- AQH Weekly Deep Dive

- Posts

- Stable Coin Trading 101

Stable Coin Trading 101

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

Last week, we gave a comprehensive review at how to use Monte Carlo Simulation to price vanilla and exotic options. This week, we explore the world of stablecoins — the “digital dollars” reshaping crypto markets, payments, and even global finance, from how they work to where the real opportunities (and risks) lie.

Bonus content, here we dive into practical stablecoin trading strategies, exploring yield-generating opportunities, staking, and advanced pairs trading on platforms like GMX, plus how to access stablecoins through major exchanges.

Table of Contents

Exclusive Algo Quant Store & Discounts

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA

Feature Article: Stablecoins - The Bridge Between Traditional Finance & Crypto

Stablecoins are best described as the “money market funds of crypto”. Just as money market funds hold safe, liquid assets to replicate traditional cash-like stability, stablecoins are digital tokens engineered to track the value of the US dollar (or other fiat currencies). Unlike volatile cryptocurrencies like Bitcoin, stablecoins provide certainty: one token should equal approximately one dollar. This makes them useful for payments, hedging, settlement, and as a familiar starting point for investors dipping their toes into crypto.

World’s Largest Stablecoins (by Market Capitalization)

Tether (USDT), $159.10 billion

USDC (USDC), $63.13 billion

Dai (DAI), $5.37 billion

Ethena USDe (USDe), $5.33 billion

World Liberty Financial USD (USD1), $2.2 billion

First Digital USD (FDUSD), $1.45 billion

The way they achieve this stability varies: some are fiat-backed (like USDC, with reserves of cash and government bonds), others are crypto-backed (like DAI, using overcollateralized deposits of Ethereum and other digital assets), while a more experimental category attempts to hold their peg via supply-demand algorithms. The last group often struggles (with high-profile failures like TerraUST), which is why the mainstream adoption curve leans toward fiat- or crypto-backed models.

In July 2025, the U.S. passed the GENIUS Act, a groundbreaking law that introduced the first clear federal regulations for payment stablecoins. It requires issuers to hold fully-backed reserves in safe assets, implement anti-money laundering safeguards, and submit to regulatory oversight. This legislation enhances market trust, reduces systemic risk, and is accelerating institutional adoption of stablecoins as a new form of digital cash.

From an investment or trading perspective, stablecoins aren’t designed to “go up.” Instead, they provide stability, yield opportunities, and arbitrage openings. Lending platforms and DeFi protocols let users earn interest by supplying stablecoins to others, though counterparty and regulatory risks apply. Arbitrage arises when a stablecoin loses its $1 peg — buying at a discount and later redeeming or selling when the peg recovers can be surprisingly lucrative for quick-moving traders.

Stablecoins operate not only as a safe harbour for capital but also as an arena where arbitrageurs, market makers, and liquidity providers pursue efficiency gains and extract liquidity premia.

Recommended Resources:

Stablecoins, Explained in 4 mins

What are stablecoins and how they work as digital cash.

World’s Top Stablecoins

Stablecoins have become an essential part of the cryptocurrency ecosystem. Designed to maintain a fixed value, these tokens provide a reliable way for traders to manage risk, reduce transaction fees and even earn passive income.

Stablecoins: The Ultimate List

Explore 20+ must-know stablecoins, how they work, and why they are essential for stability, trading and DeFi in the fast-paced world of cryptocurrency.

Stablecoins 101: Behind crypto’s most popular asset

Stablecoins have quietly become a major force in the global cryptocurrency market, representing more than two-thirds of the trillions of dollars’ worth of cryptocurrency transactions.

Keywords:

stablecoins, digital dollar, fiat-backed, crypto-backed, algorithmic, USDT, USDC, DAI, PYUSD, mechanics, peg, crypto asset stability, risks, hype US, regulation, crypto payment rails, institutional adoption, crypto liquidity, investment, arbitrage opportunities, blockchain finance, market overview, crypto startup fundraising, token sales, crypto use cases, credibility

Bonus Content: How to Trade Stablecoins

The main stablecoins dominating the market are Tether (USDT), USD Coin (USDC), and DAI, with newer entrants like PayPal USD (PYUSD) gaining traction. These tokens serve as the digital dollar on blockchain networks and form the backbone of most crypto trading pairs.

Trading stablecoins is straightforward on most centralized and decentralized exchanges, allowing swaps between stablecoins or volatile assets. Occasionally, market inefficiencies create arbitrage opportunities when stablecoins temporarily deviate from their $1 peg.

Many decentralized finance (DeFi) platforms offer yield-generating strategies where holders can earn interest expressed as an annual percentage yield (APY). APY indicates the real rate of return accounting for compounding. Typical yields range from about 5% to 14% APY on well-established platforms such as Aave, Curve, or CeFi providers like Binance and Nexo. More advanced farming and staking strategies can push yields higher (up to 20–30%), but often come with increased complexity and risk.

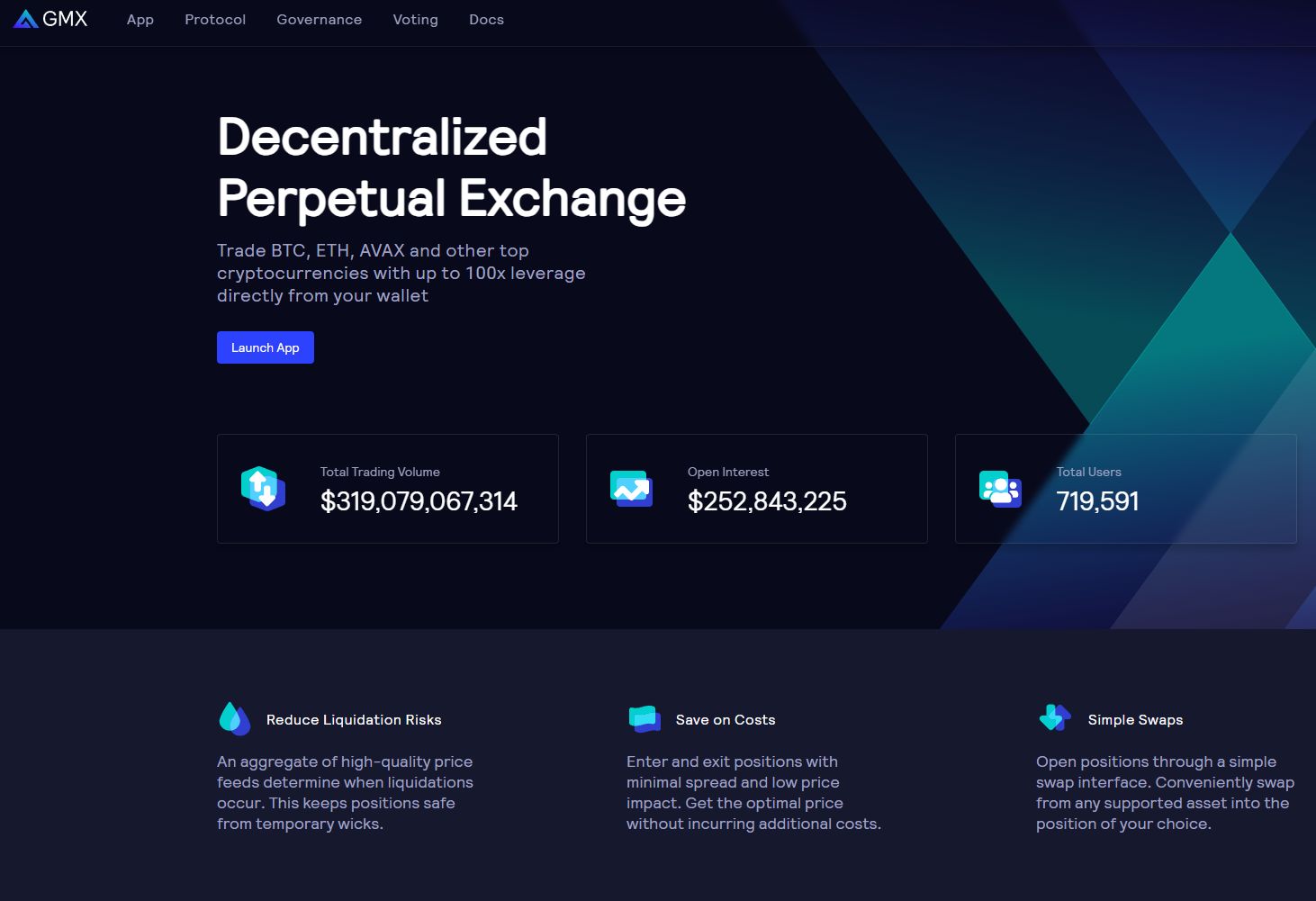

Staking stablecoins in certain protocols provides passive income by contributing liquidity or participating in network governance, typically generating steady returns 10% APY and often multiples more. Pairs trading and leveraged positions on platforms like GMX permit traders to hedge or speculate on price differences between stablecoin pairs or between stablecoins and volatile assets, expanding opportunities beyond simple spot trades.

For traditional investors, it’s important to note that traditional brokerages such as Interactive Brokers (IBKR) currently do not offer direct stablecoin trading. Access remains primarily through crypto-native exchanges such as Coinbase, Binance, and Kraken. While this limits mainstream adoption, it offers a frontier for savvy traders who navigate both traditional and crypto ecosystems to capitalize on emerging market inefficiencies.

Recommended Resources:

curve.finance

A decentralized exchange optimized for stablecoin swaps with low slippage and deep liquidity pools, perfect for large stablecoin conversions and DeFi yield strategies.

Binance

One of the largest centralized exchanges with extensive support for stablecoin trading pairs, spot trading, futures, and staking opportunities. Offers user-friendly interfaces and global liquidity.

Kraken

A highly trusted, regulated exchange known for USDT trading pairs against fiat currencies (USD, EUR, GBP), offering secure and compliant trading options for stablecoins.

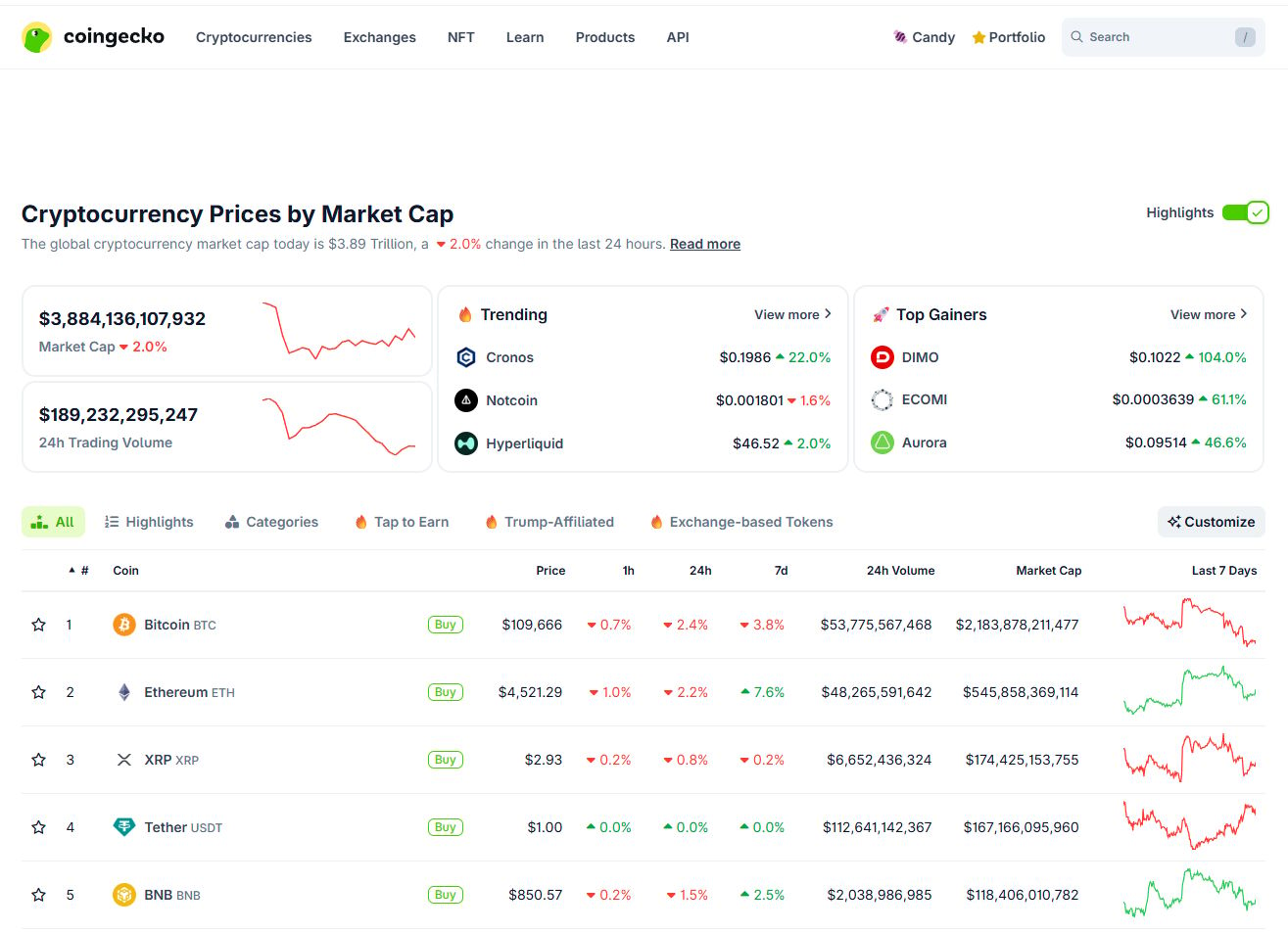

Coingecko

CoinGecko is a leading independent cryptocurrency data aggregator that provides a comprehensive 360-degree view of the crypto market, including price, trading volume, market capitalization, contract addresses, community statistics, and more, empowering users with accurate, reliable, and in-depth information to navigate the cryptocurrency ecosystem.

GMX Decentralized Exchange

Trade BTC, ETH, AVAX and other top cryptocurrencies with up to 100x leverage directly from your wallet.

Keywords

stablecoins, trading, yield-generating strategies, APY, annual percentage yield, staking, yield rates, DeFi, yield strategies, Aave, lending, Curve Finance, liquidity pools, CeFi, interest, binance, yield, nexo, pairs trading, GMX, leveraged trading, arbitrage, crypto, native exchanges, coinbase, swaps, Kraken, interactive brokers, market, inefficiencies, liquidity, market access, yield farming, passive income, risk, reward, interest rates, trading platforms

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]

1