- AQH Weekly Deep Dive

- Posts

- Understanding and Valuing AT1 Contingent Convertible Bonds (CoCos)

Understanding and Valuing AT1 Contingent Convertible Bonds (CoCos)

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

Last week, we dived into the fundamental mechanics of American options pricing models, explaining how replication, martingale, and risk-neutral concepts impact options trading and optimal exercise. This week, we turn our attention to AT1 Contingent Convertible bonds (CoCos)—hybrid instruments issued by banks that blend debt and equity features. We explore what CoCos are, why they exist, and why they command elevated yields in the market.

Bonus Content: AT1 Coco Bond Modelling & Pricing (incl. Python Code)

For readers ready to go beyond conceptual understanding, this section provides a practical guide to valuing AT1 CoCos with the techniques used by quantitative practitioners. It focuses on actionable methods for modelling, simulation, and analysis—giving you a grounded foundation to approach these hybrid instruments with confidence.

Topics include:

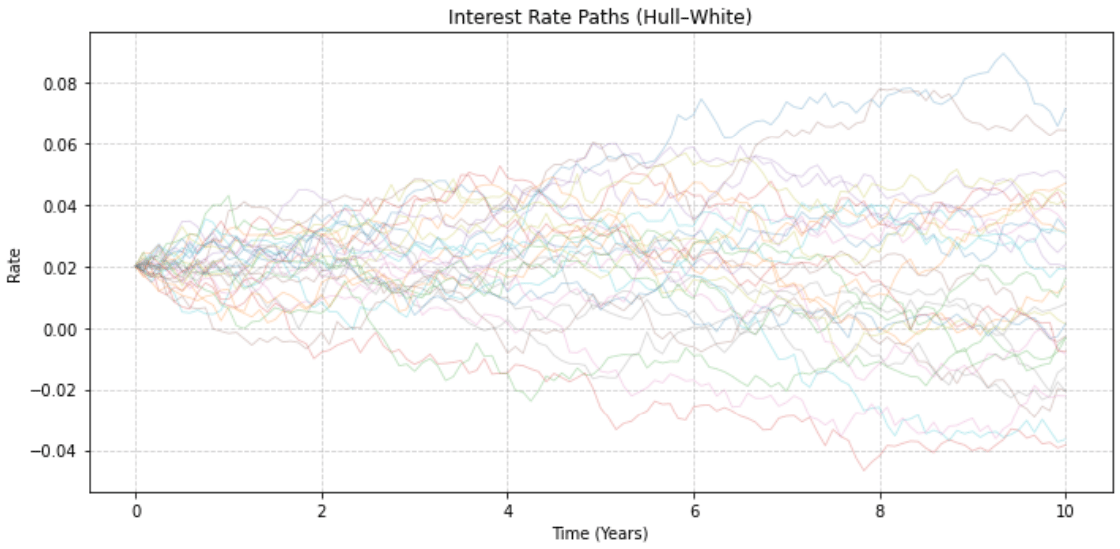

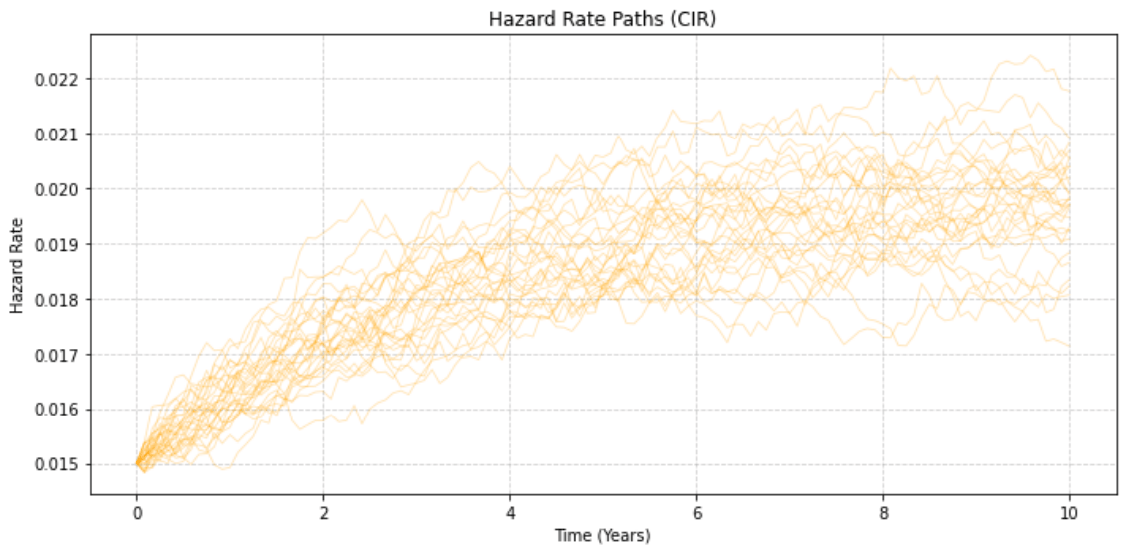

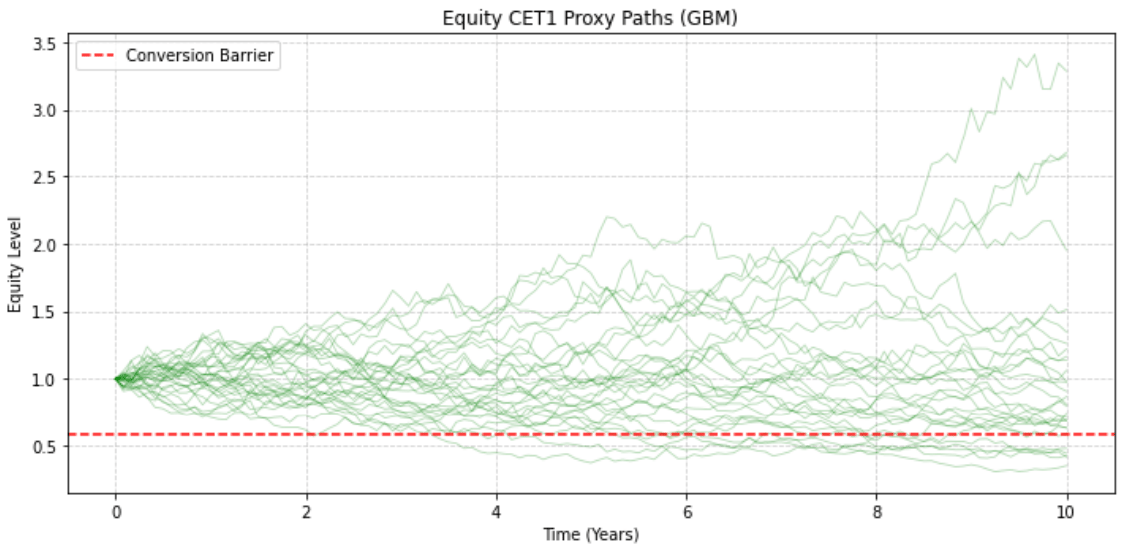

Monte Carlo Simulation for Hybrid Bonds: Step through stochastic modelling of correlated risk factors—interest rates (Hull–White), credit hazard (CIR), and equity/CET1 ratios (GBM)—to capture potential conversion events and cashflow variability.

Numerical Techniques: Understand discretization, antithetic sampling for variance reduction, and importance sampling to better capture tail risk associated with the regulatory conversion trigger.

Advanced Correlation Modelling: Consider copula methods to handle high-dimensional correlations, a practical remedy when Cholesky decomposition fails due to non-positive semidefinite matrices.

Practical Considerations: Learn about calibration to market data, handling volatility skew, and quick wins versus standard approaches for improving model realism.

Annotated Python Examples: Walk through live code for path generation, PV computation, and convergence diagnostics, providing a hands-on foundation for real-world valuation.

Table of Contents

Exclusive Algo Quant Store & Discounts

Algo Trading & Quant Research Hub

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA

Feature Article: Understanding AT1 CoCo Bonds

1. What is an AT1 CoCo Bond?

AT1 stands for Additional Tier 1, a type of Contingent Convertible bond, commonly issued by banks to satisfy regulatory capital requirements. CoCos are hybrid instruments—they behave like debt until a specified trigger event occurs, at which point they either convert to equity or are partially/fully written down. This conversion is typically linked to the bank’s Common Equity Tier 1 (CET1) ratio, which measures a bank’s core equity capital relative to its risk-weighted assets and serves as a primary indicator of capital adequacy. By issuing CoCos, banks can raise capital efficiently, bolstering their ability to absorb losses in times of stress to protect themselves—and the broader financial system—from tail-risk events, while offering investors higher yields than conventional bonds.

2. Perpetual Nature and Coupon Structure

Many AT1 bonds are often perpetual, meaning they have no fixed maturity. Issuers retain a European-style call option: at the first call date, they can redeem the bond at a predetermined price. If the issuer opts not to call, the bond’s coupon often switches from fixed to floating plus a spread, reflecting the ongoing risk of capital deficiency. This structure makes AT1 bonds particularly sensitive to interest rate movements and issuer-specific credit conditions.

3. Regulatory Triggers and Embedded Options

The conversion or write-down occurs if the bank’s capital ratio breaches a regulatory trigger. This can be modelled as a one-touch “down-and-in” option, as the event happens the moment the threshold is breached. Investors must understand that the trigger is binary: if the CET1 ratio falls below the level, the loss is immediate. Such embedded optionality explains why these instruments often offer yields several percentage points higher than comparable non-contingent bonds.

4. Pricing AT1 Bonds: An Overview

Valuation of AT1 CoCos starts with modelling the main three risk factors: interest rates, credit hazard rates, and equity (CET1 proxy). Monte Carlo simulation provides a flexible framework, capturing both the stochastic evolution of these factors and the timing of conversion events. This approach allows us to capture volatility and correlation, although not all approaches capture the volatility skew. For detailed implementation, numerical techniques, and remedies to enhance realism, readers can refer to the bonus article below.

5. Why Investors Trade AT1 CoCos

The combination of higher yields, regulatory capital benefits for the issuer, and complex embedded options makes AT1s an attractive instrument for yield-seeking investors with a strong appetite for risk. The elevated coupon compensates for the possibility of partial or total write-downs, issuer-specific credit events, and long-dated interest rate exposure. Understanding the mechanics of conversion triggers and coupon switches is essential for any investor considering these products.

Monte Carlo Simulation Resources:

For an in-depth review on Monte Carlo simulation see the links below.

Further Reading:

Keywords:

Additional Tier 1, Contingent Convertible Bonds, AT1, Regulatory Capital, Hybrid Instruments, Debt to Equity, Perpetual Bonds, Callable Options, One-Touch Credit Options, Yield, Enhancement, Bank Capital, Common Equity Tier 1, CET1

Advert: Algorithmica - Rapid Quant Solutions for Complex Products

From vanilla instruments to AT1 CoCos, Algorithmica delivers lightning-fast, flexible, and precise quantitative analytics for modern trading and risk management.

Click-here to contact us and experience the power of Algorithmica.

Keywords:

World Class, Trading Software, Quantitative Analytics, Risk Management, Financial Data

Bonus Content: Practical Guide - Pricing AT1 CoCo Bonds

This guide provides a fundamental benchmark for intuition and implementation, built around a working illustrative Python model that captures the key risk drivers behind AT1 CoCo bond valuation.

Model choice (why these three?)

These choices give a clear, tractable benchmark. Fast to run & pedagogically clean.

Hull–White (HW) for IR Forward Rates: mean-reverting, easy calibration to the yield curve and ATMF swaption vols. Good for discounting cashflows and capturing rate mean-reversion.

CIR for Credit Hazard Rates: non-negative dynamics for default intensity, simple link to survival probabilities.

GBM for Equity Levels & CET1 Proxy: simple, interpretable log dynamics for a capital ratio proxy and easy to adjust for Monte Carlo importance sampling to capture tail risk.

Implementation Steps (Minimal Working Recipe)

Discretize SDEs (Euler or slightly improved schemes).

Generate correlated Brownian increments (choice: Cholesky or copula).

Simulate many paths, evaluate cashflows with survival/discounting, apply trigger rules and call logic.

Average discounted payoffs -> present value.

Add Monte Carlo price convergence diagnostics.

Numerical Enhancements (Quick Wins)

Antithetic sampling and control variates for variance reduction.

Importance sampling (IS) to focus on CET1 trigger tails (tilt terminal GBM or use exponential tilting).

Adaptive tilting or mixtures when triggers are multimodal.

Correlation & Dependency

Cholesky is simple and works when the correlation matrix is Positive Semi Definite (PSD). In practice, fails in high dimension, so enforce PSD via nearest-PSD, use factor models or copulas.

For tail dependence (non-Gaussian), consider copulas (t-copula for heavier tails) — they allow more flexible joint tail modelling but require careful calibration.

Volatility Skew and Realism

Trees (trinomial) are convenient but break when you introduce volatility skew — they typically stop recombining and become inefficient.

Monte-Carlo handles skew flexibly: add local vol, stochastic vol, or jump terms, or use implied-vol surfaces to perturb vol per strike. For a pragmatic approach, start with deterministic shifts (local vol) then consider Heston/jumps for production quality.

Calibration & Instruments

Calibrate rates to swap curve and swaption vol; calibrate credit to CDS and (if available) CDS options; calibrate equity model to options or historical vol if options not liquid. Each calibration instrument anchors a “bucket” of the model, when using numerical risk.

Practical Caveats & Diagnostics

Monitor convergence tables, weight dispersion (for IS), and effective sample size. Many paths needed to capture tail risk from conversion triggers

Run sensitivity checks: change Monte Carlo time steps (dt), number of paths, and tilt parameters. Validate with simpler models or analytical limits where possible.

Why this is a great benchmark

The Monte-Carlo + HW/CIR/GBM framework is intuitive, fast to prototype, and gives immediate insight into the drivers of value and tail risk. It’s an ideal teaching and baseline production approach; extensions (stochastic vol, jumps, copulas, importance sampling) are natural next steps as the project moves toward production.

Click-here for Coco Bond Python model and pricing code.

Keywords:

Pricing, Valuation, Monte Carlo, Trees, Numerical Risk, Factor Models, Hull-White, Cox Ingersoll Ross, Geometric Brownian Motion, Correlation, Cholesky Decomposition, Copulas, Importance Sampling, Tail Risk

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]