- AQH Weekly Deep Dive

- Posts

- Modern Investing vs Saving - How to Build a Tax Efficient Portfolio

Modern Investing vs Saving - How to Build a Tax Efficient Portfolio

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

Last week, we reviewed the entire risk-neutral pricing framework from the ground up by linking replication, self-financing portfolios, no-arbitrage conditions, martingales and the role of convexity adjustments. We explain these concepts for traders and quants in clear, everyday language.

This week, we examine how to maximize savings and investment growth and minimize taxes with examples in the UK and USA. We discuss savings and investment portfolios, allocation weights, savings, money market ETFs, fixed income, equity ETFs, commodities, tax-free and tax deferral investments to boost growth and compounding.

Bonus Content, we discuss the practical side of how to save, invest, trade and transfer money internationally using safe and modern accounts that offer free or the lowest fees and commissions.

Disclaimer: This newsletter is for educational and informational purposes only and does not constitute investment advice. Always consult a qualified financial advisor before making investment decisions.

Table of Contents

Exclusive Algo Quant Store Discounts

Algo Trading & Quant Research Hub

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA.

Feature Article: Boosting Growth & Tax Efficient Investing

Cash savings offer stability, but over time inflation erodes their buying power, often resulting in zero growth or even negative in real terms. A long-term wealth plan often requires shifting from pure savings into a more diversified portfolio as outlined below with examples for the UK and the US respectively.

UK / USA Example | Cash | Investing |

|---|---|---|

Returns | 3-4% | 10% |

Risk | None, Only Profits | Modest, Diversification helps limit risk |

Time Horizon | Any, Easy Access to Funds | Hold for >5Y, Helps smooth market noise & capture market growth |

In the UK, through Cash ISAs and Stocks & Shares ISAs, investors can hold assets tax-free with no capital-gains or dividend taxes, allowing returns to compound more efficiently. Inside those wrappers, it’s straightforward to combine low-volatility tools such as UK Govt Bonds (Gilts) and money-market ETFs with global equity ETFs that serve as the engine of long-term growth.

Available in most geographies, Equity ETFs are particularly powerful because they enable passive investing. Instead of researching individual companies, investors can buy broad, low-cost funds that automatically spread risk across thousands of shares. Global large/mid-cap ETFs track developed-market giants; emerging-markets ETFs add exposure to faster-growing regions; quality-factor ETFs focus on companies with strong balance sheets; dividend and dividend-aristocrat ETFs emphasise firms with consistent or growing payouts. These come in accumulating versions that reinvest dividends to boost compounding and defer taxation, or distributing versions that pay income directly.

Equity ETF Examples

Category | ETF | Description | More Info |

|---|---|---|---|

Global Diversified | IWDA | Developed-world broad market exposure | |

Global Diversified | VWRL | Global including emerging markets | vanguardinvestor.co.uk/investments/vanguard-ftse-all-world-ucits-etf-usd-distributing |

Global Diversified | ACWI IMI | Large, mid, small caps globally | |

Dividend / Income | VHYL | Global high-yield equity income | vanguardinvestor.co.uk/investments/vanguard-ftse-all-world-high-dividend-yield-ucits-etf |

Dividend / Income | GEDV | Consistent dividend-raising companies | ssga.com/…/spdr-sp-global-dividend-aristocrats-ucits-etf-gedv |

Dividend / Income | SCHD | High-quality US dividend stocks | |

Quality Factor | IWQU | Strong balance-sheet global firms | |

Quality Factor | QDEV | Quality plus dividend discipline | ssga.com/…/spdr-sp-developed-world-dividend-aristocrats-ucits-etf-qdev |

Building with just a handful of these ETFs gives instant diversification and requires no market-timing skills.

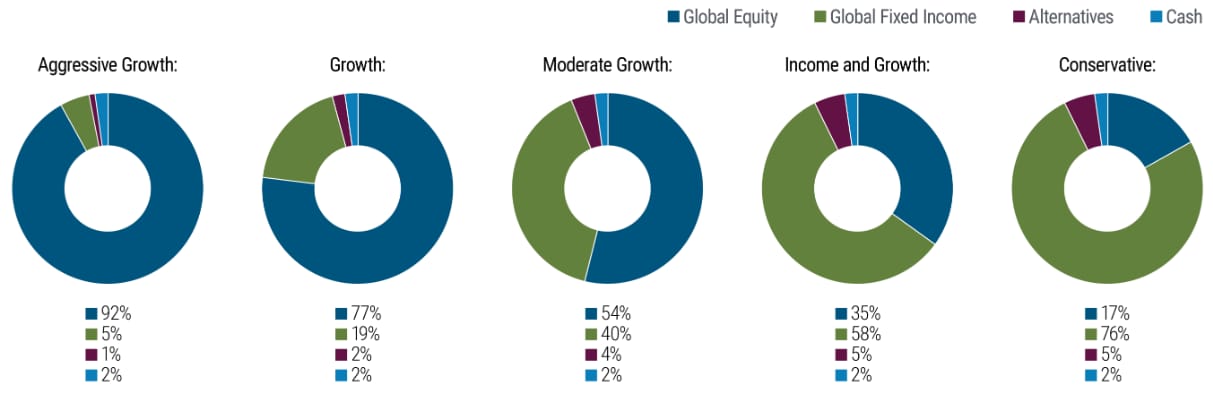

From here, risk appetite determines the mix. A low-risk portfolio might hold 20% cash, 50% bonds and 30% equities (20/50/30), prioritising money-market ETFs, short-duration government bonds and broad equity ETFs. A medium-risk portfolio mix may lean towards 10% cash, 40% bonds and 50% equities (10/40/50). A high-risk allocation might target 5% cash, 20% bonds and 75% equities (5/20/75), including global, emerging-market and quality-factor funds.

Some investors add a small allocation to commodities such as gold—held either through ETCs or, in the UK, tax-free legal-tender bullion coins e.g. Physical Gold Britannia Coins—for inflation resilience. The same principles apply internationally: US investors use IRAs and 401(k)s, US Treasuries, tax-efficient index ETFs and municipal bonds to achieve similar goals of tax reduction and long-term compounding.

Recommended Reading:

Just ETF, Everything you need to know about investing in ETFs

PIMCO, Understanding Asset Allocation & Its Potential Benefits

Rock Wealth, Why cash might not be king - A case for long-term investment

Keywords:

Cash, Savings, Inflation, Investing, Medium-Term, Long-Term, Compounding, Growth, Reward, Risk, Volatility, Diversification, Portfolios, Asset Allocation, Fixed Income, Bonds, Equities, Exchange Traded Funds, Accumulating, Distributing, ETFs, Baskets, Passive, Active, Investment, Benefits

Bonus Article: Modern Savings & Broker Accounts

Portfolio construction becomes easier with the right platforms and accounts. In the UK, most long-term plans start with tax-free accounts namely, the Stocks & Shares ISA for investment growth and the Cash ISA for savings. Moneybox is an excellent tool giving access to ISAs and they give an simple to follow ISA overview.

After ISA allowances are used, investors typically move to general investment accounts, choosing accumulating ETFs when prioritising compounding for additional growth (whilst deferring tax) and distributing ETFs when seeking regular income.

Modern brokers streamline this process. Wise is an exceptionally useful international account with ultra-low fees for currency exchange and international spending, offering strong FX rates and a widely-accepted debit card. Trading212 provides an accessible interface, commission-free trading, high interest on idle cash, fractional shares and its own debit card. IBKR (Interactive Brokers) caters to more advanced investors, offering global market access, institutional-level execution, tight spreads and low FX conversion fees.

By combining clear asset allocations, low-cost ETFs, tax-efficient wrappers and reliable brokers, investors build a structure that is simple to maintain, resilient to volatility and capable of producing steady real returns over medium to long-term horizons. It turns wealth-building into a predictable, repeatable process, rather than an exercise in trying to predict markets.

Keywords:

Cash, Savings, Growth, Active, Passive, Investing, Tax-Free, Tax-Derral, Compounding, International Accounts ETFs, Broker Accounts, Risk, Reward, Low Commissions, Good Rates

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]