- AQH Weekly Deep Dive

- Posts

- Credit Correlation Trading with First-to-Default CDS

Credit Correlation Trading with First-to-Default CDS

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

This Week, we dive into correlation trading in credit markets and review a dispersion trading strategy that looks to harvest credit correlation using first-to-default (FTD) credit default swaps. Additonally, we provide links to quant research materials, books, quant pricing and modelling workbooks.

Bonus Content, we outline how to price FTD CDS using the Gaussian Copula and Monte Carlo approach.

Table of Contents

Feature Article: Correlation Trading: A Dispersion Trading Strategy

First-to-default (FTD) credit default swaps transform a portfolio of single-name credit risks into a tradable view on correlation. Instead of buying protection on one issuer, the investor buys protection on a basket and receives a payout when the first name defaults. The payoff depends not only on individual default probabilities but also on how those defaults interact. When defaults are likely to cluster, the probability of an early default rises and the basket becomes more valuable. When defaults are idiosyncratic, risk disperses across time. FTD swaps therefore sit at the centre of credit correlation trading.

The product exists because investors often want exposure to portfolio credit risk rather than to one issuer. Compared with single-name CDS, an FTD embeds the distribution of the earliest default across the basket. Pricing begins by bootstrapping survival curves from individual CDS spreads and combining them using a dependence model such as a Gaussian copula. This allows trading desks to estimate the probability that at least one name defaults before maturity and to value the premium and protection legs. Although defaults drive the final payoff, most trading P&L comes from spread movements and changes in implied correlation rather than from realized default events.

A core strategy built around FTDs is dispersion trading. Being long the basket and short single-name CDS positions expresses a long-correlation view: it benefits if credit risk becomes systemic and defaults cluster. The reverse position expresses a short-correlation view: it benefits if defaults remain isolated and correlation falls. Even in the absence of default, these trades can generate returns through mark-to-market changes as implied correlation shifts, through time decay of spreads, and through relative movements between basket and single-name CDS. Defaults amplify outcomes but are not required for profitability.

Dispersion Trading Example

Suppose a five-name basket trades at an FTD spread of 250 bp while each name trades near 100 bp. If correlation expectations fall, the FTD spread may tighten toward 190 bp while single-name spreads remain largely unchanged. Selling the FTD at 250 and buying back at 190 generates a gain even though no default occurs. Conversely, if macro stress raises systemic risk and implied correlation rises, buying the FTD and selling single-name protection can produce gains as the basket spread widens more than individual spreads. These trades resemble dispersion trades in equity volatility: they exploit the relationship between the whole and its components.

Liquidity and Execution Considerations

In practice, correlation trades face market frictions. Single-name CDS tend to be liquid; bespoke baskets and FTDs are less so. Bid-ask spreads can be wide and quoted sizes limited. As a result, theoretical value changes may not immediately translate into tradable prices. Successful execution often depends on patience, careful sizing, and the ability to hedge dynamically using more liquid single-name instruments. Credit markets can at times be inefficient or slow to reprice correlation, meaning that relative-value opportunities exist but may take time to realise. This makes correlation trading as much about risk management and execution discipline as about modelling.

Credit Modelling

The accompanying spreadsheets referenced in this issue allow readers to bootstrap single-name credit curves and construct the underlying interest-rate term structures required for consistent CDS pricing. These examples provide a practical, hands-on framework for understanding how discount curves, hazard rates, and market spreads interact, and how single-name CDS valuations respond to changes in rates and credit assumptions. Together they offer a solid foundation for analysing credit instruments, building intuition around spread dynamics, and preparing the groundwork for more advanced correlation and portfolio credit modelling.

Keywords: first-to-default CDS, credit correlation trading, dispersion strategy, basket CDS, Gaussian copula, credit derivatives, CDS pricing, survival curves, hazard rates, structured credit, implied correlation, correlation trading

Recommended Reading:

Bonus Article: Pricing a First-to-Default CDS with Gaussian Copulas and Monte Carlo

A first-to-default (FTD) credit default swap pays out when the first name in a basket defaults. Pricing the instrument requires modelling both individual default probabilities and the dependence structure between names.

The standard market framework combines bootstrapped single-name hazard rates with a Gaussian copula to generate correlated default times and compute the expected premium and protection legs. We compute survival probabilities for each credit reference as,

In practice we bootstrap piecewise-constant hazard rates from quoted CDS spreads so that model prices match market CDS premiums. Once hazard rates are known, cumulative default probabilities follow directly.

To introduce dependence across names, we use a Gaussian copula. We first generate a vector of correlated standard normal variables with correlation matrix Σ.

Each normal variable is mapped to a uniform variable using the standard normal cumulative distribution function.

These uniform draws are then transformed into default times using the inverse survival function for each name. This step converts correlation in the Gaussian space into correlation between default times.

The first-to-default time for the basket is the minimum of the individual default times.

We simulate many such paths. For each path we determine whether a default occurs before maturity and record both the timing and identity of the first defaulter.

The premium leg consists of periodic spread payments until the first default or maturity. Its present value is the discounted expectation of those payments, conditional on survival of the basket up to each payment date.

Here Δ( k ) is the accrual period, s( FTD ) is the FTD spread, and D( 0, t ) is the discount factor. The protection leg pays out when the first default occurs. Its present value is the discounted expected loss given default.

Here R( j ) is the recovery rate of the name that defaults first. The fair spread for the FTD is obtained by equating the premium and protection legs.

Implementation Steps

Bootstrap the interest-rate discount curve.

Bootstrap single-name hazard rates from CDS spreads.

Construct the correlation matrix for the basket.

Generate correlated normal draws.

Convert normals to uniforms using the normal CDF.

Map uniforms to default times via inverse survival curves.

Identify the first-to-default time for each path.

Compute discounted premium and protection cashflows.

Average across simulations.

Solve for the spread that equates premium and protection legs.

All of this can be implemented directly in Excel, Python, or C++ once the credit curves are built. The heavy lifting is not conceptual but mechanical: bootstrapping curves, generating correlated draws, and averaging cashflows. Once those pieces are in place, pricing FTD structures becomes a natural extension of single-name CDS analytics.

Keywords: first-to-default CDS, Gaussian copula, credit correlation, dispersion trading, CDS pricing, hazard rates, Monte Carlo simulation, credit derivatives, basket CDS, correlation trading

Algo Quant YouTube Channel

Algo Trading & Quant Research Channel

YouTube playlists include:

Interest Rate Markets

Bond Markets

Credit Derivatives

Monte Carlo Simulation

Advanced Quant Models

American Option Trading

Live Algo Trading with IB Broker

Exclusive Algo Quant Store Discounts

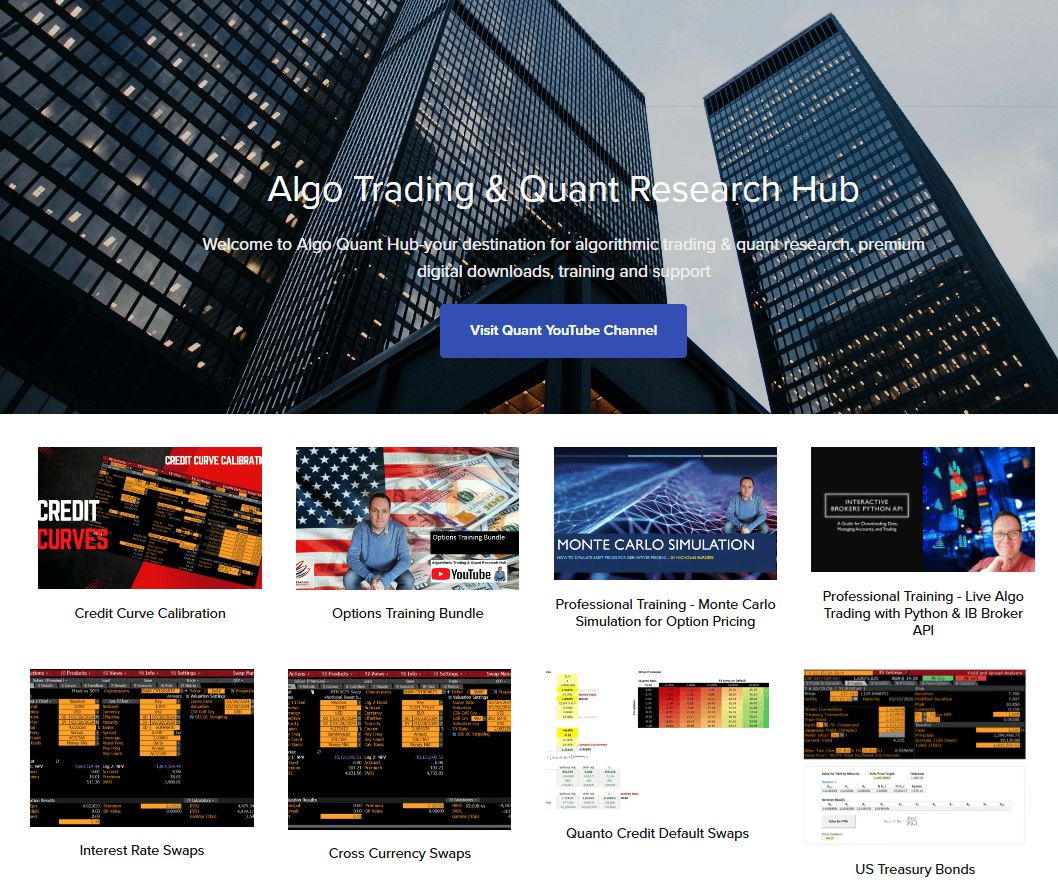

Algo Trading & Quant Research Hub

Get 25% off all purchases at the Algo Quant Store with code 3NBN75MFEA.

Useful Links

Quant Research

SSRN Research Papers - https://ssrn.com/author=1728976

GitHub Quant Research - https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Subscribe to my Quant YouTube Channel - https://youtube.com/@AlgoQuantHub

Quant Training & Software - https://payhip.com/AlgoQuantHub

Follow me on Linked-In - https://www.linkedin.com/in/nburgessx/

Explore my Quant Website - https://nicholasburgess.co.uk/

My Quant Book, Low Latency IR Markets - https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

Dive deeper into the world of algo trading and quant research with a focus on getting things done for real, includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]