- AQH Weekly Deep Dive

- Posts

- Low Latency Models & Real-Time Portfolio Risk

Low Latency Models & Real-Time Portfolio Risk

AlgoQuantHub Weekly Deep Dive

Welcome to the Deep Dive!

Here each week on ‘The Deep Dive’ we take a close look at cuttting edge topics on algo trading and quant research.

AlgoQuantHub brings you the latest hands-on quant tutorials, insightful videos, and cutting-edge research—designed to bridge the gap between quantitative theory and practical implementation in real markets. This newsletter delivers actionable knowledge right to your inbox, featuring targeted explorations of key topics each week.

Last week, we explored how Algorithmic Adjoint Differentiation (AAD) enables ultra-fast, high-precision swap risk calculations, including a practical example on computing DV01 for interest rate swaps.

This week, we focus on supercharging pricing and risk analytics for electronic markets. You’ll learn about low-latency models and how to accelerate computations to produce real-time portfolio risk using the Jacobian approach.

Stay tuned for advanced strategies, state-of-the-art techniques, and impactful insights—delivered weekly to help you master quant finance and algorithmic trading.

Table of Contents

Digital Download Discounts

In this week’s newsletter we give readers a digital download discounts for use in AlgoQuantHub’s digital download store https://payhip.com/AlgoQuantHub

Quant Software Discount

20% off total order amount

Code: 6QTBPS1GUL

Feature Article - Real-Time Models & Risk

In today’s electronic financial markets, both speed and reliability in model calibration and risk calculation are crucial for professionals managing sophisticated portfolios. Large financial institutions often grapple with the dual challenges of tuning complex models to current market conditions and computing portfolio risk metrics on demand. Recent advances in mathematical techniques and computational algorithms now make it possible to address both challenges simultaneously, improving efficiency without sacrificing precision.

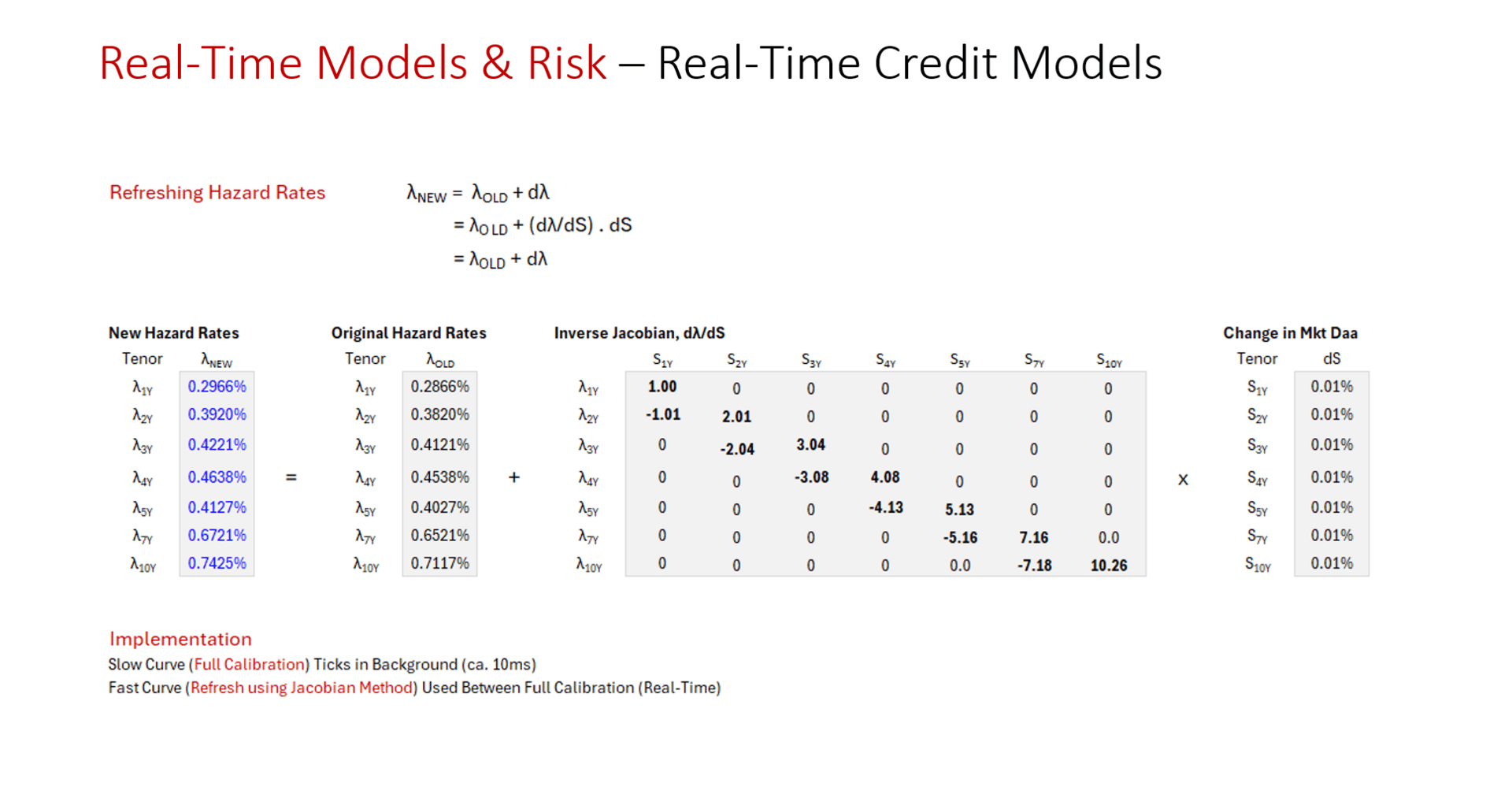

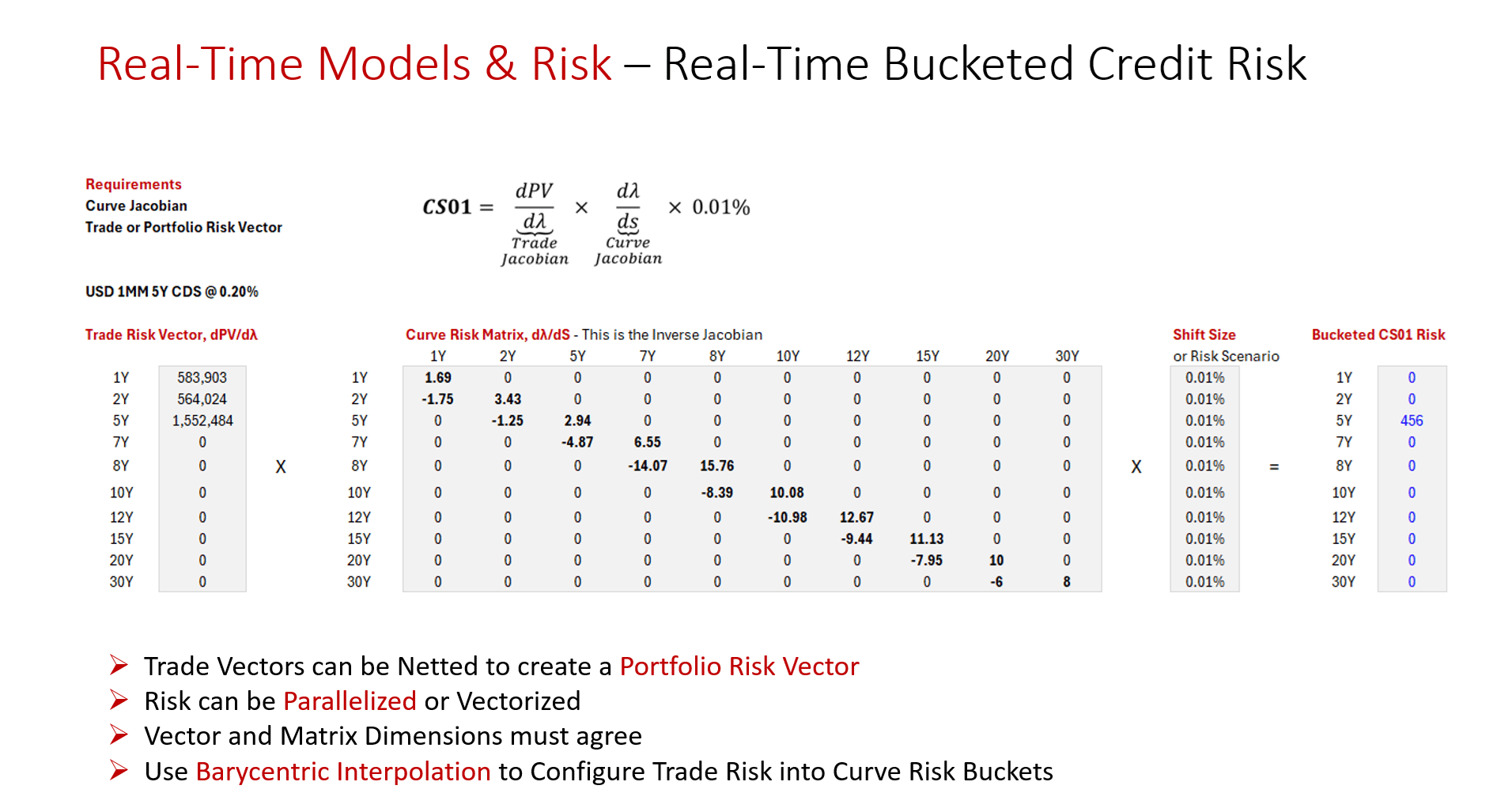

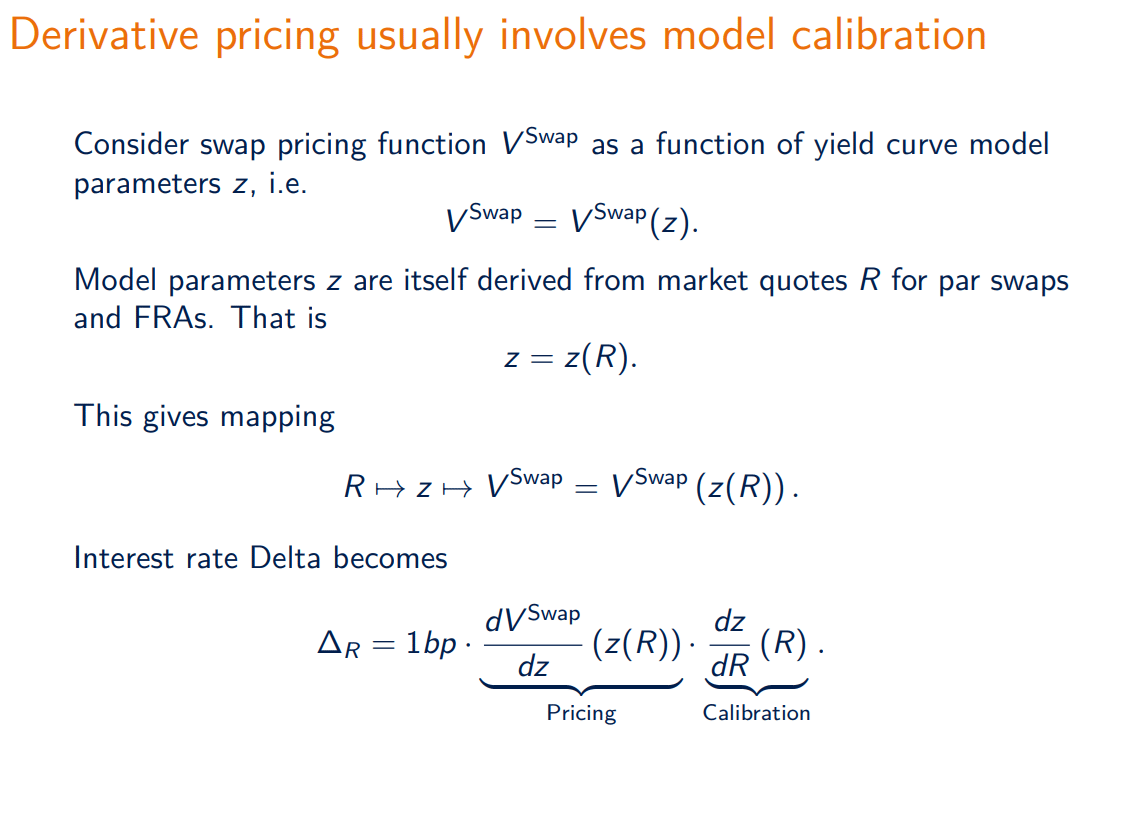

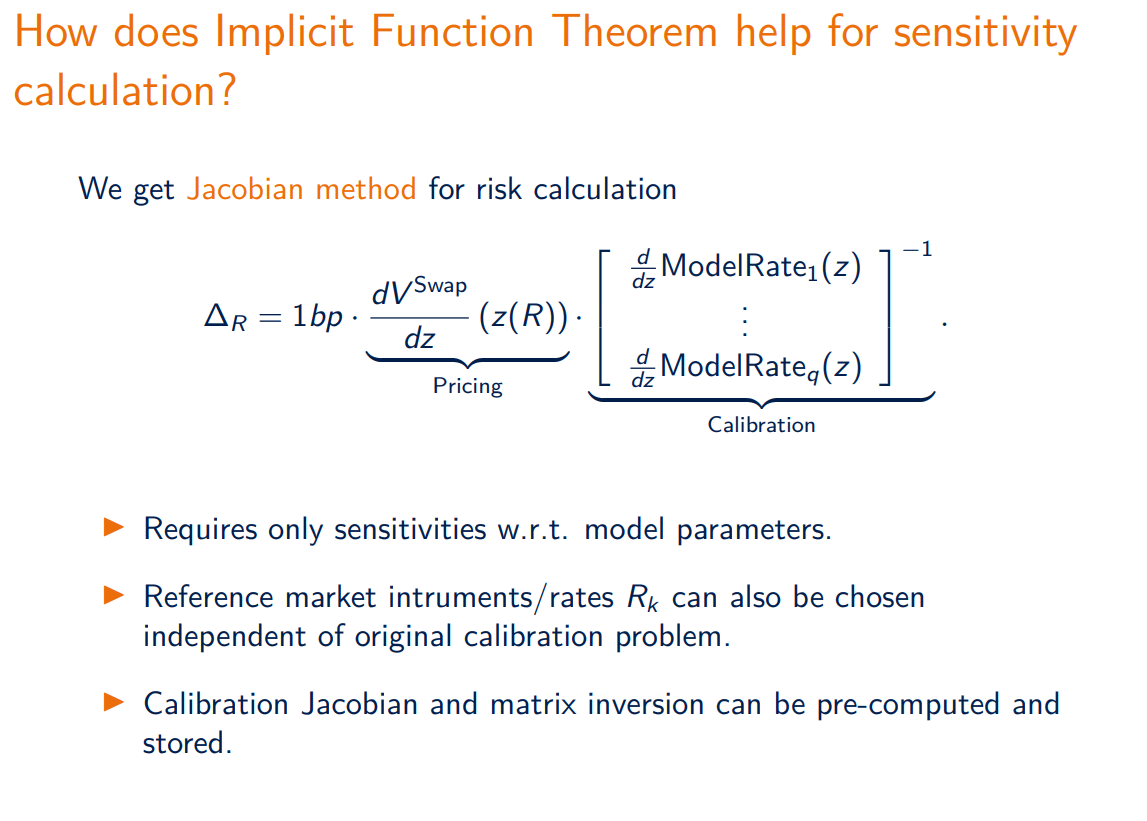

Central to this is the Jacobian approach—a mathematical method that accelerates calibration by efficiently computing the sensitivities of model outputs to changes in input parameters. By explicitly calculating the Jacobian matrix, practitioners can streamline the process of aligning model parameters with observed market data. This not only accelerates the calibration process but also enhances the calculation of risk metrics, such as CS01, by enabling real-time computation of the first-order sensitivities required for risk management.

The article delves into how the Jacobian approach can be applied to credit derivatives, dramatically reducing calibration and risk computation times. Quantitative analysts and risk managers will discover practical guidance on integrating this technique into their existing workflows, ultimately super-charging model calibration and supporting real-time risk assessment. Adopting these advances positions professionals to adapt rapidly to evolving market data and support proactive, data-driven portfolio management.

Full Article

Click-here for access to the full article or on the images below!

Credit Derivative - Examples

The Jacobian can be used to quickly determine how financial models change with market data. For example, how does a credit or hazard curve respond to changes in liquid CDS credit spreads quoted in the market.

The Jacobian can also be used to track how financial instrument prices change with market data. For example, how does the PV of a CDS change for a 1 bps change in credit spreads i.e. CS01.

Keywords

Quant, Model, Calibration, Jacobian Approach, Low Latency, Electronic Markets, Real-Time Risk, Bucketed Risk, Interest Rate Swaps, IRS, DV01, Credit Default Swaps, CDS, CS01, Credit Curves, Hazard Curves, Portfolio Risk, Analytics, Analytical Risk, Numerical Risk, Sensitivity Analysis, Risk Management

Feature Video - Credit Default Swaps

Subscribe to AlgoQuantHub’s Quant YouTube Channel!

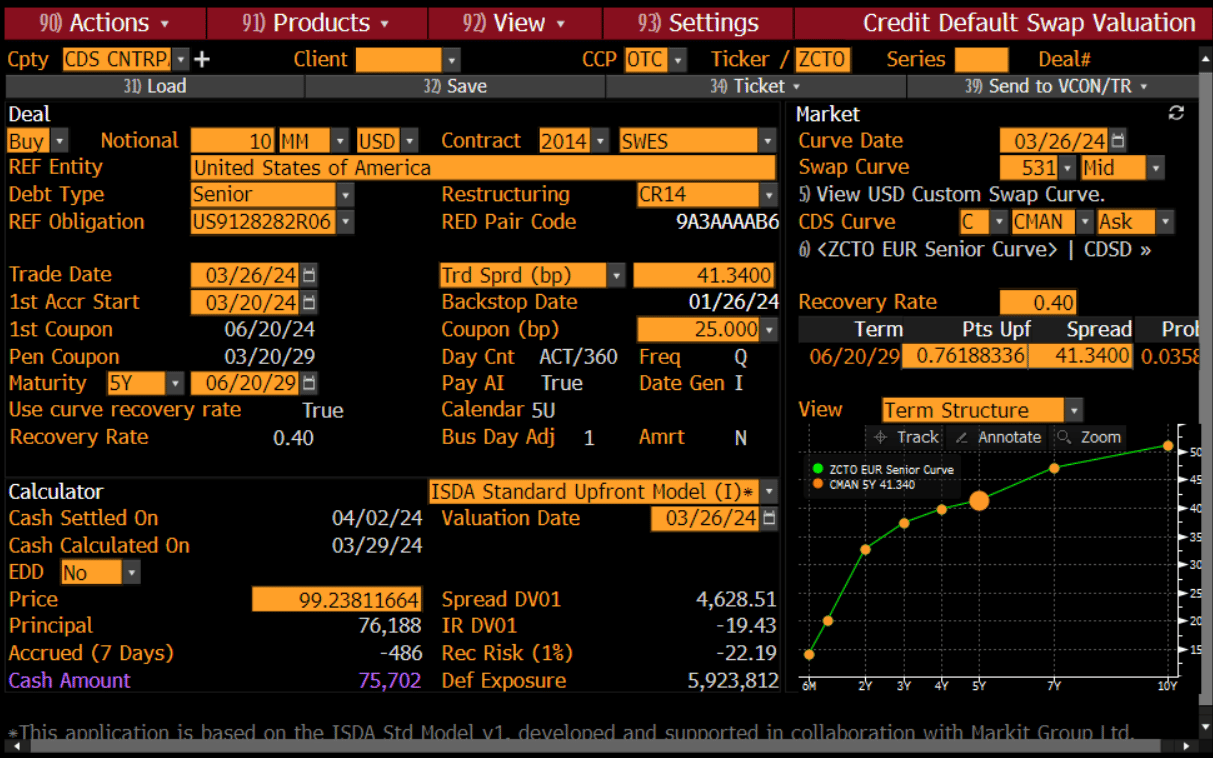

Credit Default Swaps (CDS) are essential tools in credit risk management and trading, but their structure and market conventions have evolved significantly in recent years. This concise training video offers a clear, practical overview of modern CDS mechanics, from contract structure and standard coupon payments to par spread calculations and upfront pricing, using real Bloomberg data.

Designed for finance professionals and quants, the video also explains how regulatory changes and the ISDA Standard Model have standardized CDS trading, making them more transparent and liquid. It's a valuable resource for anyone looking to deepen their understanding of CDS pricing and market conventions.

Click on the image below for more info!

Feature Download - Credit Default Swap Training Bundle

Visit AlgoQuantHub’s Digital Download Store!

This week we feature the Credit Default Swap (CDS) training bundle, which contains Excel workbooks showing how to price CDS analytically and using the Monte Carlo approach, plus a PDF training guide.

We review the pricing and model calibration of Credit Default Swaps referring to both the International Swaps and Derivatives Association (ISDA) CDS contract and credit model standardization guidelines. Furthermore, we provide an Excel pricing workbook to supplement the materials discussed. The main goal is for these materials to act as a credit primer and to review the impact and purpose of ISDA contract and model standardization on credit pricing and modelling techniques.

We review the Credit Default Swap product highlighting contract specifications, terminology and how the product has been standardized for increased liquidity and XVA capital cost reduction. We perform a fundamental review of probability and credit modelling, outlining standard market assumptions and techniques used by traders and other market practitioners. Furthermore, we demonstrate how to price CDS contracts, calibrate credit models and discuss the ISDA Standard Model, ISDA Fair Value Model and Bloomberg Fair Value Models in particular. Finally, we discuss CDS liquidity, the need for credit index proxies to hedge credit risk and outline liquidity alternatives to this such as the use of sector and index CDS contracts.

Click on the image below for more info!

Keywords:

Credit Widening, Survival Probability, Default Probability, Hazard Rate, Loss Given Default (LGD), Recovery Rate, ISDA Standardization, Credit Spread, Par Spread, Risky Annuity, Risky Discount Factor, Credit Models, Reduced Form Intensity Models, ISDA Standard Models, Model Calibration, Credit Proxy Curves, Bloomberg CDSW, Excel CDS Pricing.

Feature Research - Interest Rate Modelling, Derivative Pricing & Risk

The following article is an excellent resource and arguably one of the best Quant research articles for Interest Rate modelling. It stands out as a comprehensive and rigorously structured exploration of modern interest rate theory and its application to derivative products. Written with the seasoned quantitative practitioner in mind, the article distinguishes itself through its methodological depth and emphasis on computational efficiency—attributes that elevate it among the best in the field. Schlenkrich addresses the acute industry need for rapid and highly accurate interest rate risk measurement, offering advanced mathematical frameworks and practical tools directly applicable in today's dynamic financial markets.

A significant portion of the article is dedicated to the calculation of sensitivities, an essential topic for risk management and hedging in trading and banking. Schlenkrich guides the reader through the motivation and theory of sensitivity analysis, from foundational concepts to the implementation of finite difference approximations and their trade-offs. Particularly valuable is the critical perspective on the limitations of finite difference methods and the introduction of algorithmic differentiation—a modern approach increasingly adopted by leading financial institutions for its superior speed and precision. The document’s structured treatment of model differentiation, calibration, and the practicalities of portfolio valuation arms quantitative analysts and risk managers with techniques that are both cutting-edge and robust in real-world application

For a link to the article click-here or on the images below!

Useful Links

Quant Research

Links to my Quant Research

SSRN Research Papers

https://ssrn.com/author=1728976

GitHub Quant Research

https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Links to learning resources for Financial Markets

Subscribe to my Quant YouTube Channel

https://youtube.com/@AlgoQuantHub

Algorithmic Trading & Quant Research Hub

https://payhip.com/AlgoQuantHub

Follow me on Linked-In

https://www.linkedin.com/in/nburgessx/

Explore my Quant Website

https://nicholasburgess.co.uk/

Read my Quant Book - Low Latency IR Markets

https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

My AlgoQuantHub (AQH) newsletters showcase the latest hands-on quant tutorials, videos and research, helping you bridge the gap between theory and real-world quant practice.

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

In this newsletter we deep dive into the world of algo trading and quant research with a focus on implementation and getting things done for real, and includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]