- AQH Weekly Deep Dive

- Posts

- Ultra-Fast & High Precision Swap Risk using AAD

Ultra-Fast & High Precision Swap Risk using AAD

AlgoQuantHub Weekly Deep Dive

Welcome

Welcome to AlgoQuantHub’s Weekly Deep Dive into Algo Trading & Quant Research!

AlgoQuantHub includes the latest hands-on quant tutorials, videos and research, helping you bridge the gap between theory and real-world quant practice. All delivered by this newsletter! Each week I will deliver a targeted deep dive into a feature topic.

Last weeks’ feature article looked at Cross Currency Basis Arbitrage & Relative Value Trading. We explain the drivers of the basis including liquidity and market microstructure, and consider potential trading strategies.

This week we review and demonstrate how to use Algorithmic Adjoint Differentiation (AAD) to compute Ultra-Fast and High Precision Swap Risk. We also present an example and show how to compute interest rate swap DV01.

Table of Contents

Digital Download Discounts

In this week’s newsletter we give readers a digital download discounts for use in AlgoQuantHub’s digital download store https://payhip.com/AlgoQuantHub

PRO - Training Bundle

20% off Interest Rate Markets Training Bundle

Code: R2EVIGZJTG

PRO - Training Bundle

25% off IR & Fixed Income Training Bundle

Code: ZUQ2AHZU80

Feature Article - Ultra-Fast & High Precision Swap Risk using Algorithmic Adjoint Differentiation (AAD)

We introduced AAD in a previous Deep Dive newsletter, click-here. Here we show how to apply AAD to interest rate swaps to compute swap DV01.

Introduction

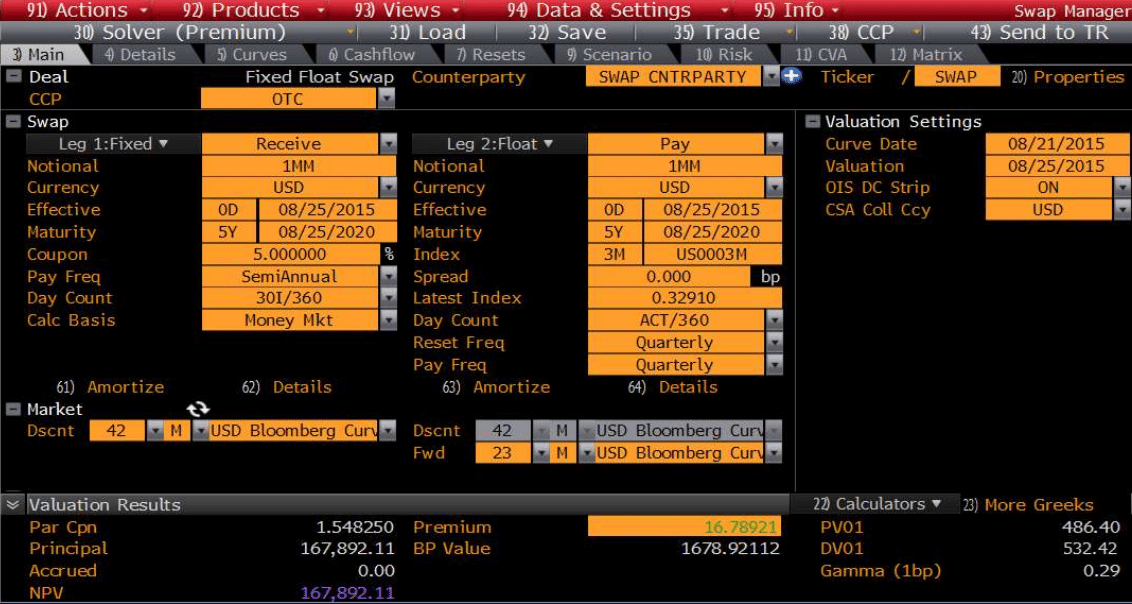

Algorithmic Adjoint Differentiation (AAD), also known as Automatic Adjoint Differentiation, which computes the derivative(s) of computer code. In finance this leads to a relatively new and novel approach, pioneered by (Giles and Glasserman, 2006), to compute financial risks. When trading in electronic rates markets, AAD can be used to produce exact swap risks, such as DV01, at high speed and give users a competitive advantage.

Outline

AAD is well presented in finance, see (Capriotti, 2010), (NAG, n.d.) and (Savine, 2018). However, in what follows we present algorithmic differentiation from an implementation perspective with a focus on how to apply AAD to interest rate swaps (IRS) for interest rate risk (DV01) calculations. Firstly, we give a brief overview of interest rate swaps and how to price them. Secondly, we discuss swap risks, PV01 and DV01 risk calculations and the different approaches on how to compute them, namely via analytical closed-form solutions, numerical bumping and curve Jacobians. Thirdly we introduce algorithmic differentiation (AD) and show how to implement AD in both tangent and adjoint modes on a simple function. Fourthly we show how to compute DV01 risk using AD for an interest rate swap. Fifthly we discuss how to professionally implement AD using both open-source and commercial software solutions.

Swap Example

Throughout this implementation paper we present AD case studies in C++ code, for a simple function and for swaps. The source code has also been pre-loaded onto a free online compiler, can be run with a single button click, and is available as follows:

Short Example: https://bit.ly/SimpleSwapAADinCPP

Full Example: https://bit.ly/SwapAADinCPP

Full Article

Algorithmic Adjoint Differentiation (AAD) for Swap Pricing and DV01 Risk

Keywords: Interest Rate Swaps, Swap Pricing, Swap Risk, DV01, Algorithmic Differentiation (AD), Tangent Mode, Adjoint Mode, C++, AD By Hand, Professional AD Implementation

Feature Video - Quant YouTube Channel

Subscribe to AlgoQuantHub’s Quant YouTube Channel!

Algorithmic Trading & Quant Research Hub or AlgoQuantHub for short is your go-to destination for in-depth insights into quantitative finance, algorithmic trading strategies, and advanced financial engineering. This channel delivers expert-led tutorials and research-driven content on topics such as bond pricing, yield curves, total return swaps, credit default swaps, and market microstructure, tailored for both aspiring and experienced quants. Whether you're looking to unlock quant models, master electronic market dynamics, or explore the latest in statistical arbitrage and trading automation, you'll find practical guides, detailed explanations, and actionable strategies to help you excel in the fast-paced world of modern finance.

Feature Download - Interest Rate Markets & Fixed Income Training Bundle

Visit AlgoQuantHub’s Digital Download Store!

This week we feature the Interest Rate & Fixed Income Training Bundle, which contains Excel workbooks, PowerPoint and PDF training materials for interest rate and fixed income markets including the following,

Contents

IR Markets Overview

Interest Rate Swaps

Cross Currency Swaps

Credit Default Swaps

Quanto Credit Default Swaps

US Treasury Bonds

Asset Swaps

Bond Futures

This comprehensive training bundle covers the fundamentals of interest rate markets and provides step-by-step guidance on pricing key instruments, including interest rate swaps, cross-currency swaps, credit default swaps (CDS), and Quanto CDS. You will also learn to price US Treasury bonds and accurately match bond prices and yields as quoted on major trading venues like Bloomberg. The course further explains asset swaps—enabling investors to finance bond purchases in a single transaction—and concludes with an overview of bond total return swaps, essential for creating synthetic Money Market and Bond ETFs.

Click on the image below for more info!

Feature Book - Modern Computational Finance: AAD and Parallel Simulations

Algorithmic Adjoint Differentiation (AAD) is one of the strongest additions to numerical finance of the past decade. It is the technology implemented in modern financial software to produce thousands of accurate risk sensitivities, within seconds, on light hardware. AAD recently became a centrepiece of modern financial systems and a key skill for all quantitative analysts, developers, risk professionals or anyone involved with derivatives. It is increasingly taught in Masters and PhD programs in finance.

This book offers a unique insight into the modern implementation of financial models. It combines financial modelling, mathematics and programming to resolve real life financial problems and produce effective derivatives software. This book is a complete, self-contained learning reference for AAD, and its application in finance. AAD is explained in deep detail throughout chapters that gently lead readers from the theoretical foundations to the most delicate areas of an efficient implementation, such as memory management, parallel implementation and acceleration with expression templates.

The book comes with professional source code in C++, including an efficient, up to date implementation of AAD and a generic parallel simulation library. Modern C++, high performance parallel programming and interfacing C++ with Excel are also covered. The book builds the code step-by-step, while the code illustrates the concepts and notions developed in the book

Click on the image below for more info!

Useful Links

Quant Research

Links to my Quant Research

SSRN Research Papers

https://ssrn.com/author=1728976

GitHub Quant Research

https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Linked to learning resources for Financial Markets

Subscribe to my Quant YouTube Channel

https://youtube.com/@AlgoQuantHub

Algorithmic Trading & Quant Research Hub

https://payhip.com/AlgoQuantHub

Follow me on Linked-In

https://www.linkedin.com/in/nburgessx/

Explore my Quant Website

https://nicholasburgess.co.uk/

Read my Quant Book - Low Latency IR Markets

https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

My AlgoQuantHub (AQH) newsletters showcase the latest hands-on quant tutorials, videos and research, helping you bridge the gap between theory and real-world quant practice.

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

In this newsletter we deep dive into the world of algo trading and quant research with a focus on implementation and getting things done for real, and includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]