- AQH Weekly Deep Dive

- Posts

- Statistical Arbitrage & Pairs Trading

Statistical Arbitrage & Pairs Trading

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cutting-edge topics on algo trading and quant research.

AlgoQuantHub brings you the latest hands-on quant tutorials, insightful videos, and cutting-edge research—designed to bridge the gap between quantitative theory and practical implementation in real markets. This newsletter delivers actionable knowledge right to your inbox, featuring targeted explorations of key topics each week.

Last week, we discussed how to land a Quant job. We explained what is a Quant, what they do, how to become a Quant, CVs, the interview process and why become a Quant.

This week, we delve into the world of algorithmic trading, focusing on the practical mechanics and appeal of statistical arbitrage—also known as pairs trading. Building on our exploration of quantitative careers, we now turn our attention to how quants apply mathematics, technology, and disciplined models to systematically uncover and profit from pricing anomalies between correlated stocks. Through statistical arbitrage, we reveal how quantitative techniques can transform raw market data into actionable trading strategies that are both robust and adaptive in today’s high-speed markets.

Bonus content, this week we provide a rigorous and detailed outline of a statistical arbitrage in pairs trading strategy. We give example code in Python and a step-by-step guide of how to connect Python code to IB Broker using their Python API. We also provide links to an excellent video series on pairs trading.

Stay tuned for impactful insights—delivered weekly to help you master quant finance and algorithmic trading.

Table of Contents

Exclusive Quant Discounts

In this week’s newsletter we give readers a digital download discounts for use in AlgoQuantHub’s digital download store https://payhip.com/AlgoQuantHub

Discount - Expiry 1st August 2025

25% off total order amount

Code: 3NBN75MFEA

Feature Article: Statistical Arbitrage & Pairs Trading

Algorithmic trading, or "algo trading," relies on automated computer programs to carry out trades according to rigorous, pre-set instructions based on market data. By delegating execution to algorithms, traders can operate with speed, discipline, and consistency—attributes difficult to maintain when trading manually.

A cornerstone of quantitative trading is statistical arbitrage, and pairs trading is one of its most practical implementations. As detailed in Ernest P. Chan’s "Algorithmic Trading: Winning Strategies and Their Rationale," pairs trading aims to capitalize on the transient divergence between two historically correlated stocks. When the usual price relationship between the two stocks deviates, an algorithm identifies this short-term misalignment and establishes positions designed to profit when the stocks' prices inevitably converge again.

The workflow begins by selecting a pair of stocks with established price correlation such as the MSCI Australia and Canada ETFs with symbols EWA and EWC respectively. Using historical price data, you estimate the hedge ratio—often via linear regression—to define a spread, calculated as the difference between one stock’s price and a hedge-adjusted portion of the second stock’s price. This spread serves as the basis for entry and exit signals.

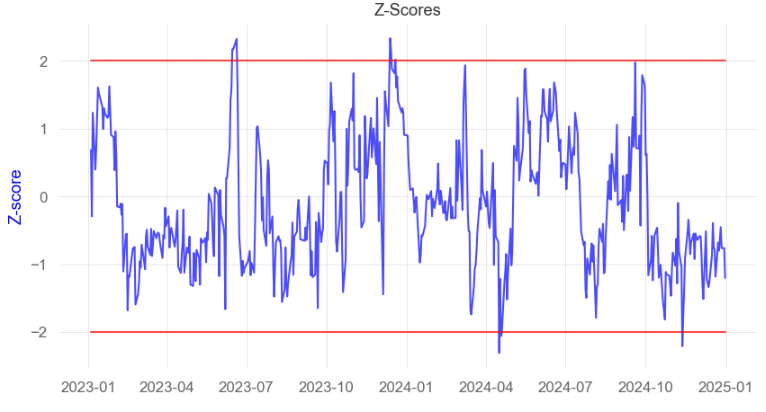

To determine when to enter or exit trades, you monitor the spread's deviation from its mean, quantified as a z-score. If the z-score falls beneath a lower threshold (e.g., -2), it signals the spread is unusually low: you go long the spread (buy one stock, sell the other). If the z-score rises above an upper threshold (e.g., +2), the spread is unusually high and you short the spread. Exits are triggered when the spread mean-reverts, typically when the z-score crosses back toward zero. This structured approach reduces emotional bias and allows for systematic backtesting to gauge robustness.

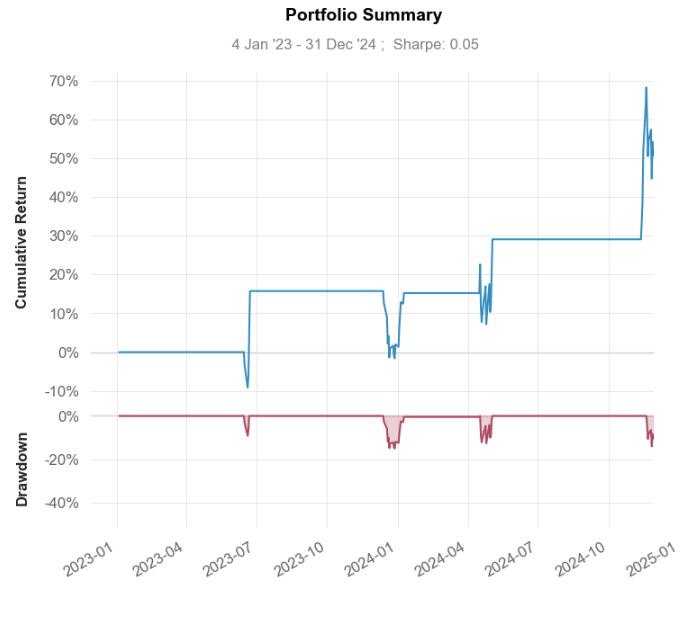

We use an equity curve to summarize a trading strategy’s value over time, and give a visual measure of performance and risk. Finally, in mean reversion strategies, promptly exiting losing positions is crucial to protect against large drawdowns should the price spread cease to mean revert or the underlying relationship fundamentally change, this is essential for robust risk management.

Keywords

Algorithms, Algorithmic Trading, Statistical Arbitrage, Pairs Trading, Quantitative Trading, Hedge Ratio, Z-Score, Mean Reversion, Trading Strategy, Trade Signals, Automated Trading, Market Neutral, Backtesting, Financial markets, Price Correlation, Strategy Execution

Bonus Content - Algorithmic Trading using Python

Methodology

For a detailed outline of statistical arbitrage in pairs trading click-here. The article gives concise step-by-step instructions on the process including: pair selection, data normalization, cointegration tests, trading signals and gives a good methodology outline.

Python Code

For an example of a customizable pairs trading strategy in Python click-here. The code is well commented, and below we summarize the main steps.

Select two historically correlated stocks and collect historical price data.

Estimate the hedge ratio between the pair using linear regression.

Calculate the spread as: spread = price of stock 1 minus (hedge ratio × price of stock 2).

Compute rolling mean and standard deviation of the spread to generate a z-score.

Enter a trade when the z-score crosses a defined threshold (e.g., long at z < -2, short at z > 2).

Exit the trade when the z-score reverts toward zero.

Connecting Python Code to IB Broker (IBKR)

Python trading strategies can be used to execute live trades with most brokerage accounts. Interactive Brokers offers a Python API called that enables you to connect your Python code to their trading platform (TWS or IB Gateway) to automate trading, access live or historical market data, and manage orders programmatically.

To get started, you simply install the API via pip and connect your code to an active IB client running on your machine. For a comprehensive guide and detailed instructions. For a detailed step-by-step guide click-here.

Video Lecture Series

Hudson and Thames provide an excellent video series introduction to pairs trading strategies, click-here for more details. Note video links are at the bottom.

Keywords

Algorithmic Trading, Statistical Arbitrage, Pairs Trading, Python Code, Step-by-Step Summary, Automation, Python API, IB Broker, Connectivity, Hudson and Thames, Video Lecture Series

Useful Links

Quant Research

Links to my Quant Research

SSRN Research Papers

https://ssrn.com/author=1728976

GitHub Quant Research

https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Links to learning resources for Financial Markets

Subscribe to my Quant YouTube Channel

https://youtube.com/@AlgoQuantHub

Algorithmic Trading & Quant Research Hub

https://payhip.com/AlgoQuantHub

Follow me on Linked-In

https://www.linkedin.com/in/nburgessx/

Explore my Quant Website

https://nicholasburgess.co.uk/

Read my Quant Book - Low Latency IR Markets

https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

My AlgoQuantHub (AQH) newsletters showcase the latest hands-on quant tutorials, videos and research, helping you bridge the gap between theory and real-world quant practice.

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

In this newsletter we deep dive into the world of algo trading and quant research with a focus on implementation and getting things done for real, and includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]