- AQH Weekly Deep Dive

- Posts

- Algo Quant Training

Algo Quant Training

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

Last week, we discussed Credit Curves and Corporate Default Risk and explored how credit curves translate market CDS spreads into actionable insights, helping investors better understand, price and risk manage credit exposures.

This week, we take a deep dive into the essential algo quant skills needed to succeed in Investment Banks and Hedge Funds — from market intuition and product knowledge, to coding, testing and the math that underpins it all.

Bonus Content, here we discuss how to learn and develop these skills. I will introduce algo quant training resources, newsletter deep dives, video walkthroughs, SSRN papers, books, code, Excel examples and more.

Table of Contents

Exclusive Algo Quant Store & Discounts

Algo Trading & Quant Research Hub

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA

Feature Article: Essential Algo Quant Skills

Becoming an algorithmic quant isn’t about learning one programming language or mastering a single model — it’s about building a deep, interdisciplinary toolkit that allows you to understand markets, model risk, and engineer solutions that perform under pressure. The modern quant operates at the intersection of finance, mathematics, and computer science, blending intuition and technical rigour to create systems that think faster than the human mind can.

First we need to understand financial markets. Algorithms may execute trades, but the human quant designs them to survive and profit in real-world conditions. That means understanding how liquidity behaves, how volatility emerges, how central banks shape yield curves, and how institutional flows influence price dynamics. Without a sense for how markets breathe, even the most elegant model will fail the moment it meets live data.

Next comes product knowledge, pricing & risk management. Quants must be fluent in the pricing and dynamics of instruments — from swaps and futures to credit derivatives and exotic options. The goal isn’t only to calculate fair value, but to understand risk sensitivity: how delta, gamma, and vega behave as conditions shift. A quant who understands both pricing and risk is no longer reacting to the market — they’re anticipating it.

The third layer is implementation & technical execution. Coding transforms mathematical ideas into functional trading engines. Python remains the lingua franca for analysis and rapid prototyping; C++ delivers the speed needed for execution and latency-critical systems; and Excel/VBA provides an indispensable sandbox for visualising and testing ideas (yes - both Excel and Python are widely used on the trading floor). The professional quant treats code as an extension of their mathematical reasoning — precise, readable, and optimised.

Finally, none of this works without a solid grasp of quantitative reasoning. Mathematics, stochastic calculus and statistics form the grammar of the quant’s language. These tools make uncertainty measurable and turn intuition into testable hypotheses. Yet the best quants also bring creativity — the willingness to experiment, to debug the unexpected, to find signal in chaos. This combination of discipline and curiosity defines the algo quant’s mindset: not just solving problems, but designing the future of trading itself.

Keywords:

Algo Quant, Trading, Quant Research, Financial Markets, Products, Pricing, Risk Management, Execution, Mathematics, Programming, Statistics, Stochastic Calculus

Bonus Article: Algo Quant Training Resources

To help you accelerate your development as an algo quant, I’ve curated a set of resources that cover every stage of the journey — from learning the theory to implementing live trading systems. Whether you prefer reading, watching, coding, or researching, these materials are designed to build real-world competence: understanding markets, pricing products, managing risk, and developing robust algorithms. Below you’ll find a collection of newsletters, research papers, video tutorials, books, and premium training packs — all aimed at helping you sharpen your edge and move from learning to live execution.

Weekly Quant Newsletter - The Edge

Newsletter for cutting edge algo trading and quant research.Weekly Quant Newsletter - The Deep Dive

Deep dive into the world of algo trading and quant research with a focus on implementation and getting things done for real, and includes video content, digital downloads, courses and more.

Quant YouTube Channel - Algo Quant Hub

Subscribe to this Quant YouTube Channel for video content covering: Financial Markets, Monte Carlo Simulation for Derivatives Pricing, American Option Trading, Advanced Quant Models, Interest Rate & Fixed Income Markets, Live Algorithmic Trading with Interactive Brokers and more.

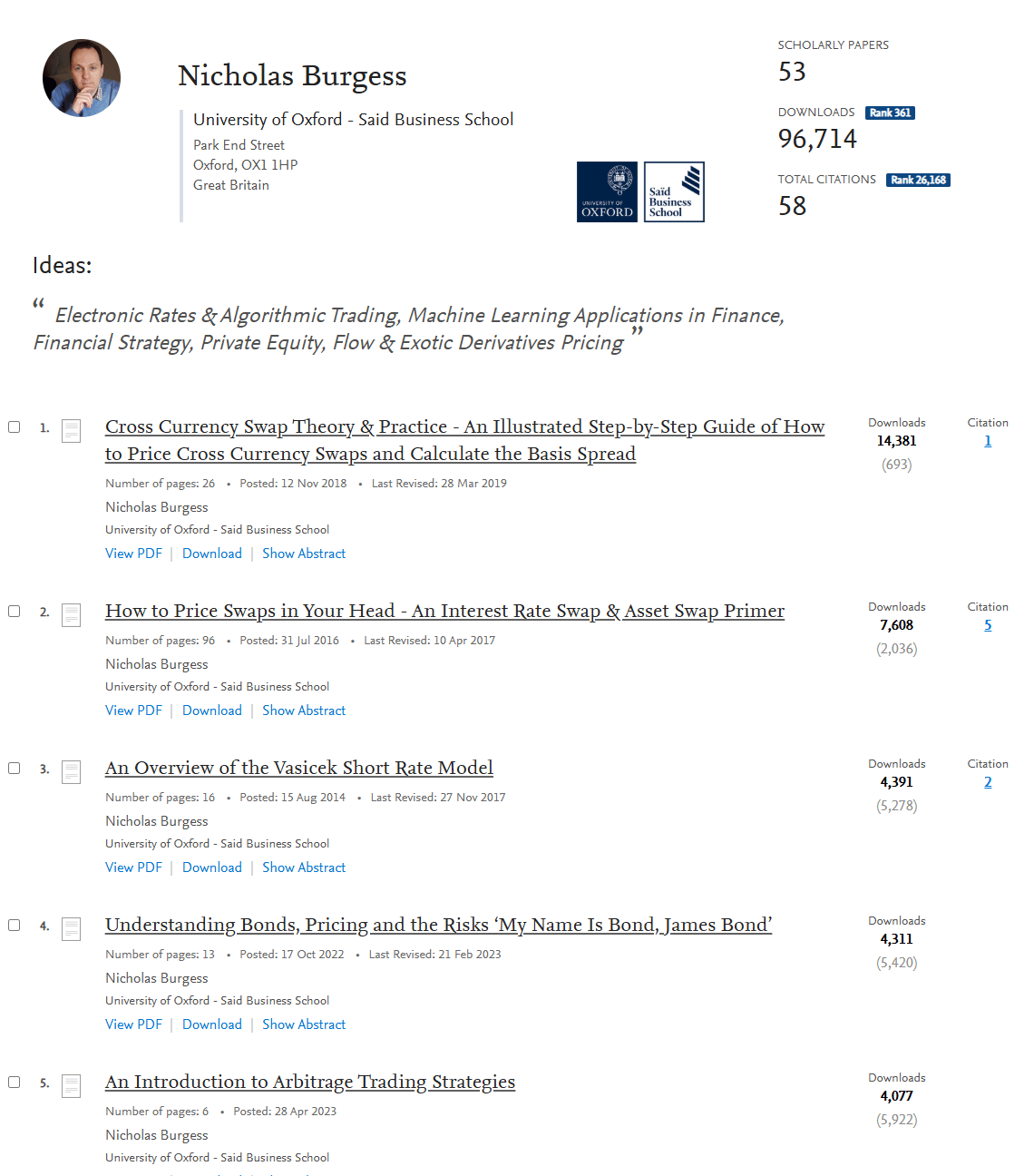

Quant Research & Working Papers - SSRN

Ranked top 0.01% with 53 research papers covering: Quant Models, Financial Markets, Financial Strategy, Corporate Finance, Machine Learning, Trading & more.

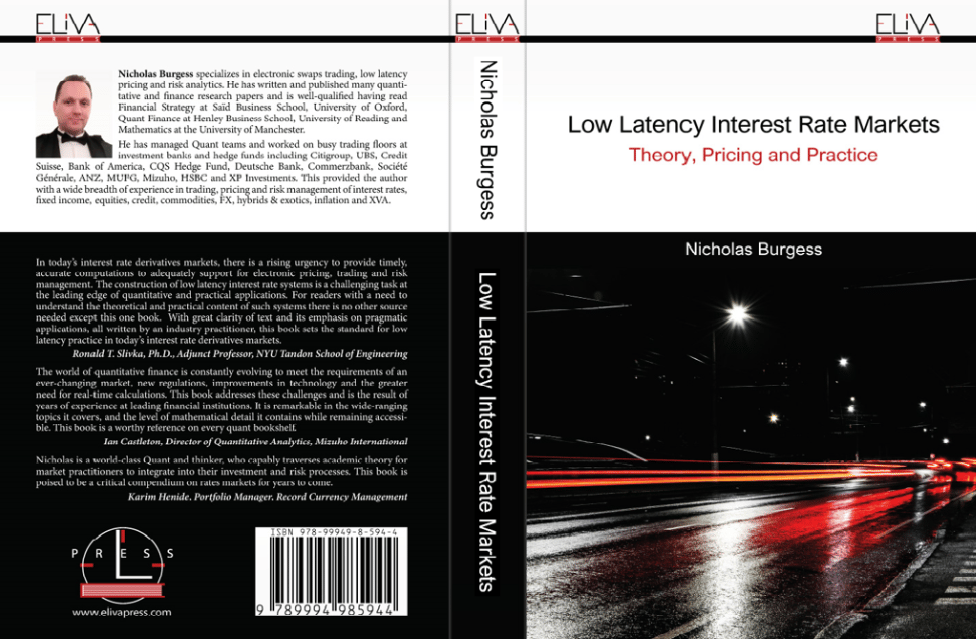

Book - Low Latency Interest Rate Markets

Dive into a hands-on guide where deep theory meets real-world application in the ultra-fast world of interest-rate swaps and low-latency markets.

Premium Content Quant Store - Algo Quant Hub

Here you’ll find a curated selection of professional financial code, Excel training workbooks and support materials, all designed to help you deepen your quant skills and elevate your trading capabilities. Whether you’re a quant, trader, or researcher, I’m here to support your journey with tools and insights drawn from years at the cutting edge of global finance.

Keywords:

Algo Trading, Quant Research, Training Resources, YouTube, Videos, Quant Newsletters, The Edge, The Deep Dive, Financial Markets, Modeling & Quant Finance, Programming, C++, Python, Excel, Mathematics, Stochastic Calculus, Statistics

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]