- AQH Weekly Deep Dive

- Posts

- Credit Curves & Pricing Corporate Default Risk

Credit Curves & Pricing Corporate Default Risk

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

Last week, we looked at AT1 Contingent Convertible bonds (CoCos)—hybrid instruments issued by banks that blend debt and equity features. We discussed what CoCos are, why they exist, and why they command elevated yields in the market.

This week, we turn our attention to Credit Curves and Corporate Default Risk. We explore how credit curves translate market CDS spreads into actionable insights, helping investors and risk managers better understand and price credit exposure

Bonus Content, for readers looking to dig deeper, our bonus article walks through the practical steps of credit curve calibration using market CDS quotes. You’ll learn how to translate CDS par spreads into hazard rates, compute survival probabilities, and implement the necessary calculations to build a market-consistent credit curve. This hands-on guide is ideal for anyone interested in applying these concepts to pricing, risk management, or credit analytics.

Table of Contents

Exclusive Algo Quant Store & Discounts

Algo Trading & Quant Research Hub

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA

Feature Article: Understanding Credit Curve Calibration

Credit curves are fundamental tools in modern credit risk management and fixed income markets. Simply put, a credit curve represents the market-implied probability of default of a corporation over time. It allows investors and risk managers to understand how credit risk evolves across different maturities, providing insights into the likelihood that a firm may default on its obligations. Without credit curves, it would be difficult to price credit-sensitive instruments accurately or to assess the risk embedded in a corporate bond portfolio.

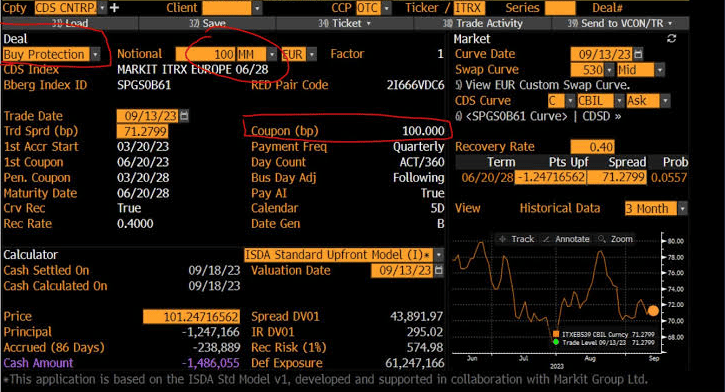

The process of calibrating a credit curve starts with observable market instruments, most commonly credit default swaps (CDS). CDS par spreads encode the market’s view of credit risk, and by calibrating a curve to these spreads, we can extract the implied hazard rates — the instantaneous probability of default. These hazard rates then allow us to compute the probability of survival or default at any point in time, giving a complete picture of the issuer’s credit profile. Calibration is thus the key step that translates market prices into actionable default probabilities.

To implement a credit curve, a few coding ingredients are essential. First, a solver is needed to iteratively adjust hazard rates so that the model-implied CDS spreads match observed market spreads. Second, an interpolator ensures the hazard rate curve is smooth between quoted maturities, allowing for realistic, continuous credit risk profiles. These components together enable a robust and flexible calibration that can adapt to various instruments and maturities.

Before any of this can be done, we need a well-defined yield curve to compute discount factors. Discount factors allow us to value future CDS cashflows accurately and to convert the hazard rates into present-value terms for pricing.

With discounting in place, we can accurately relate market spreads to the underlying credit risk implied by the market. Now while CDS instruments are the most common calibration instruments, the same principles can be applied to corporate bonds, offering a broader toolkit for investors — more on that next time.

Calibrating a credit curve is not just an academic exercise; it directly impacts portfolio risk management, pricing of credit-sensitive instruments, and strategic decision-making. Understanding the curve provides actionable insights into how the market prices credit risk and helps professionals make more informed investment and hedging decisions.

Additional Resources:

For an in-depth overview on Yield Curves and Credit Default see the links below.

Further Reading:

Keywords:

Credit Curves, Calibration, Credit Default Swaps, Corporate Bonds, Default Risk, CDS Market Quotes, Par Spreads, Hazard Rates, Instantaneous Default Probabilities, Probability of Default, Corporate Credit Risk, CDS Pricing

Bonus Article: Implementation Steps for Credit Curve Calibration

Setting up a CDS credit curve begins with collecting market par spreads for the maturities you wish to calibrate. Each par spread provides a market-implied view of the probability of default over that term. Using an iterative solver, these spreads are converted into hazard rates, the instantaneous default probabilities for each period. Once calibrated, the curve allows for the computation of survival probabilities for any horizon.

The practical implementation involves summing discounted cashflows for both the protection leg and the premium leg of each CDS. The solver adjusts the hazard rates until the model matches the observed par spreads. For smoothness between quoted maturities, an interpolator fills in the hazard rates for intermediate points. The result is a continuous, market-consistent credit curve ready for pricing or risk management applications.

Once you have this framework, it can be used to price more complex instruments or longer maturities, providing a flexible platform for both CDS and corporate bond pricing. The key takeaway: once you understand how to extract hazard rates from market quotes, you gain a powerful tool to interpret and act on credit market signals.

Keywords:

Credit Curve, Calibration, Credit Default Swaps, CDS, Corporate Bonds, Interpolation, Solver, Optimization

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]