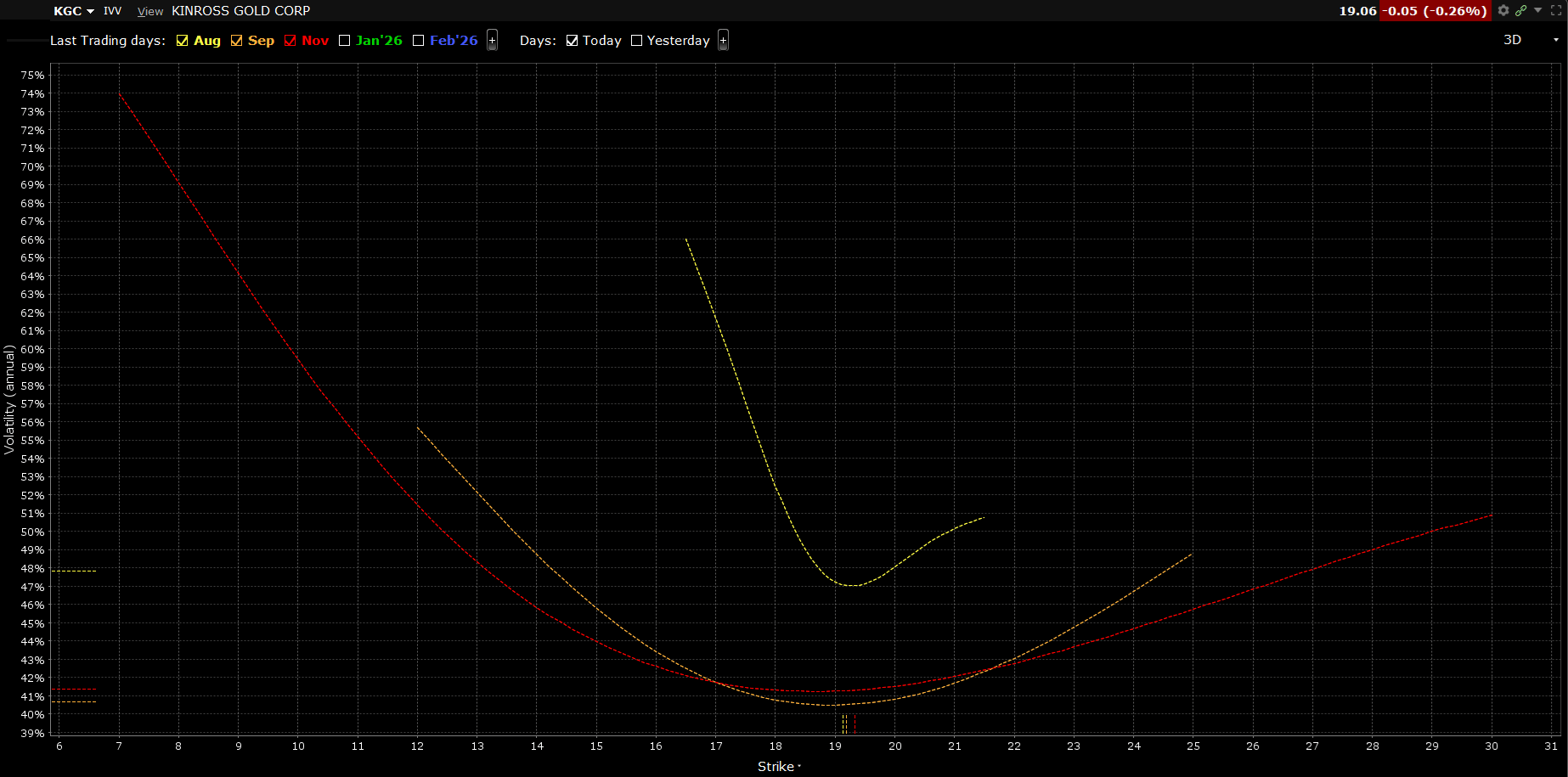

Volatility Modelling

At its core, selling puts means you are short implied volatility. The premium you collect incorporates the market’s consensus of future volatility embedded in option prices. Accurately modelling this volatility surface is essential to identifying richly priced puts that compensate you well for the risk you take.

Modern quant traders leverage Python and C++ libraries to build implied volatility surfaces and capture volatility skew and term structure. Using calibrations to local volatility models or stochastic volatility frameworks (e.g., Heston model), you can:

Observe how implied volatility changes with strike and maturity (volatility skew and smile effects)

Detect elevated implied volatility regimes where premium capture opportunities improve

Compute Greeks (vega, delta) for sensitivity analysis and dynamic risk hedging

By parameterizing the volatility surface, you can price puts more precisely and select strikes where implied volatility premiums justify the risk of assignment, enhancing strategy profitability.

KGC Implied Volatility - Aug, Sep & Nov (ATM Vol 19.06%)

Probability of Assignment and Exercise

Modelling Equally important for disciplined risk selection is understanding the probability of assignment for American-style puts (most US equity options) that allow early exercise.

Quantitative tools can compute these probabilities using risk-neutral probability distributions inferred from option prices combined with early exercise heuristics:

Calculate the risk-neutral distribution (RND) of the underlying price at expiration via implied volatilities and option data

Use binomial or trinomial trees with dividend adjustments to approximate early exercise boundaries and the timing likelihood of assignment

Incorporate corporate events such as dividends, earnings, and volatility jumps, which affect early exercise risk

Programming these models in Python with libraries like QuantLib, or implementing custom binomial tree models in C++, gives you actionable numeric insights on the optimal strike selection and timing for rolling or layering put positions.

Risk Management

Numerical risk management integrates these quant insights with practical portfolio controls:

Position sizing guided by Value at Risk (VaR) and Expected Shortfall (ES) simulations under RND

Selection of strike prices where put premiums exceed expected loss adjusted for assignment probabilities

Dynamic monitoring dashboards in Python to track delta exposure, gamma risk, and implied volatility shifts in real time

Predefined rules for hedging or cutting losses if the underlying price breaches critical technical or fundamental thresholds

You can further enhance control by building automated signal generators using your quant stack, which trigger alerts or adjusted option trades based on threshold volatility or probability metrics.

To compute the probability of assignment, or equivalently the option being in the money, it is standard practice to compute using the Black-Scholes parameter N(d2) and N(-d2) for calls and puts options respectively as shown below.

import numpy as np

from scipy.stats import norm

def prob_itm(opt_type, S, K, r, T, sigma):

"""Black-Scholes probability of option finishing ITM."""

# opt_type: call/put, S: spot, K: strike, r: risk-free rate ...

# T: time to expiry (yrs), sigma: volatility (pct)

d2 = (np.log(S/K) + (r - 0.5*sigma**2)*T) / (sigma*np.sqrt(T))

if opt_type.lower() == 'call': return norm.cdf(d2)

if opt_type.lower() == 'put': return norm.cdf(-d2)

raise ValueError("opt_type must be 'call' or 'put'")

# Option Parameters

S0, K, r, T, sigma = 19, 17, 0.04, 45/365, 0.25

print(f"Prob(Put ITM): {prob_itm('put', S0, K, r, T, sigma):.2%}")

print(f"Prob(Call ITM): {prob_itm('call', S0, K, r, T, sigma):.2%}")This basic approach approximates the probability that the underlying will finish below the strike at expiration under a Black-Scholes model, serving as a first-order assignment proxy. Extensions can incorporate binomial early exercise trees and dividend impact.

Quant Discipline Meets Practical Income Strategy By blending sophisticated volatility modelling with probability-of-assignment analytics, a quant trader can systematically select and manage short put positions to maximize premium income while rigorously controlling risk. Anchoring decisions on the underlying stock’s fundamentals and statistical risk profiles—not just option prices—creates a low-risk, repeatable income engine.

Leveraging Python and C++ tools for volatility surface calibration, probability modelling, and real-time monitoring transforms what is often seen as a simple income strategy into a precise, mathematically grounded approach aligned with institutional trading standards. This empowers you to capture the volatility risk premium effectively, refine strike and expiry choices quantitatively, and respond dynamically to market shifts — maximizing the put seller’s edge.

Recommended Reading

Option Volatility and Pricing: Advanced Trading Strategies and Techniques, 2nd Edition

by Sheldon Natenberg

Keywords

Options, Trading, Selling Puts, Short, Volatility, Premium, Income, Buying Low, Assignment, Cash Covered Puts, Covered Calls, Wheel Strategy, Implied Volatility, Black-Scholes, Statistics, Probability, In-The-Money, ITM

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]