- AQH Weekly Deep Dive

- Posts

- Algo Quant Highlights & Season's Greetings

Algo Quant Highlights & Season's Greetings

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

As the year winds down and liquidity thins, this felt like a good moment to pause the models and reflect. It’s been a year of sharp regime shifts, noisy signals, and plenty of reminders that markets still enjoy humbling even the most elegant equations. Thank you for reading, sharing, and thinking deeply alongside me throughout the year.

This Christmas edition is intentionally short. No backtests, no parameters to tune — just gratitude and a chance to recharge. Below we present the most popular Quant topics & newsletters of the year.

Monte Carlo Pricing & Fast Convergence

FX Volatility Smiles & Market Quotes

Algo Quant Training

Next week, we’ll rewind the year properly, revisiting a few key ideas, lessons, and surprises from 2025. Until then, happy holidays, and may your drawdowns be shallow and your Sharpe ratios festive.

Table of Contents

Exclusive Algo Quant

tore Discounts

Algo Trading & Quant Research Hub

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA.

Interest Rates

Fixed Income

Credit Derivatives

Options Trading

Training Bundles

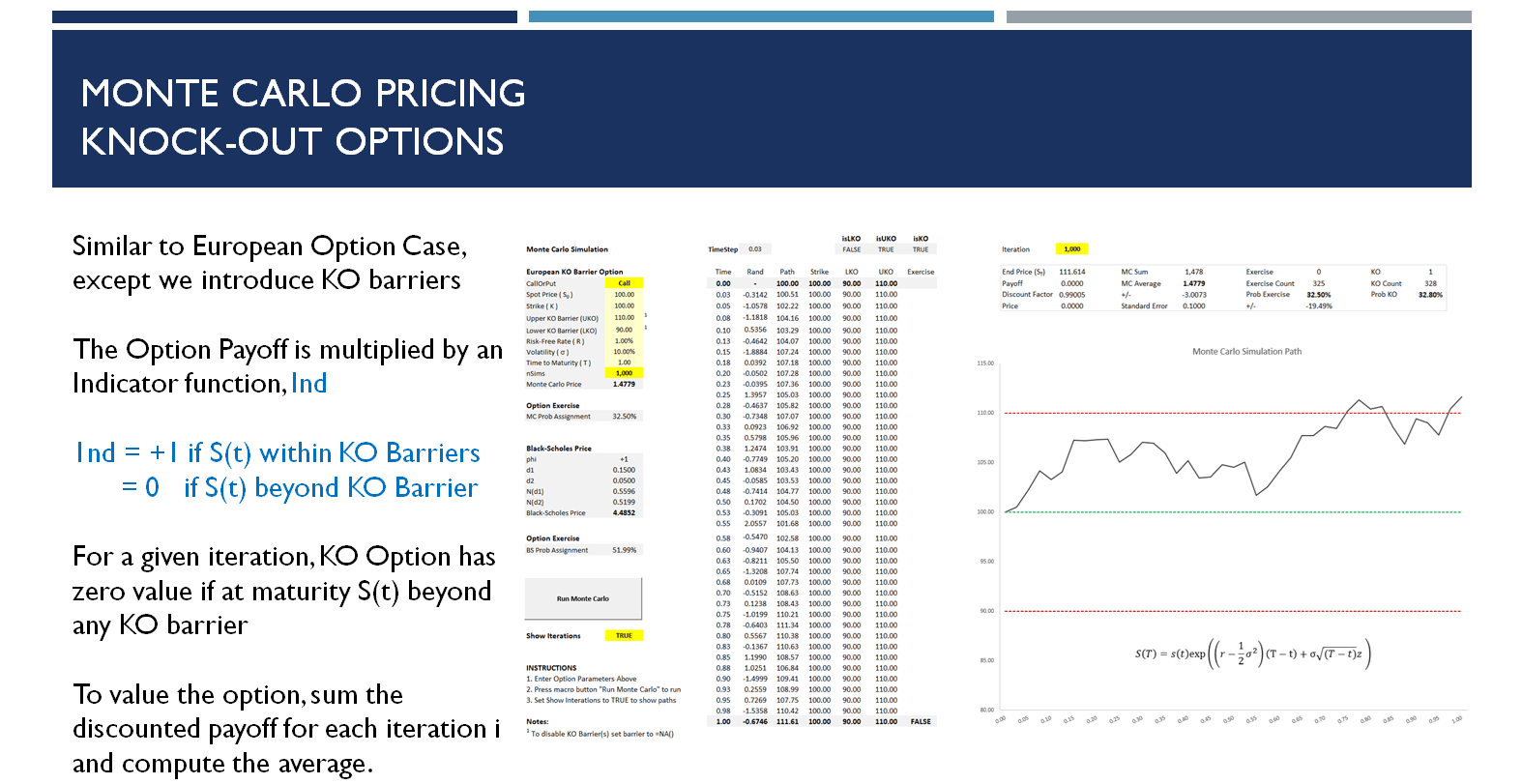

Monte Carlo Simulation, Pricing & Fast Convergence Techniques

Here we explore how Monte Carlo with quasi-random number Sobol sequences and Brownian Bridge results in option pricing that converges dramatically faster than traditional pseudo-random simulation.

Bonus Content, here show how to generate Sobol Brownian Bridge random numbers, giving a practical coding example in C++ using the QuantLib open-source library.

Professional Training & Excel Workbook

Monte Carlo Simulation for Option Pricing

FX Volatility Smiles & Market Quotes

Here we dive into FX options and the world of volatility smiles — showing how traders turn deltas, risk reversals, and butterflies into a full smile that reveals the market’s view of currency moves.

Bonus Content, Ever wondered how traders turn a few market quotes into a full FX volatility smile? In this week’s bonus article, we break down the practical steps: from ATM vols, risk reversals, and butterflies to wing volatilities, and finally converting deltas into strikes using premium-adjusted conventions with formulas and a Python example you can try yourself.

|  |

Algo Quant Training

Here we take a deep dive into the essential algo quant skills needed to succeed in Investment Banks and Hedge Funds — from market intuition and product knowledge, to coding, testing and the math that underpins it all.

Bonus Content, here we discuss how to learn and develop these skills. I will introduce algo quant training resources, newsletter deep dives, video walkthroughs, SSRN papers, books, code, Excel examples and more.

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]