- AQH Weekly Deep Dive

- Posts

- Bond Futures & Cash Futures Basis Trading

Bond Futures & Cash Futures Basis Trading

AlgoQuantHub Weekly Deep Dive

Welcome

Welcome to AlgoQuantHub’s Weekly Deep Dive into Algo Trading & Quant Research!

AlgoQuantHub includes the latest hands-on quant tutorials, videos and research, helping you bridge the gap between theory and real-world quant practice. All delivered by this newsletter! Each week I will deliver a targeted deep dive into a feature topic.

Last weeks’ feature article looked at FX arbitrage and the persistent cross-currency basis and why Covered Interest Rate Parity (CIP) breaks down. We also provided many links to detailed market research.

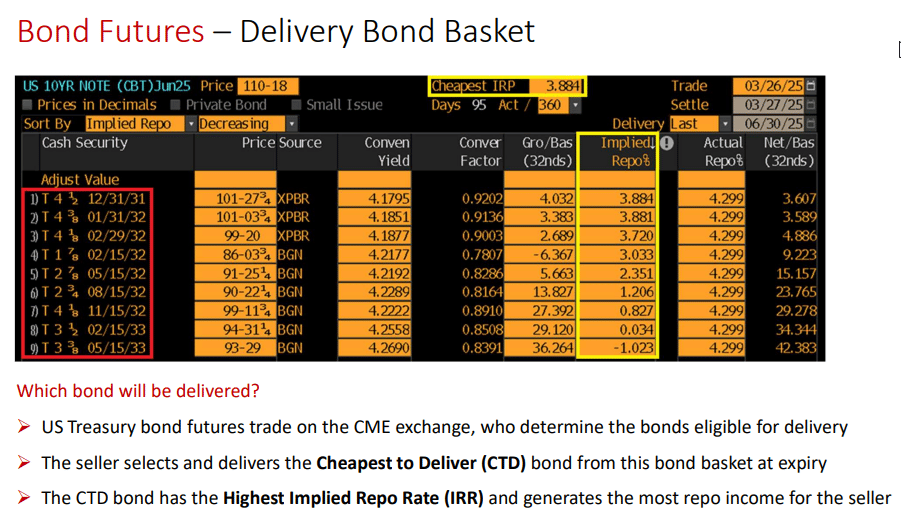

This week we explore how quantitative research gives traders a real edge in Bond Futures Cash Basis Trading Strategies—especially when leverage and embedded options come into play.

Table of Contents

Digital Download Discounts

In this week’s newsletter we give readers a digital download discounts for use in AlgoQuantHub’s digital download store https://payhip.com/AlgoQuantHub.

25% off Interest Rate Markets Training Bundle

Code: AEL9DA8MWN

25% off Fixed Income Training Bundle

Code: RLY6JUNG1O

20% off total order amount

Code: 5W4E5T3GV4

Feature Article - Unlocking Trading Edge in Cash Bond Futures Basis

Quantitative research is key to gaining a trading edge in cash-futures basis strategies, especially when leverage and embedded options are involved. By rigorously modeling the delivery options and other embedded features within futures contracts, quants ensure accurate pricing and help identify genuine arbitrage opportunities.

With leverage amplifying both returns and risks, robust quantitative models allow for precise risk management and optimal position sizing. Ultimately, advanced quant analysis transforms complex market dynamics into actionable insights, enabling traders to profit from basis trades while effectively managing risk.

Article: Bond Futures Trading - Theory, Pricing & Practice

https://ssrn.com/abstract=5312117

CME Trading Simulator

https://www.cmegroup.com/trading_tools/simulator

|  |

Keywords:

Bond Futures, Implied Repo Rate, Delivery Option, Switch Option, Cash-Futures Basis, Cheapest-to-Deliver, Conversion Factor, Futures Pricing, Fixed Income Derivatives, Arbitrage, Repo Financing, Carry, Basis Trading

Feature Video - Bond Future Trading Strategies

Subscribe to AlgoQuantHub’s Quant YouTube Channel!

In this video “Bond Future Trading Strategies” we’ll explore how quantitative research gives traders a real edge in bond futures cash basis trading strategies—especially when leverage and embedded options come into play.

I’ll walk you through how to use the Bloomberg Terminal to analyze bond futures trades. We’ll look at how quants ensure accurate pricing and uncover genuine arbitrage opportunities—helping you profit from basis trades while keeping risk under control. Let’s dive in and see how you can put these quant techniques to work in your own trading!

Click on the image below for more info!

Feature Download - Interest Rates & Fixed Income Training Bundle

Visit AlgoQuantHub’s Digital Download Store!

This week we feature the Interest Rates & Fixed Income Training Bundle, which contains Excel workbooks, PowerPoint and PDF training materials for interest rate and fixed income markets including the following,

IR Markets Overview

Interest Rate Swaps

Cross Currency Swaps

Credit Default Swaps

Quanto Credit Default Swaps

US Treasury Bonds

Asset Swaps

Bond Futures

This comprehensive training bundle covers the fundamentals of interest rate markets and provides step-by-step guidance on pricing key instruments, including interest rate swaps, cross-currency swaps, credit default swaps (CDS), and Quanto CDS. You will also learn to price US Treasury bonds and accurately match bond prices and yields as quoted on major trading venues like Bloomberg. The course further explains asset swaps—enabling investors to finance bond purchases in a single transaction—and concludes with an overview of bond total return swaps, essential for creating synthetic Money Market and Bond ETFs.

Click on the image below for more info!

Feature Book - Python for Algorithmic Trading

Algorithmic trading, once the exclusive domain of institutional players, is now open to small organizations and individual traders using online platforms. The tool of choice for many traders today is Python and its ecosystem of powerful packages. In this practical book, author Yves Hilpisch shows students, academics, and practitioners how to use Python in the fascinating field of algorithmic trading.

You'll learn several ways to apply Python to different aspects of algorithmic trading, such as backtesting trading strategies and interacting with online trading platforms. Some of the biggest buy- and sell-side institutions make heavy use of Python. By exploring options for systematically building and deploying automated algorithmic trading strategies, this book will help you level the playing field.

Set up a proper Python environment for algorithmic trading

Learn how to retrieve financial data from public and proprietary data sources

Explore vectorization for financial analytics with NumPy and pandas

Master vectorized backtesting of different algorithmic trading strategies

Generate market predictions by using machine learning and deep learning

Tackle real-time processing of streaming data with socket programming tools

Implement automated algorithmic trading strategies with the OANDA and FXCM trading platforms

Click on the image below for more info!

Useful Links

Quant Research

Links to my Quant Research

SSRN Research Papers

https://ssrn.com/author=1728976

GitHub Quant Research

https://github.com/nburgessx/QuantResearch

Learn about Financial Markets

Linked to learning resources for Financial Markets

Subscribe to my Quant YouTube Channel

https://youtube.com/@AlgoQuantHub

Algorithmic Trading & Quant Research Hub

https://payhip.com/AlgoQuantHub

Follow me on Linked-In

https://www.linkedin.com/in/nburgessx/

Explore my Quant Website

https://nicholasburgess.co.uk/

Read my Quant Book - Low Latency IR Markets

https://github.com/nburgessx/SwapsBook

AlgoQuantHub Newsletters

My AlgoQuantHub (AQH) newsletters showcase the latest hands-on quant tutorials, videos and research, helping you bridge the gap between theory and real-world quant practice.

The Edge

The ‘AQH Weekly Edge’ newsletter for cutting edge algo trading and quant research.

https://bit.ly/AlgoQuantHubEdge

The Deep Dive

In this newsletter we deep dive into the world of algo trading and quant research with a focus on implementation and getting things done for real, and includes video content, digital downloads, courses and more.

https://bit.ly/AlgoQuantHubDeepDive

Feedback & Requests

I’d love your feedback to help shape future content to best serve your needs. You can reach me at [email protected]